oil and gas

oil and gas Articles

The Canadian government has granted authority to complete the expansion of the Trans Mountain oil pipeline system. Not all Canadians and certainly not all native First Nations are pleased, to say the...

Published:

Last Updated:

Here are five very different contrarian picks in what many would consider a very contrarian sector. These stocks are all rated Buy at SunTrust.

Published:

Last Updated:

Short interest fell in four of the six oil & gas companies we track. Do short sellers really believe that oil prices won't go any lower?

Published:

Last Updated:

Oil has long been a key barometer for a real-time reading on the global economic picture. There may be a move to clean energy and renewables, but oil still dominates the energy world.

Published:

Last Updated:

The huge purchase of Anadarko by Occidental Petroleum has put the spotlight directly on these Permian companies as potential takeover targets. That plus incredibly cheap valuations make them good...

Published:

Last Updated:

Short sellers loved the winner of a $38 billion acquisition and did not love the company that gave up.

Published:

Last Updated:

Three of the world's largest oil companies have adopted proposals to make them more responsive to and transparent regarding their impact on climate change. Don't expect any big changes.

Published:

Last Updated:

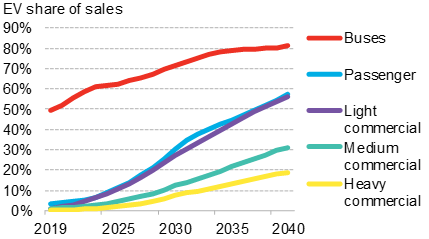

By 2040, electrified vehicles will account for well over half of global sales according to a new report from BloombergNEF.

Published:

Last Updated:

These four Merrill Lynch picks make sense for total return investors looking for sensible energy ideas and dependable income.

Published:

Last Updated:

Large-cap oil and gas exploration and production companies are being put under a microscope following the Occidental acquisition of Anadarko. Here are few more, plus a couple of ETFs that allow...

Published:

Last Updated:

The now-concluded battle over which oil giant would get to pay billions of dollars for Anadarko is now over and short sellers probably made some money no matter which horse they backed.

Published:

Last Updated:

Now that Chevron has declined to make a counter-offer to Occidental's bid for Anadarko, where else can Chevron and the other supermajor companies look for possible acquisitions?

Published:

Last Updated:

The headlines sound bad, but the Chesapeake Energy earnings report on an adjusted basis evaluated by analysts met the Refinitiv consensus target.

Published:

Last Updated:

Two mid-size energy master limited partnerships announced a definitive merger agreement Wednesday morning.

Published:

Last Updated:

For investors looking for quality energy stocks with Permian and Denver-Julesburg Basin exposure, these stocks are among the best individual ideas, regardless of whether Chevron is interested in them.

Published:

Last Updated: