Transportation

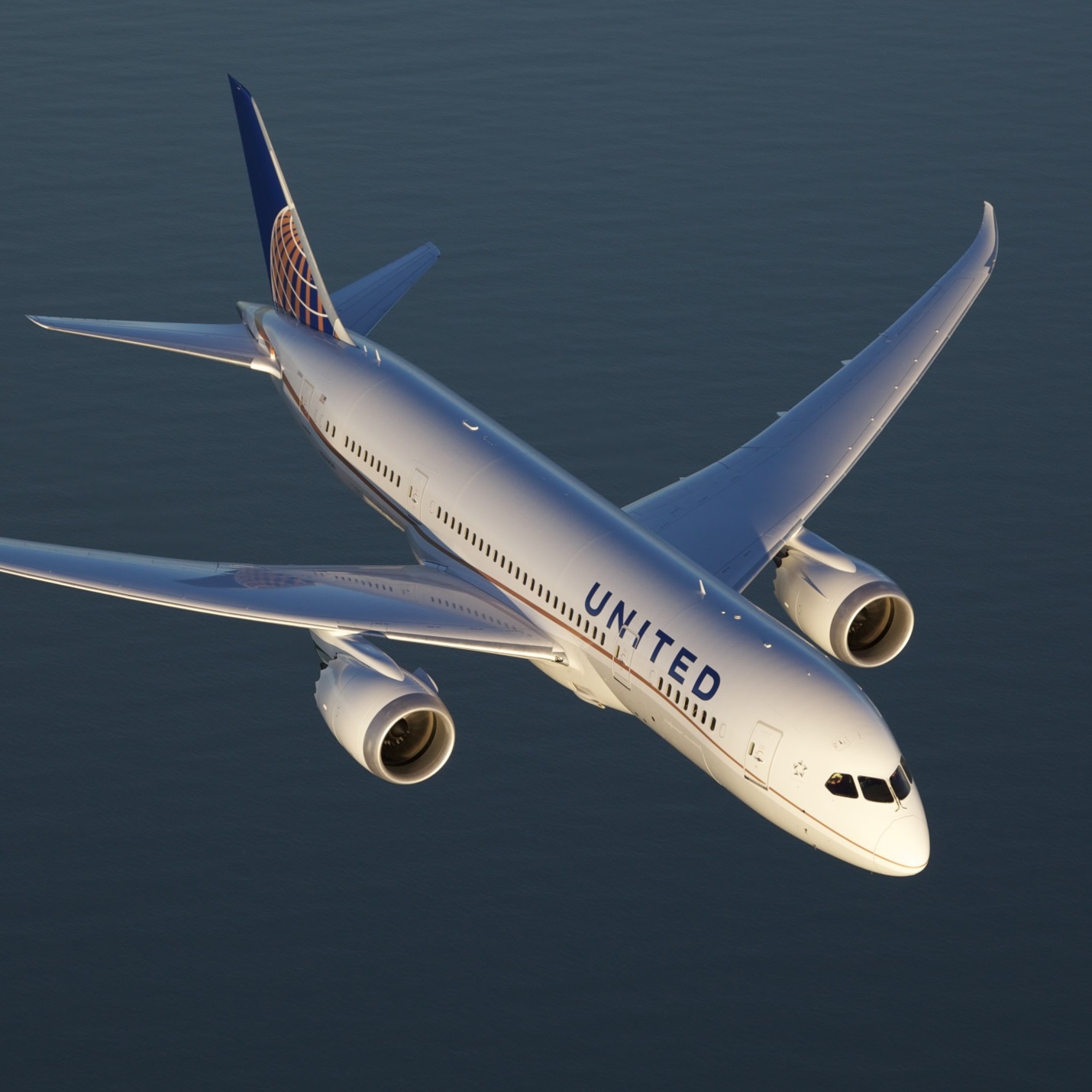

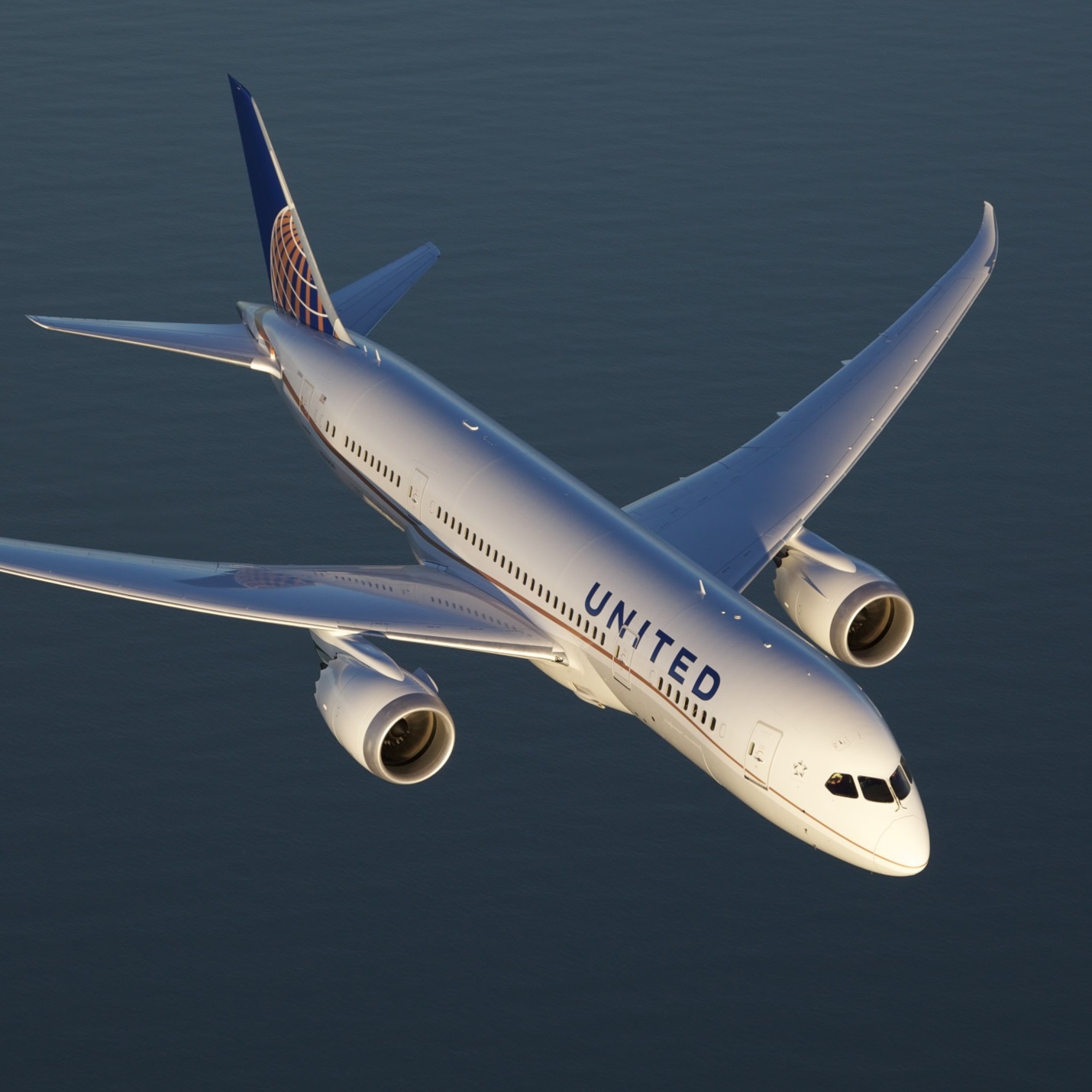

United Airlines Earnings Don't Impress Investors

Published:

Last Updated:

United Continental Holdings Inc. (NYSE: UAL) reported second-quarter 2017 results after markets closed Tuesday afternoon. The airline reported adjusted diluted quarterly earnings per share (EPS) of $2.75 on revenues of $10 billion. In the same period a year ago, United reported EPS of $2.61 on revenues of $9.4 billion. Second-quarter results compare to the consensus estimates for EPS of $2.63 on revenues of $9.95 billion.

Adjusted to excluding fuel-hedging losses, fuel cost averaged $1.62 a gallon, an increase of 12.5% a gallon year over year. Total fuel expense for the quarter equaled $1.67 billion, up 16.1% compared with $1.44 billion in the same quarter last year.

Passenger revenue per available seat mile (PRASM) was up 2.1% year over year and consolidated yield rose 2% year over year in the second quarter. Cargo revenue jumped 22.1% to $254 million.

Cost per available seat mile(CASM, the unit cost) including special charges, third-party business expenses, fuel and profit sharing decreased by 1% compared to the second quarter of 2016 due mainly to lower special charges. Consolidated CASM, excluding special charges, third-party business expenses, fuel and profit sharing, increased 3.1% year-over-year, driven mainly by higher labor expense.

United’s president and CEO, Oscar Munoz, said:

The positive financial and operational performance this past quarter demonstrates that United is firmly on the right path. From investing in our products and our people, redoubling our focus on the customer experience, closing the margin gap with our peers and delivering strong returns to our investors, we have made important progress and moved United decisively forward. No single quarter constitutes a trend and we still have much further to go before we fully realize the potential of this airline and exceed the expectations of our customers. But, we also know that one success begets another and the strong financial and operating performance we posted this quarter adds to the momentum that all of us here at United are determined to build upon.

Available seat miles rose 4.2% compared with the same quarter last year and passenger revenue increased by 2.1% per available seat mile. For all segments the consolidated load factor was 83.5%, unchanged year over year. Domestic load factor improved by 0.3 percentage points and international fell by a like amount.

The company did not offer third-quarter guidance, but consensus estimates call for revenues of $10.39 billion and EPS of $3.13. In the third quarter of 2016 revenues totaled $9.91 billion and EPS came in at $3.11.

Shares traded down about 2.8% at $76.70 in Tuesday’s after-hours session. The stock’s 52-week range is $44.15 to $93.04. Prior to the earnings release the 12-month consensus price target on the company’s shares was $93.29.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.