Hedge Funds

Hedge Funds Articles

Hedge fund managers are always buying and selling shares of stocks in their portfolios, whether to rebalance them or take advantage of market pricing opportunities. When one dumps billions of dollars...

Published:

There are many billionaires who style themselves as Buffett-esque investors. They may not quite be value investors in the vein of Graham and Dodd, Warren Buffett’s influential mentors, but they do...

Published:

David Shaw has long been known as the “King of Quants” because of his pioneering use of computers and algorithms to foster high-speed quantitative trading. A computer scientist by training who...

Published:

Noted short-seller David Einhorn rose to prominence betting against Allied Capital, a private equity firm that offered debt and equity capital to finance leveraged buyouts, acquisitions, and...

Published:

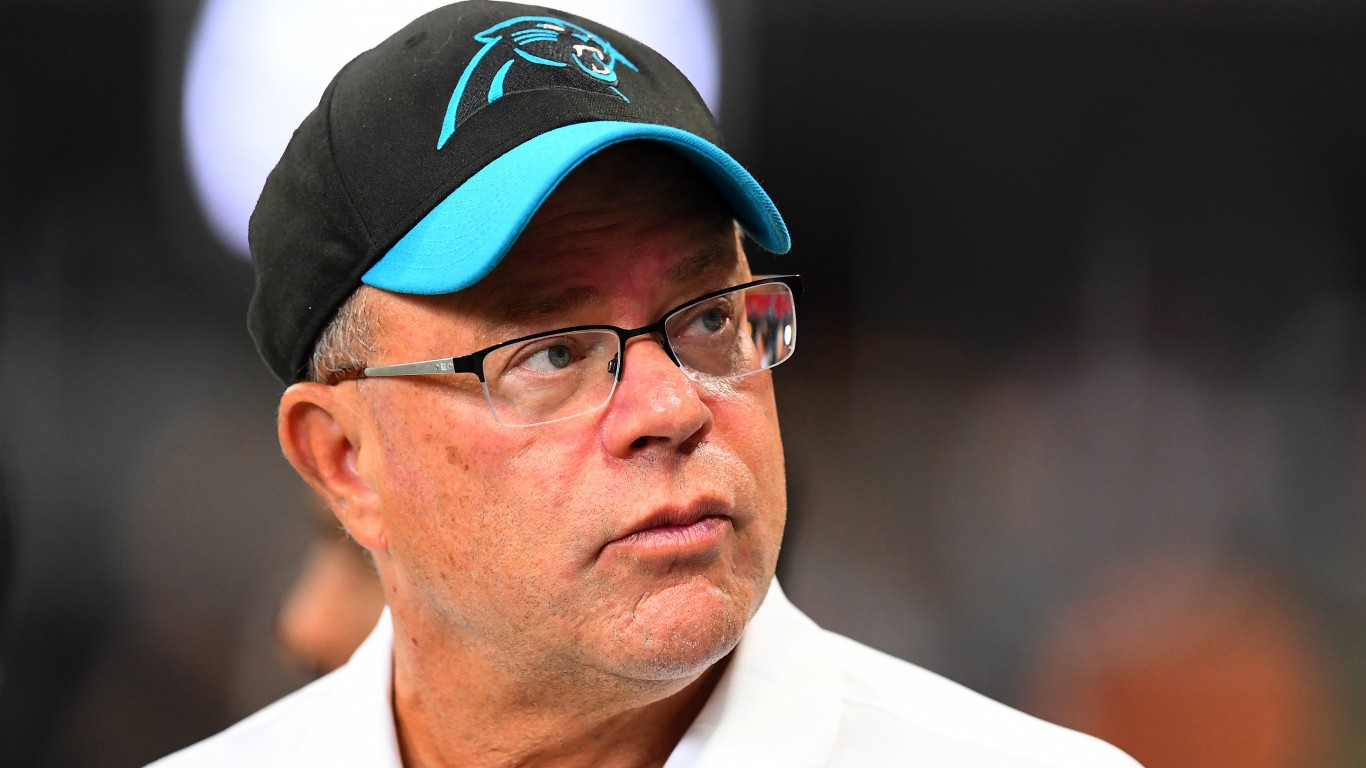

Billionaire investor David Tepper has a better track record in the stock market than his Carolina Panthers National Football League team has on the gridiron this year. His Appaloosa Management hedge...

Published:

Legendary value investor Bruce Berkowitz likes to bet big on just a couple of stocks. His Fairholme Capital Management owns just seven stocks. When he is right, he hits massive home runs. For more...

Published:

Politicians are more known for their trading than running hedge funds. They seem to have an uncanny knack for making stock trades that perform remarkably well, well above what the averages suggest...

Published:

The publication in 2005 of Joel Greenblatt’s book “The Little Book That Beat the Market” caused a sensation as it opened up a unique opportunity for investors. The investing strategies used by...

Published:

David Einhorn has a penchant for picking stocks to short. The one that put the billionaire investor on the map was his hedge fund Greenlight Capital‘s short of private financing giant Allied...

Published:

While many investors might not know who Israel Englander is, they have likely heard of his Millennium Management hedge fund. It is one of the world’s largest hedge funds with almost $68 billion in...

Published:

Daniel Loeb is the quintessential activist investor. His Third Point Capital hedge fund is known for launching activist campaigns against companies and their boards to shake them out of their...

Published:

Hedge fund operator Bill Ackman likes to make big bets. His Pershing Square Capital Management fund has $10.4 billion in assets under management and it is concentrated in just nine positions. These...

Published:

The old investing adage that you can’t beat the market so just buy index funds misses the point. Warren Buffett, Peter Lynch, and a host of other money managers prove you can beat the stock...

Published:

U.S. markets are trading lower for a second straight day. No upside catalyst has appeared, and traders may begin to be wondering if one will ever show up.

Published:

Steven Cohen’s Point72 Hedge Fund Backs Salesforce, Broadcom And Meta While Cutting Palo Alto And Wo

An unusually large call option trade was recorded for Ford stock.

Published: