Transportation

Stifel Massively Raises Price Targets on Top Buy-Rated Airline Stocks

Published:

Last Updated:

If there is any sector that loves lower oil prices, it’s the airlines, and with good reason. Jet fuel is a huge cost for the major carriers. While prices have jumped dramatically from a year ago, they have leveled off and are falling as oil drops below the $50 level. Despite that drop, most fares have stayed the same, so the airlines are poised to post some outstanding earnings this year. With spring here, and the busy summer travel season right around the corner, the top stocks look very attractive now.

A new Stifel research report makes the case that the airlines are what the analyst calls “intrinsically undervalued” and that a confluence of new metrics could drive the long-standing multiples for the industry higher. The report noted:

The consensus, longer-term bullish view on airlines is that consolidation, better management teams, improved balance sheets, and capacity discipline will allow the industry to deliver more durable earnings and cash flow which will ultimately lead to airline stocks re-rating to industry multiples.

Stifel raised its price targets on four top companies, and shares of all rated Buy at the firm.

This major carrier has been hit hard and is offering investors a very solid entry point. American Airlines Group Inc. (NASDAQ: AAL) is the holding company for American Airlines. Together with wholly owned and third-party regional carriers operating as American Eagle and US Airways Express, the airlines operate an average of nearly 6,700 flights per day to 350 destinations in over 50 countries from its hubs in Charlotte, Chicago, Dallas/Fort Worth, Los Angeles, Miami, New York, Philadelphia, Phoenix and Washington, D.C.

The company posted solid but somewhat slower first-quarter revenue by available seat miles (RASM), which is a commonly used measure of unit revenue for airlines, expressed in cents received for each available seat mile and determined by dividing various measures of operating RASM.

Shareholders receive a 0.99% dividend. Stifel raised the price target from $65 to $95. The Wall Street consensus target is $53.60. The shares closed Tuesday at $40.42.

This company consistently has ranked high with Wall Street. Delta Air Lines Inc. (NYSE: DAL) and the regional Delta Connection carriers offer service to 334 destinations in 64 countries on six continents. Headquartered in Atlanta, Delta employs nearly 80,000 employees worldwide and operates a mainline fleet of more than 700 aircraft.

Wall Street analysts have long lauded Delta for the most extensive hedging policy among the airlines and it owns and operates a refinery in addition to a sizable hedging book. The stock underperformed last year, and if bookings and the economy continue to spike up in 2017, many believe that the company’s multiple stands to benefit the most among the major carriers.

Delta investors receive a 1.78% dividend. The Stifel price objective was raised from $65 to $75, and the consensus target is at $61.43. The stock closed most recently at $45.52.

This company continues to expand routes and remains a low-cost leader. It is also one of the top picks across Wall Street. Southwest Airlines Inc. (NYSE: LUV) is the fourth-largest U.S. airline by revenues and operates a customer-friendly, low-cost, point-to-point model without fees and offers flights throughout the continental United States. Its six largest operations are in Dallas, Chicago, Las Vegas, Baltimore, Phoenix and Houston.

Jet fuel prices, which remain much lower than in past years, are almost 30% of Southwest’s total costs. They have been a key for improving revenues and earnings. With almost no international business at this time, currency headwinds are not an issue for the airline.

Based on the U.S. Department of Transportation’s most recent data, Southwest Airlines is the nation’s largest carrier in terms of originating domestic passengers boarded. The company operates the largest fleet of Boeing aircraft in the world, the majority of which are equipped with satellite-based Wi-Fi, providing gate-to-gate connectivity.

Southwest shareholders receive a 0.77% dividend. The Stifel price target was raised to $80 from $65. The consensus target is $61.87, and shares closed Tuesday at $51.88.

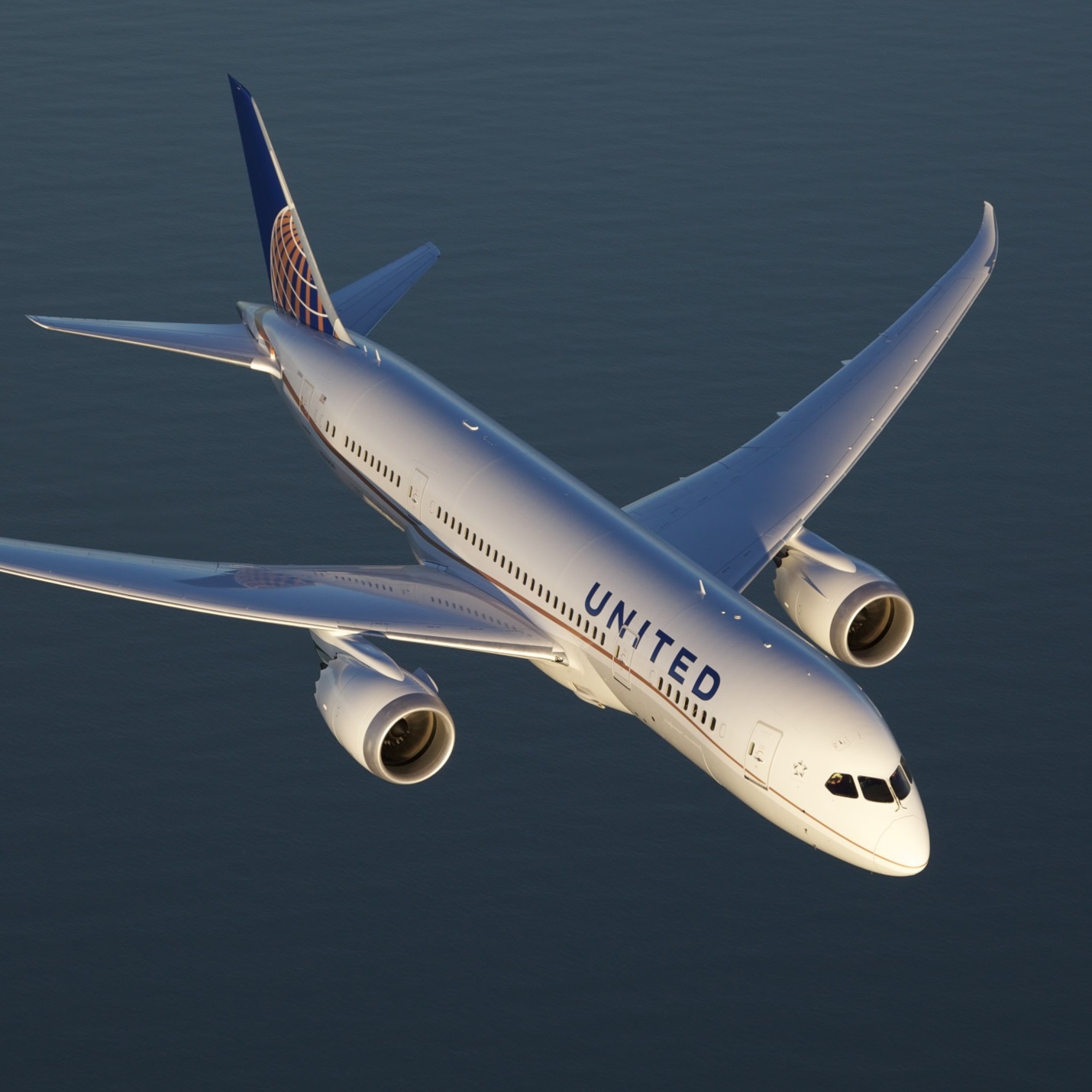

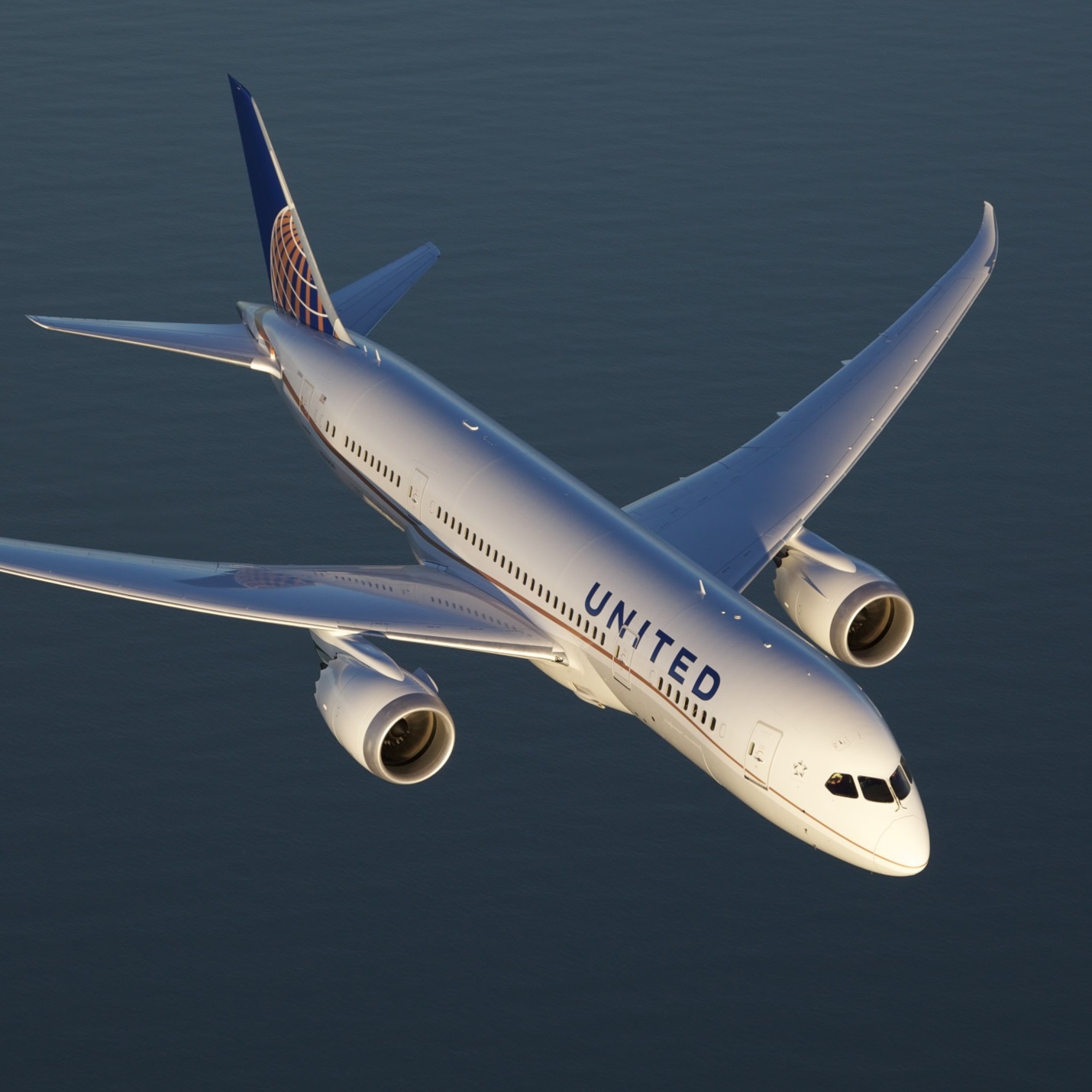

This company still feels lingering effects of its huge merger almost six years ago, but Wall Street likes the improving story and the shares look cheap. United Continental Holdings Inc. (NYSE: UAL) has been a show-me story for many investors as the merger with Continental has not been smooth, and customers have experienced numerous computer glitches that have snarled traffic over the past couple of years.

United Airlines and United Express operate an average of 5,055 flights a day to 373 airports across six continents. United’s key U.S. hubs include Chicago, Denver, Houston, Los Angeles, New York/Newark, San Francisco and Washington, D.C. The airline is a founding member of Star Alliance, which provides service to 193 countries via 27 member airlines.

The $95 Stifel price target was raised to $125, and the consensus target is $83.94. The stock closed on Tuesday at $65.28.

The big key for the airlines is economic growth, which finally after eight years of stagnation appears to be coming around. All these stocks offer good entry points as they all trade below highs printed over the past few years.

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.