ETFs and Mutual Funds

ETFs and Mutual Funds Articles

Schlumberger has performed horribly in 2018, and the small gain after Friday's earnings announcement has been followed by even more selling pressure.

Published:

Last Updated:

A quick look at the performance of some of the most popular high-yield ETFs doesn’t seem too encouraging on the surface.

Published:

Last Updated:

The “future of sports” is here, and now investors have the option to put their money in it. eSports has been a growing phenomenon in the United States and it is drawing a lot of attention.

Published:

Last Updated:

24/7 Wall St. has come up with its own view on earnings season by sector, along with relative performance on the top exchange traded funds for those sectors.

Published:

Last Updated:

What investors need to be concerned about now is how much higher the stock market can rise and when the end of the bull market will be.

Published:

Last Updated:

What are investors supposed to do with 2018 rapidly coming to an end with the major indexes effectively at all-time highs? One way that many retail investors have tried to succeed in stock picking is...

Published:

Last Updated:

Millions of Americans make money outside of just buying stocks or bonds. 24/7 Wall St. has outlined 10 alternative investment strategies that the public can use.

Published:

Last Updated:

After having been way too slow to raise interest rates to stem inflation and a major currency depreciation, Turkey finally raised its benchmark interest rates.

Published:

Last Updated:

Too many people procrastinate about investing for their future. Many think they just cannot afford to invest, and many people just don't know how.

Published:

Last Updated:

The more recent observations about Buffett's portfolio changes coming into mid-2018 have been quite different than many of the historic and traditional Buffett picks.

Published:

Last Updated:

What happens when investors hear that one of the nation's top money managers is now willing to allow investors to buy two funds without any management fees at all?

Published:

Last Updated:

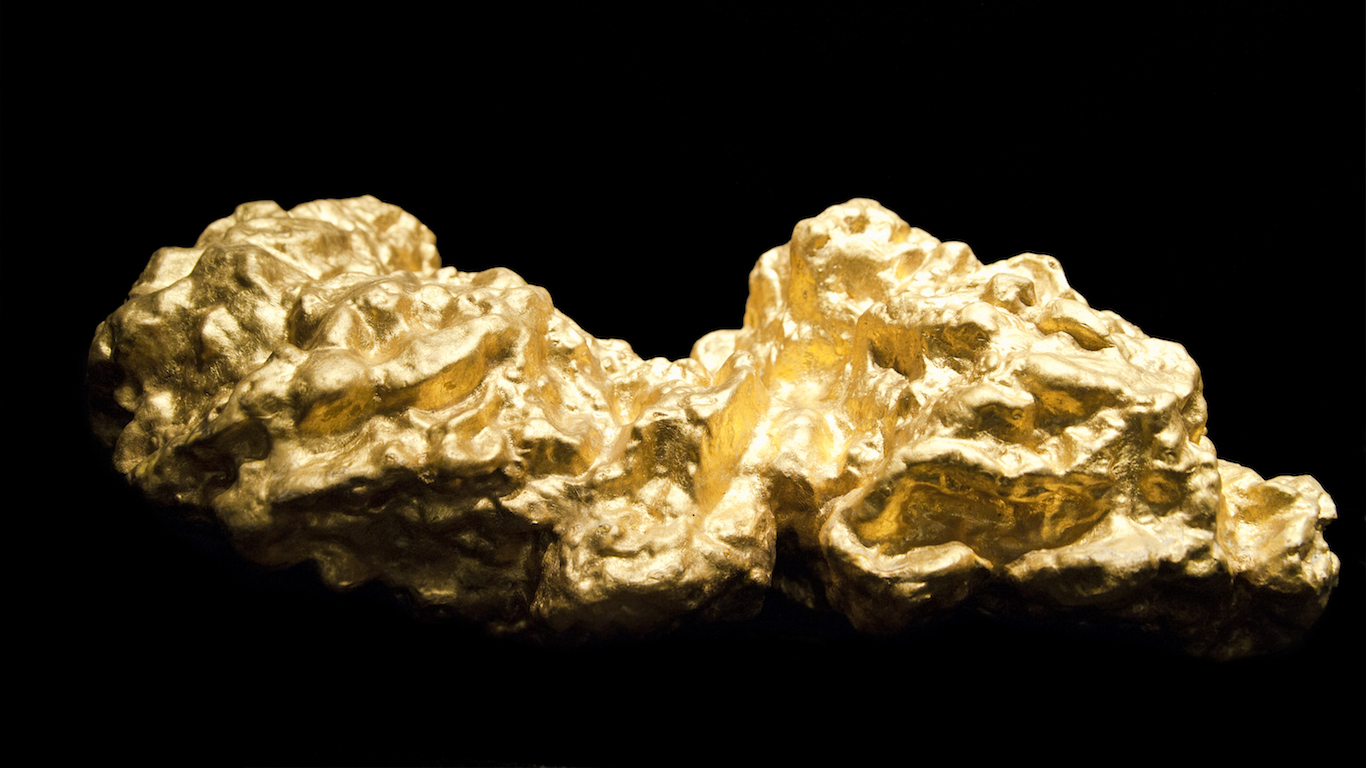

Global gold ETFs saw a decline of some $4 billion in assets under management in July. North American outflows totaled about $984 million.

Published:

Last Updated:

Gold has had a rough 2018. Despite some of the international trade worries and international suspense, the reality is that most investors are just not looking for the "ultimate safety trade."

Published:

Last Updated:

These top holdings make sense as they are huge, dominate much of their specific business lines, are very liquid and look to continue to maintain their growth trajectory for the foreseeable future.

Published:

Last Updated:

These top mutual fund holdings are huge, dominate much of their specific business lines, are very liquid and look to continue to maintain their growth trajectories for the foreseeable future.

Published:

Last Updated: