After a multiyear rally that saw the airline stocks outperform many of the others on Wall Street, the transports, especially the airlines, have been murdered since the price of oil started to rise again. In a new report, UBS maintains that comparisons are getting easier as we get into the second half of the year, and three top stocks may be a good value at this point.

Jet fuel is a huge component of airline costs, yet oil at $60 is still more than 40% below highs that were printed just last summer. While not hyper-bullish on the sector, the UBS team does have three top pick stocks they recommend investors buy now.

Delta Air Lines

This stock ranks high at almost every Wall Street firm. Delta Air Lines Inc. (NYSE: DAL) was named the 2014 Airline of the Year by Air Transport World magazine and was named to FORTUNE magazine’s 50 Most Admired Companies, in addition to being named the most admired airline for the third time in four years.

Delta has among the most extensive hedging policies among the airlines and owns and operates a refinery in addition to a sizable hedging book. The airline participated in 80% of the oil price decline last year and had substantial hedging gains added to revenues.

ALSO READ: 3 Specialty Pharma Stocks That Could Be Acquired in 2015

Delta announced recently plans to initiate flights from the Seattle-Tacoma International Airport to Boston; Orlando; Pasco, Wash.; and Victoria, British Columbia. Victoria will be the latest addition to Delta’s network, and the route is subject to approval from the Canadian government.

Delta investors are paid a 0.85% dividend. The UBS price target for the stock is $53. The Thomson/First Call consensus target is at $61.36. The stock closed Monday at $44.35.

Southwest Airlines

This company continues to expand routes and remains a low-cost leader. Southwest Airlines Inc. (NYSE: LUV) continues to increase its footprint and brand awareness all over the country. With the domestic market showing reasonably good strength, and the pricing environment looking very solid for the rest of 2015, revenues should stay strong and continue to grow. Jet fuel prices, while still much lower than in past years, is almost 30% of Southwest’s total costs and have been key for improving revenues and earnings. With almost no international business at this time, currency headwinds are not an issue for the airline.

Southwest recently announced that newly designed seats, which will be seen on new 737-800s beginning mid-2016, join other significant brand milestones, including cabin interior updates on Southwest’s 737-700s, which will begin later this year, and continued 737-800 deliveries in the new Heart livery. The industry-leading seats are wider than current seats, and include an adjustable headrest and increased leg room, as well as more personal stowage, while decreasing the overall weight of the product. That is something all travelers can appreciate.

ALSO READ: Deutsche Bank Raises Price Targets on Top Oil Stocks to Buy

CEO Gary Kelly recently said when interviewed, “Our available seat-mile growth will be a little bit more than our seat growth, but it will be around 7 percent for this year; and likewise we will manage aggressively to the low end of that range for next year. Much of the growth in 2016 is simply carryover from 2015.” This has been a concern for some investors and probably relieves some anxiety of overcapacity.

Southwest shareholders are paid a 0.8% dividend. The UBS price target is $47, and the consensus target is higher at $52.79. The stock closed most recently at $37.85.

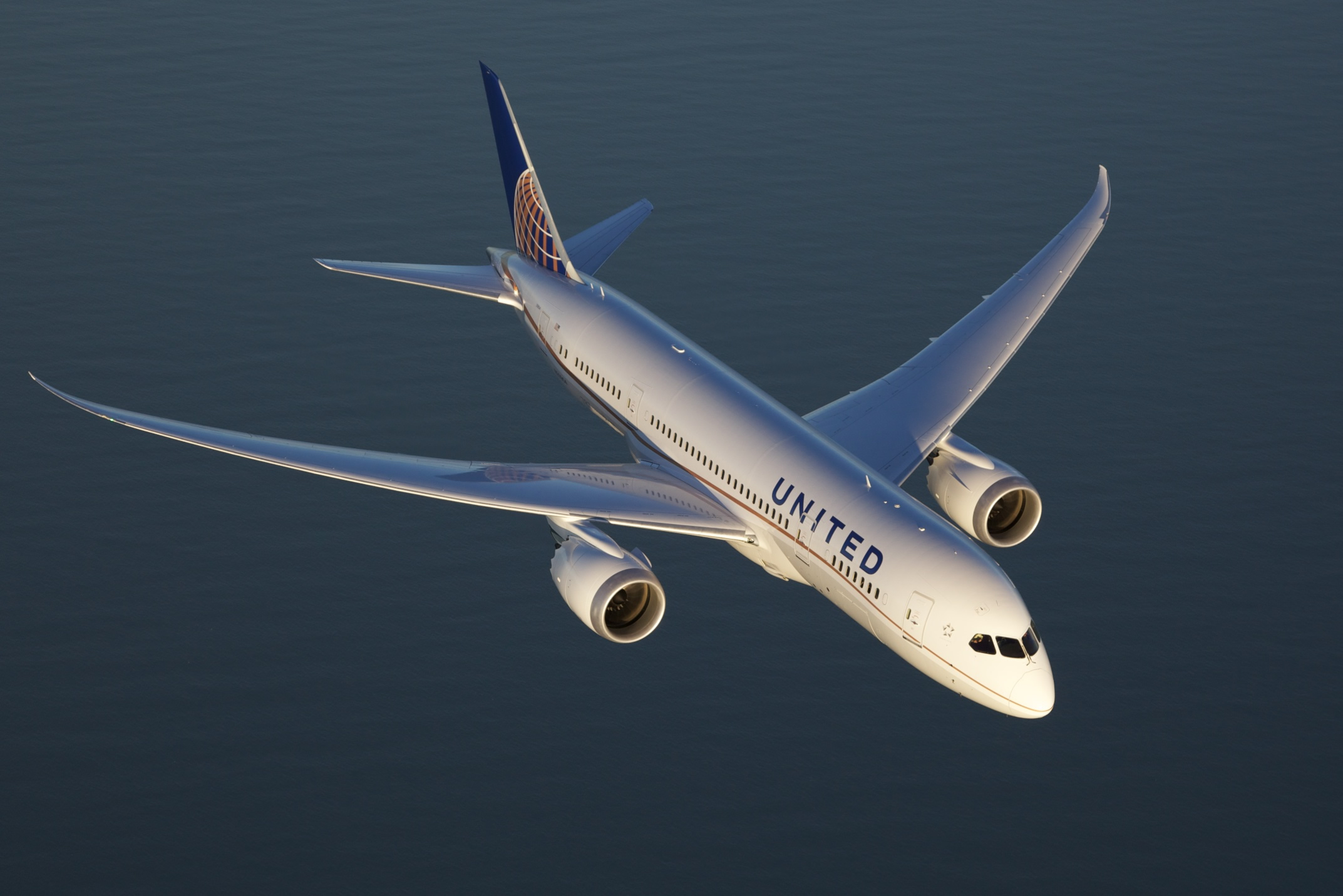

United Continental

This company still feels lingering effects of the merger with Continental five years ago. United Continental Holdings Inc. (NYSE: UAL) has been a show-me story for many investors, as the merger has not been smooth, and customers have experienced numerous computer glitches that have snarled traffic over the past two years.

United Airlines and United Express operate an average of nearly 5,000 flights a day to 373 airports across six continents. In 2014, United and United Express operated nearly 2 million flights carrying 138 million customers. United is proud to have the world’s most comprehensive route network, including U.S. mainland hubs in Chicago, Denver, Houston, Los Angeles, New York/Newark, San Francisco and Washington D.C.

The UBS price target is $85, and the consensus is lower at $82.07. The stock closed on Monday at $56.31 per share.

ALSO READ: 4 Top US Growth Stock Calls for This Week

With the price of oil still way lower than a year ago, the summer travel season just about to get into full-swing and much easier comparisons, these stocks look like good additions to a growth portfolio. They have all come down substantially from highs printed just a few short months ago.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.