oil and gas

oil and gas Articles

Oilfield services firm Schlumberger reported third-quarter results Friday that beat estimates for adjusted profit. A $12.7 billion pretax charge appears not to have dulled investors' enthusiasm for...

Published:

Last Updated:

These big oil stocks are at some of the best entry prices in years and could offer solid upside for shareholders in 2020 and beyond.

Published:

Last Updated:

The U.S. crude oil stockpile rose by more than 9 million barrels last week but the impact of the huge increase was partially offset by large declines in gasoline and distillate inventories.

Published:

Last Updated:

Energy pipeline and terminal giant Kinder Morgan reported third-quarter results that were a bit short of expectations. The stock is not getting punished for, however, for one simple reason.

Published:

Last Updated:

The U.S. green economy contributed about 7% to the country's gross domestic product in fiscal year 2016 and employed nearly 9.5 million Americans.

Published:

Last Updated:

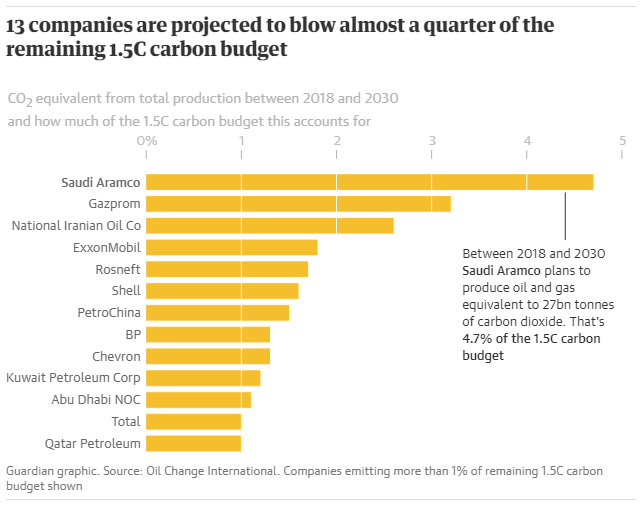

The oil industry is expected to raise production by 7 million barrels a day by 2030 according to a new study by Rystad Energy commissioned by the Guardian. Efforts to mitigate climate warming will be...

Published:

Last Updated:

Short sellers appear to have lost interest in the exploration and production business. Short interest in the supermajor integrated firms increased, however.

Published:

Last Updated:

With slower global growth and oil in ample supply, a fresh new look from the U.S. Energy Information Administration projects that oil prices will be lower in 2020.

Published:

Last Updated:

It might seem odd with the lower oil prices and with energy stocks in the tank that one of the industry giants might really want to commit to raising its dividend by any large amount right now.

Published:

Last Updated:

On Saturday, two months early and 10 years after its discovery, the Johann Sverdrup oil field began production.

Published:

Last Updated:

These are five energy stocks for aggressive accounts that look to get share count leverage on companies that have sizable upside potential and to add energy exposure.

Published:

Last Updated:

Energy industry analysts at Credit Suisse have downgraded three oil and gas exploration and production companies citing low prices, continuing oversupply, and declining production from existing...

Published:

Last Updated:

Hess and Hess Midstream Partners have announced a $6.2 billion transaction that will convert the MLP to a corporation and is expected to boost investor returns significantly.

Published:

Last Updated:

These four SunTrust picks range from very conservative to aggressive, so they offer investors looking to add or increase energy exposure an outstanding set of choices.

Published:

Last Updated:

The dramatic drop in drilling for oil in conventional basins could limit additions to future reserves.

Published:

Last Updated: