IPOs and Secondaries

IPOs and Secondaries Articles

Zoom Video Communications had one of the hottest initial public offerings so far in 2019, and now its quiet period has come to an end.

Published:

Last Updated:

Uber Technologies snuck into the market Friday with its initial public offering (IPO).

Published:

Last Updated:

Many investors have played the “if I could just go back in time” game to pretend how much money they could have made if they bought shares in an up and coming company. Starbucks Corp. (NASDAQ:...

Published:

Last Updated:

It's an impressive day when two IPOs are well received when drug-selling revenues are unlikely for quite some time, and even longer before profits can be considered.

Published:

Last Updated:

Some of Uber's founders and investors will make hundreds of millions of dollars as the company goes public. Some of its drivers will strike to protest their low pay.

Published:

Last Updated:

VF Corp. now has approved the previously announced separation of its VF Jeanswear business, which includes the Wrangler and Lee brands.

Published:

Last Updated:

The world of blank check companies and specialty purpose acquisition companies continues to have a place in the markets. Landcadia Holdings II now has priced its initial public offering.

Published:

Last Updated:

Beyond Meat made its debut on Thursday, with an IPO of more than $9 million at a per-share price above its expected price range.

Published:

Last Updated:

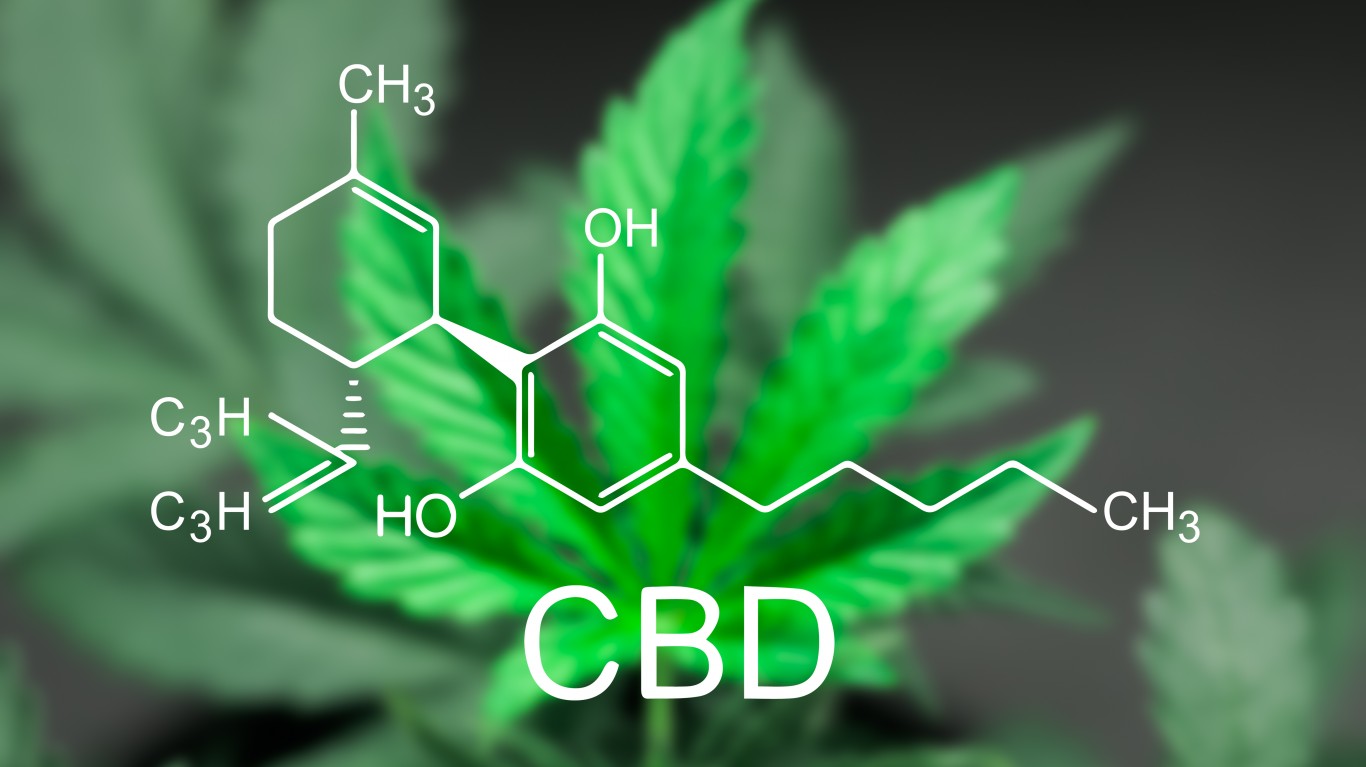

Marijuana producer CannTrustintends to price more than 36 million shares to result in a secondary offering valued up to roughly $230 million.

Published:

Last Updated:

In an effort to mitigate this risk and concern about picking the winners or the losers with each company that comes public, exchange-traded funds are available that sample the IPO market.

Published:

Last Updated:

Uber expects to price its 180 million shares to result in an initial public offering valued up to more than $10 billion.

Published:

Last Updated:

Collaboration tools and services provider Slack Technologies has filed with the SEC for its initial public offering.

Published:

Last Updated:

Lyft came public at the end of March in one of the biggest IPOs of the year. Analysts are finally getting their chance to go to bat for the ride-sharing firm now that the quiet period is over.

Published:

Last Updated:

Netflix said in a press release that the company is planning to take on approximately $2 billion in new debt via the sale of senior unsecured notes.

Published:

Last Updated:

Pinterest and Zoom Video Communications captured the attention of many investors when they came public last week. Each company saw explosive gains out of the gate on Thursday, but let’s check in on...

Published:

Last Updated: