Transportation

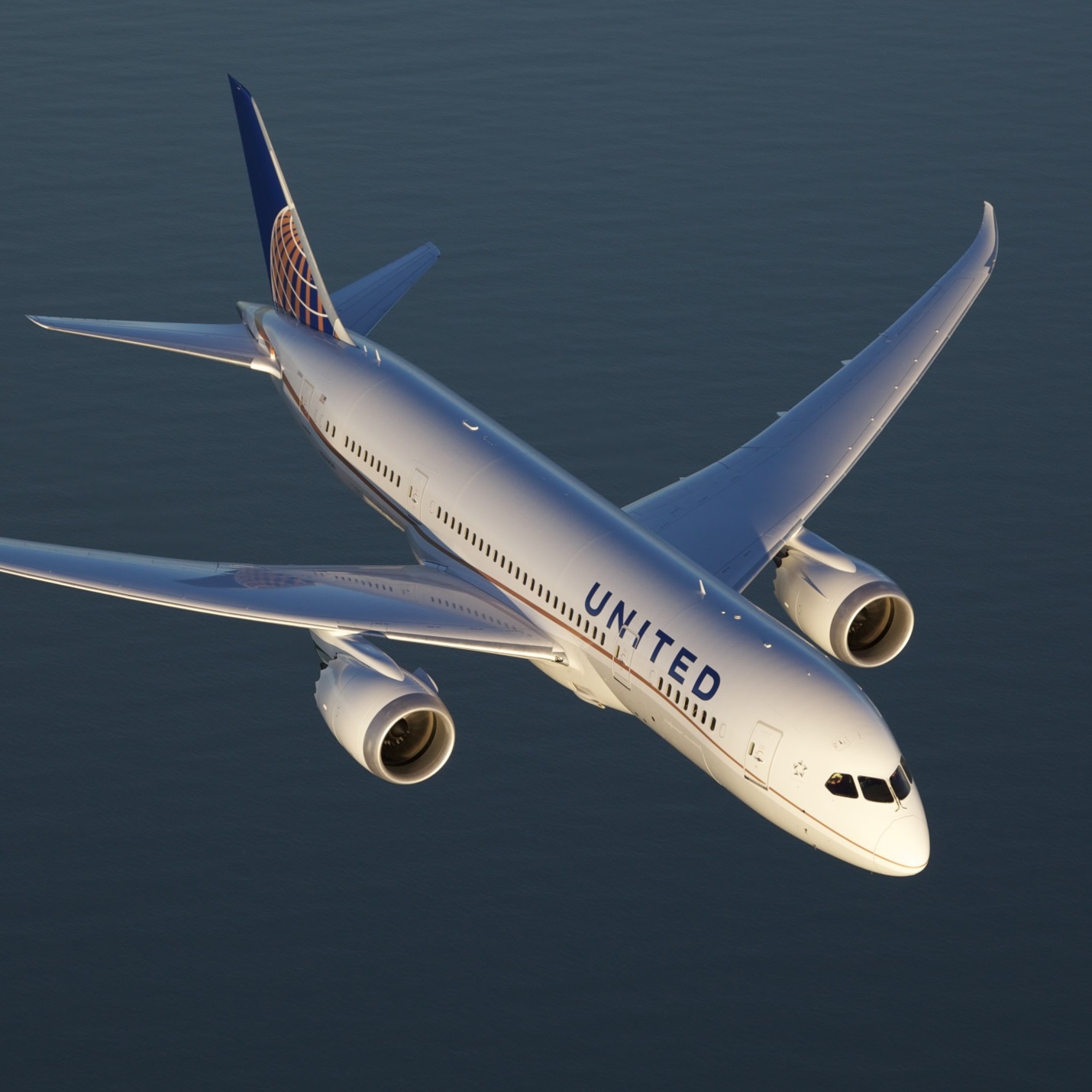

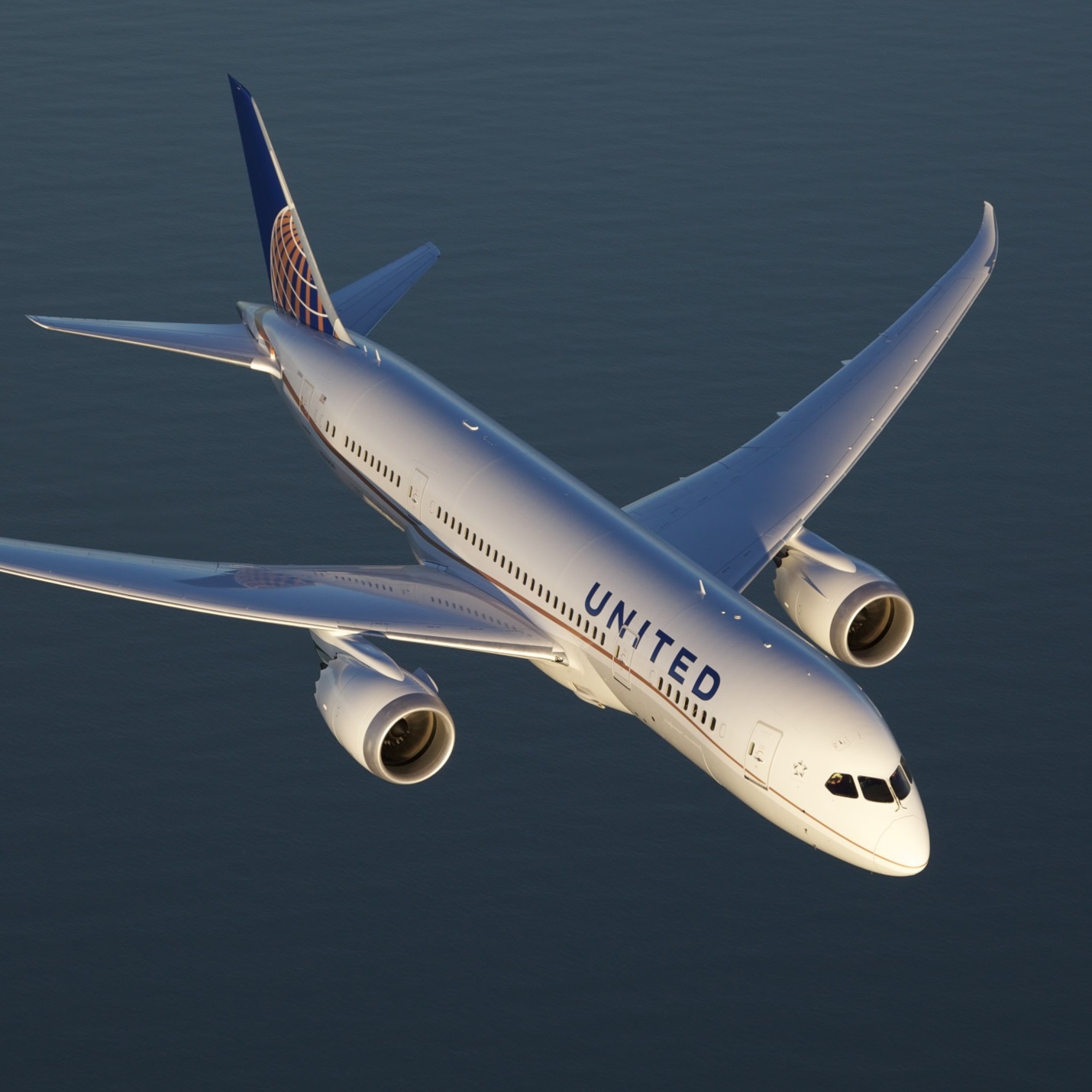

United Airlines Announces Lottery to Replace Bonuses

Published:

Last Updated:

Last December, United Continental Holdings Inc. (NYSE: UAL) announced that it would complete a $2 billion share buyback program by the end of 2017 and announced a new $3 billion share buyback plan. On Friday, CEO Scott Kirby announced that qualified United Continental employees would no longer receive quarterly cash performance bonus payments.

Instead, if the company meets certain performance goals, the company will hold a drawing for quarterly prizes of $2,000 to $4,000 in cash, luxury cars, vacation packages and one $100,000 grand prize per quarter. In order to be included in the drawing, an employee must apparently meet certain performance criteria, although that is not entirely clear.

Kirby linked the lottery system to the so-called core4 Score initiative to provide better service to airline customers. He called the lottery the core4 Score Rewards program.

According to a report at Business Insider, which has seen the memo announcing the program, the maximum number of employees who will receive a bonus payout during a quarter will be 1,351, of which 73% will receive a $2,000 cash prize. United Continental has about 88,000 employees.

Ken Diaz, president of the airline’s Association of Flight Attendants told Business Insider:

The new United has been built on the principle of “shared purpose” and it only makes sense that the fruits of that united effort would mean shared reward. With this move, there’s no doubt management has succeeded in achieving a united voice with all employees, but that voice is entirely opposed to and offended by this new “select” bonus program. Being “caring” cannot be choosy.

Chicago Business Journal, which first reported the change late Friday, noted that Kirby’s memo had largely failed to create the “caring” attitude the company has been trying to develop and that the CEO cannot afford to jeopardize the company’s improving on-time performance.

No worries on that score though. Happy shareholders will just fly more often on United Continental flight. Being on-time is so much less important than a small improvement in the company’s share price. Right?

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.