oil and gas

oil and gas Articles

The U.S. crude oil inventory added nearly 6 million barrels last week compared with consensus estimates for a decline of more than 3 million barrels. Gasoline inventories fell more than expected,...

Published:

Last Updated:

The Intercontinental Exchange will launch a WTI crude oil contract this quarter for oil physically delivered to Houston from the Permian Basin.

Published:

Last Updated:

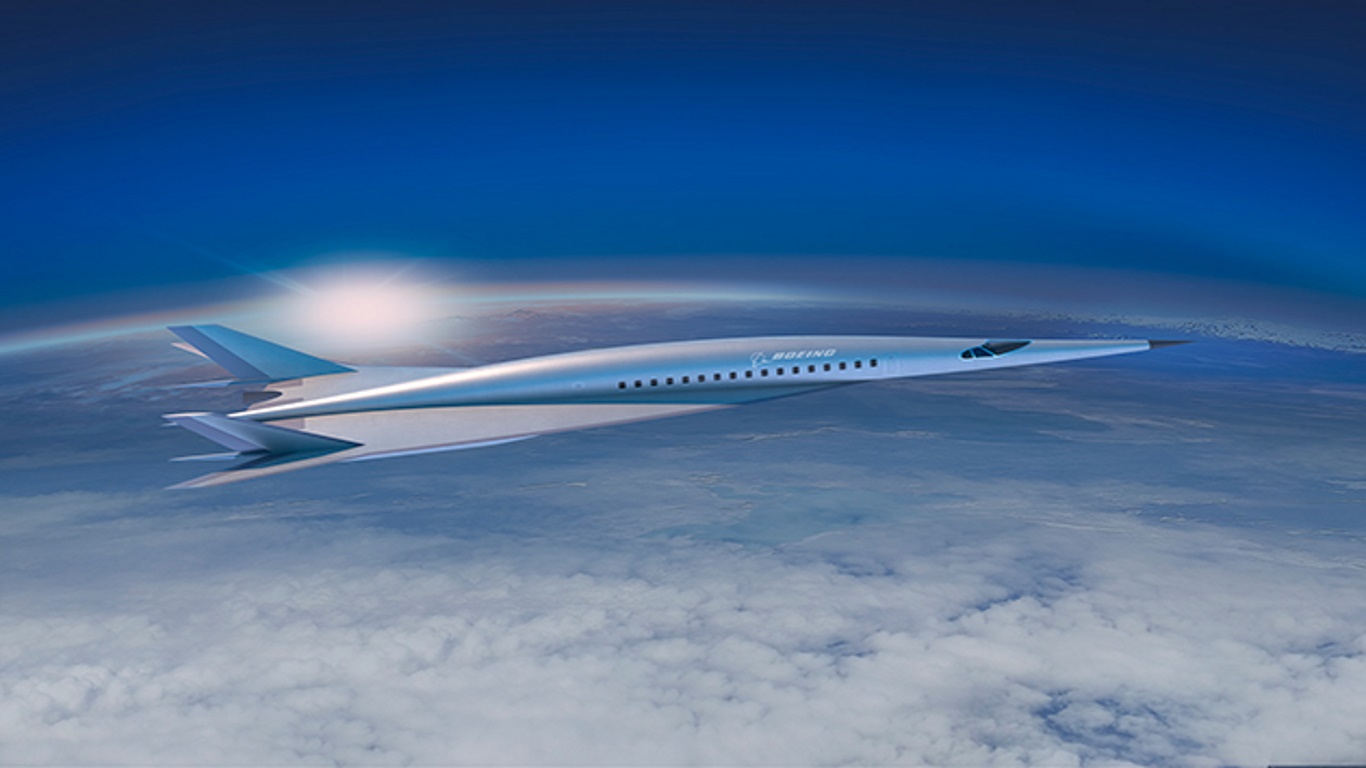

The CEO of Texas Instruments has resigned, Boeing sets deal to build Air Force One, Google faces massive fine from the European Union, and other important business headlines.

Published:

Last Updated:

Oil could trade between $70 and $80 a barrel for the next year or longer. These five top companies with distinctly different businesses offer investors a variety of ways to play the energy sector.

Published:

Last Updated:

The number of U.S. land-based oil rigs did not change this week, but two natural gas rigs were put to work along with one new rig in the Gulf of Mexico.

Published:

Last Updated:

The amount of U.S. natural gas in storage rose less than expected last week and is now about 25% lower than it was at the same time last year. Prices did not react much to the news.

Published:

Last Updated:

The June 29 short interest data have been compared with the previous figures, and short interest in most of these selected big oil stocks decreased.

Published:

Last Updated:

Higher oil prices almost certainly are around the corner, and with them, higher gasoline prices, which may trigger a global economic slowdown.

Published:

Last Updated:

The U.S. commercial crude inventory fell by more than 12 million barrels last week but the decline was more than offset as inventories of other petroleum products rose.

Published:

Last Updated:

These are two large-cap plays and four small and mid-cap favorites from the energy team at RBC are good for growth accounts with a degree of risk tolerance looking for more energy exposure.

Published:

Last Updated:

Original equipment manufacturer AFG intends to sell more than 18 million shares in an initial public offering valued up to more than $376 million.

Published:

Last Updated:

The U.S. land-based rig count rose by five this week, all new oil rigs. The Permian Basin in southwest New Mexico got most of the new action. This is the first rig count increase in three weeks.

Published:

Last Updated:

The U.S. natural gas inventory increased by 78 billion cubic feet last week according to the U.S. Energy Information Administration. The inventory total remains lower than both last year's level and...

Published:

Last Updated:

The proposed IPO of a piece of Saudi national oil company Aramco appears to have stalled and may not happen at all now that crude prices have more than doubled since the IPO was first discussed.

Published:

Last Updated:

After a serious rut, now the Goldman Sachs Commodities Research is telling customers that it's time to buy commodities.

Published:

Last Updated: