Transportation

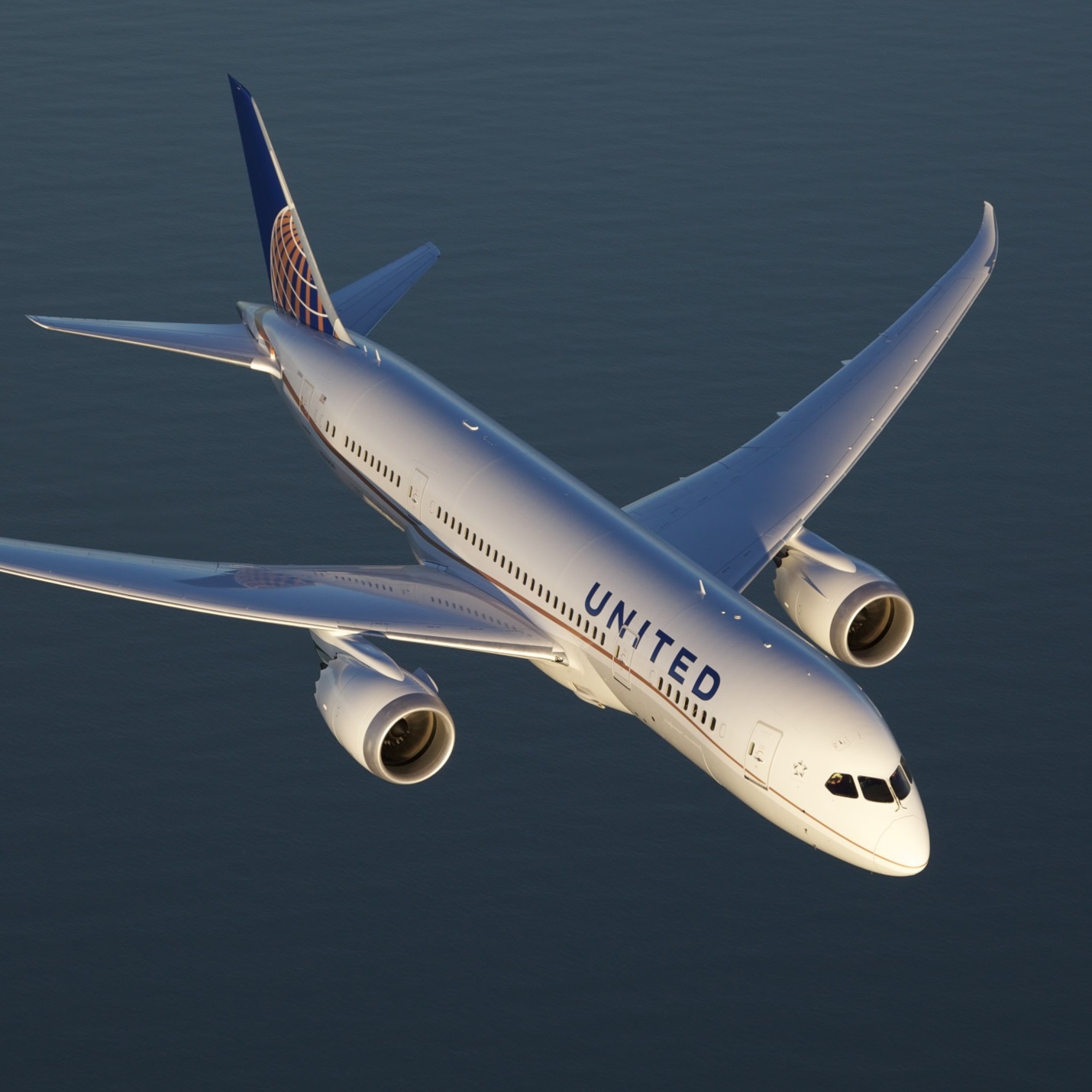

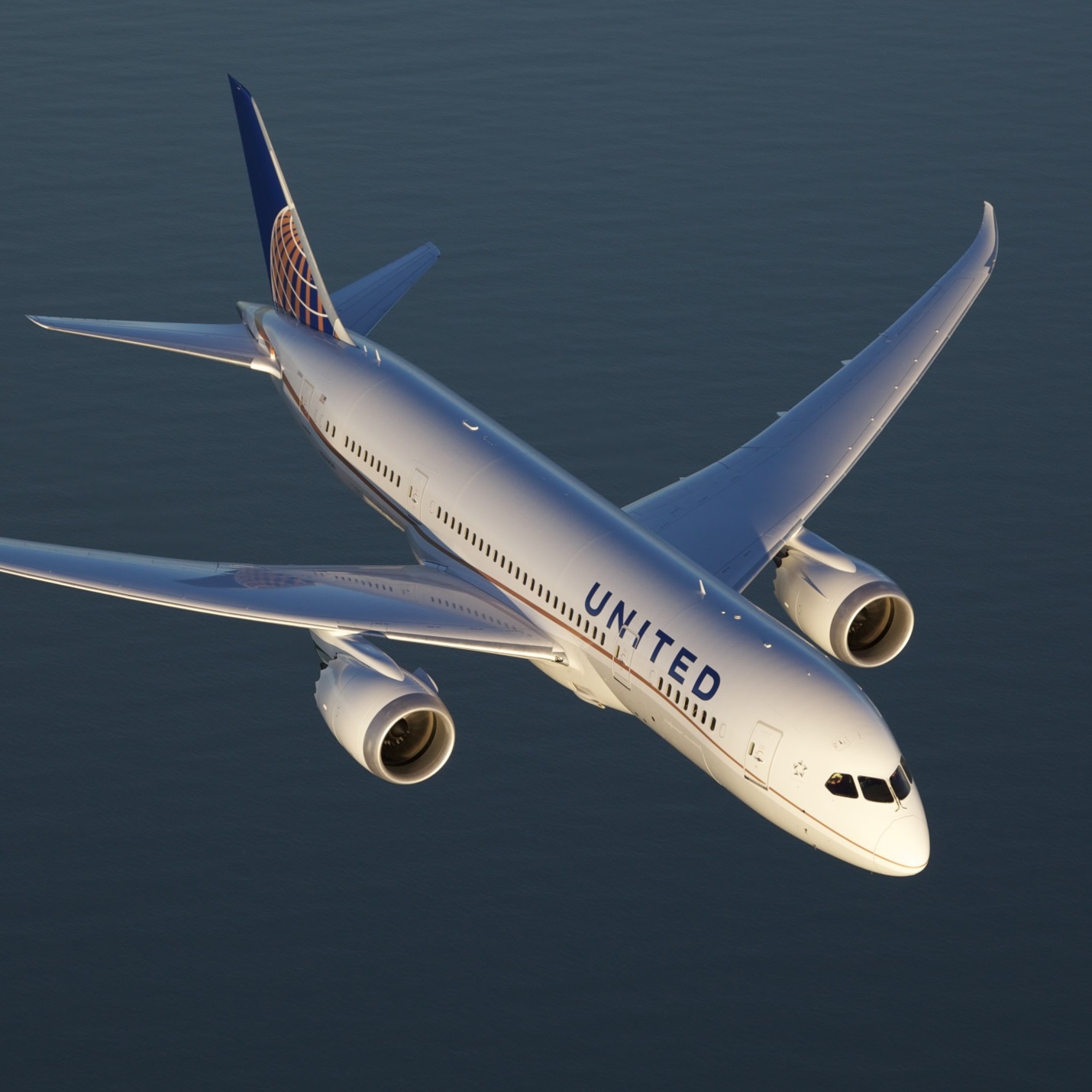

United Airlines Earnings Beat Estimates, but Outlook Worries Investors

Published:

Last Updated:

United Continental Holdings Inc. (NYSE: UAL) reported fourth-quarter and full-year 2016 results after markets closed Tuesday afternoon. The airline reported adjusted quarterly earnings per share (EPS) of $1.78 on revenues of $9.05 billion. In the same period a year ago, United reported EPS of $1.64 on revenues of $9.04 billion. Fourth-quarter results compare to the consensus estimates for EPS of $1.73 on revenues of $9.03 billion.

For the full-year adjusted EPS totaled $8.65 on revenues of $36.56 billion compared with 2015 EPS of $7.65 and revenues of $37.86 billion. Consensus estimates called for EPS of $8.57 and revenues of $36.52 billion.

Adjusted to excluding fuel-hedging losses, fuel cost averaged $1.60 a gallon, an increase of 5.3% a gallon year over year. Total fuel expense for the quarter equaled $1.56 billion, down 10.3% compared with $1.73 billion in the same quarter last year.

Passenger revenue per available seat mile (PRASM) dropped 1.6% and consolidated yield fell 1.2% year over year in the fourth quarter. The declines were below the company’s forecast due to stronger late bookings and yields in November and December.

Cost per available seat mile(CASM, the unit cost) including special charges, third-party business expenses, fuel and profit sharing decreased 0.8% compared to the fourth quarter of 2015 due mainly to lower fuel prices. Consolidated CASM, excluding special charges, third-party business expenses, fuel and profit sharing, increased 4.1% year-over-year driven largely by the impact of recently ratified labor agreements.

United’s president and CEO, Oscar Munoz, said:

In 2016, we put into action our plan to become the best airline in the world, and last year’s results demonstrate we are on our way to achieving that ambition. We will continue delivering on this commitment by investing in our employees, elevating our customer experience and driving strong and consistent returns for our shareholders.

For the full year United repurchased $2.6 billion worth of its common stock during the quarter, representing about 14% of shares outstanding. The remaining authorization in the share repurchase program totals $1.8 billion.

Available seat miles rose 2% compared with the same quarter last year but passenger revenue dropped by 1.6% per available seat mile.

The company expects first-quarter consolidated unit revenues to be approximately flat, and that is likely responsible for the sell-off following Tuesday’s report.

Consensus estimates call for 2017 first-quarter EPS of $0.41 and revenues of $8.28 billion. For the fiscal year analysts are looking for EPS of $6.64 and revenues of $37.49 billion.

Shares traded down about 2% at $72.00 in Tuesday’s after-hours session. The stock’s 52-week range is $37.41 to $61.8776.80. Prior to this release the 12-month consensus price target on the company’s shares was $84.66.

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.