Transportation

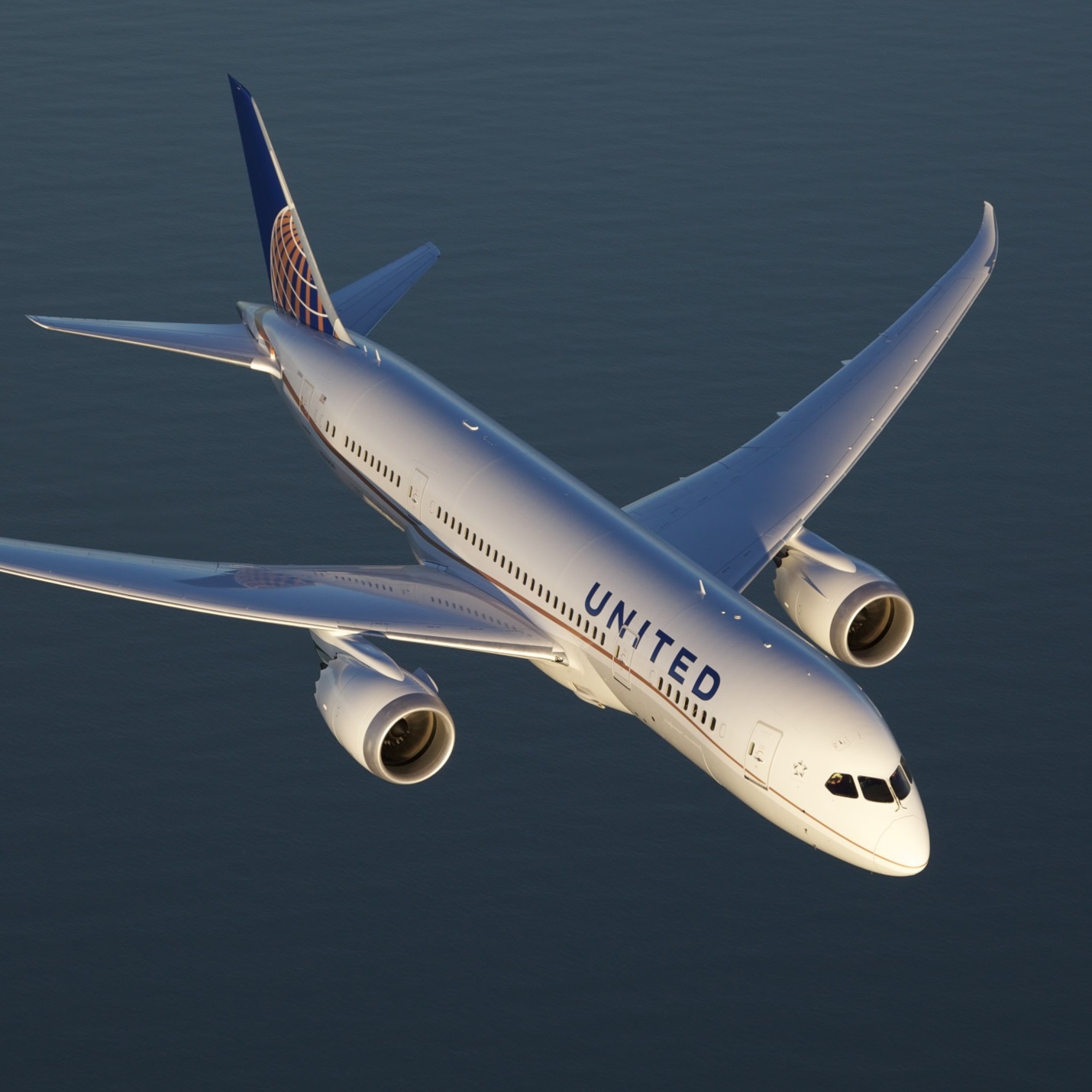

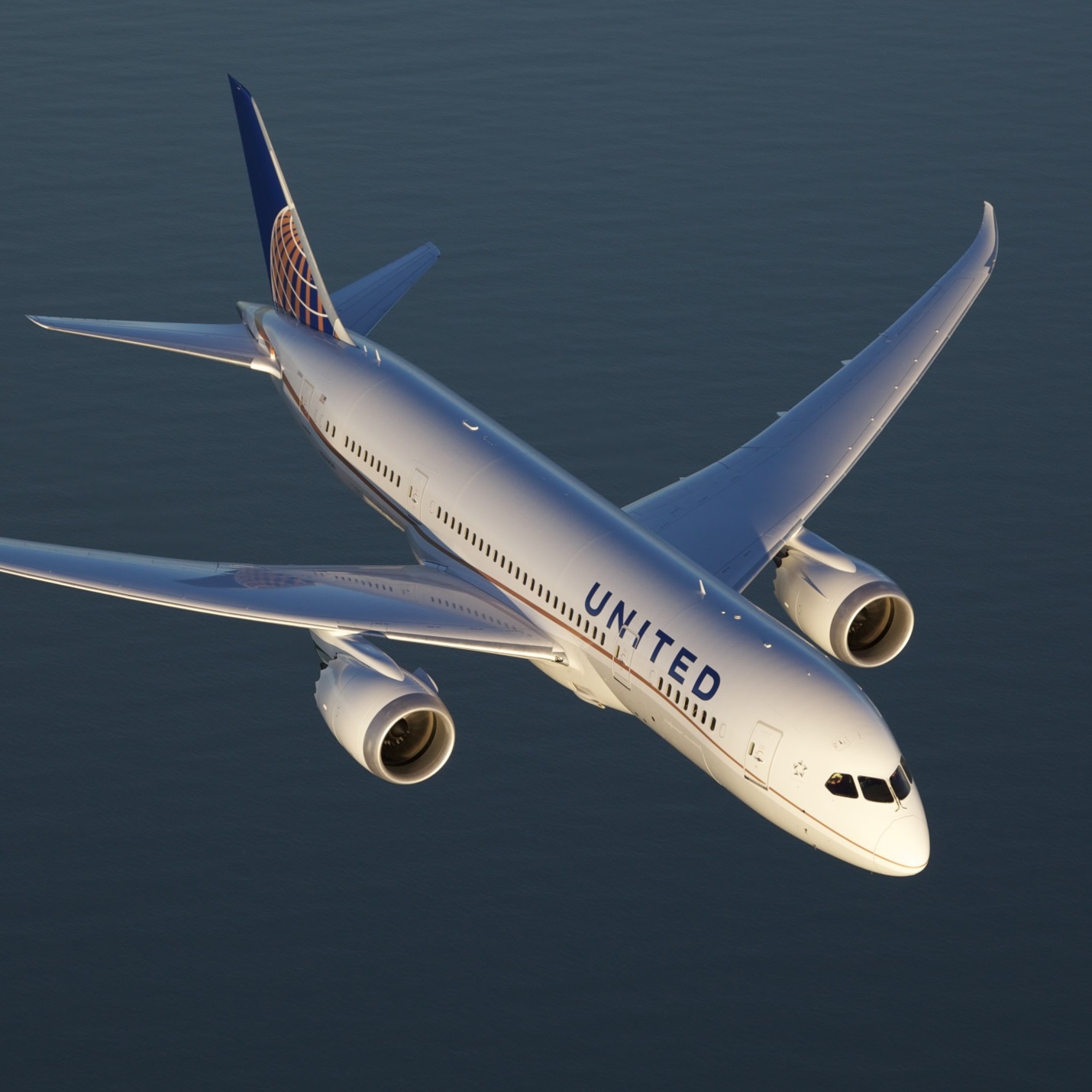

United Airlines Posts Lower Profits on Less Traffic

Published:

Last Updated:

United Continental Holdings Inc. (NYSE: UAL) reported second-quarter 2016 results after markets closed Tuesday afternoon. The airline reported adjusted quarterly earnings per share (EPS) of $2.61 on revenues of $9.4 billion. In the same period a year ago, United reported EPS of $3.31 on revenues of $9.91 billion. Second-quarter results compare to the consensus estimates for EPS of $2.57 on revenues of $9.38 billion.

On a GAAP basis, Delta’s EPS for the quarter totaled $1.78 and includes $272 million in total special items for the quarter..

Adjusted to include fuel-hedging impacts, fuel cost averaged $1.44 a gallon, a drop of 32% a gallon year over year. Total fuel expense for the quarter equaled $1.44 billion, down 34% compare with $2.18 billion in the same quarter last year.

Cost per available seat mile(CASM, the unit cost) including special charges, third-party business expenses, fuel and profit sharing decreased 1.6% compared to the second quarter of 2015 due mainly to lower oil prices. Consolidated CASM, excluding special charges, third-party business expenses, fuel and profit sharing, increased 2.5% year-over-year driven largely by the impact of recently ratified labor agreements.

Lower revenue per seat mile was attributed to a strong dollar, lower surcharges, travel reductions from customers who took advantage of lower oil prices, competitive actions, and higher-yielding demand not keeping pace with industry capacity.

United’s president and CEO, Oscar Munoz, said:

We made significant progress in the second quarter as a direct result of the passion and dedication that United’s aviation professionals around the world have for running a great airline. This progress is exemplified by the best six months of operational performance in our history and we will continue down the path of unlocking United’s full potential.

United repurchased $694 million worth of its common stock during the quarter, representing 4.4% of shares outstanding. The company’s board authorized an additional $2 billion in share repurchases to be tacked on to the $255 million remaining in the prior authorization.

Available seat miles rose just 0.1% compared with the same quarter last year but passenger revenue dropped by 6.6% per available seat mile. Domestic capacity rose 0.9% and revenues per available seat mile fell 4.6%.

The airline is estimating third quarter capacity will increase by 1.5% to 2.5% and that full-year capacity will rise by 1% to 1.5%. Consolidated passenger revenue per available seat mile is forecast to be lower by 5.5% to 7.5%.

Consensus estimates call for third-quarter EPS of $2.87 and revenues of $9.92 billion. For the fiscal year analysts are looking for EPS of $7.95 and revenues of $36.32 billion.

Shares traded up about 0.9% at $48.28 in Tuesday’s after-hours session. The stock’s 52-week range is $37.41 to $62.21. Prior to this release Thomson/Reuters had a consensus price target of $59.83 on the company’s shares.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.