Tax & Finance

Tax & Finance Articles

Online brokerages have seen a surge in new accounts and trading activity over the past year. Younger and novice investors are taking their first plunges into investing, during a period of wild swings...

Published:

Before the COVID-19 pandemic, each day, motorists drove about 8.8 billion miles on American roadways, while the U.S. railroad system carried 85,000 passengers and 5 million tons of freight. Though...

Published:

The major coronavirus relief bill passed by Congress in March included provisions to allow Americans affected by the crisis special dispensation to withdraw from their retirement accounts, including...

Published:

The nationwide effort to contain the spread of COVID-19 has taken a considerable economic toll. In recent weeks, travel has all but ground to a halt, and nonessential businesses have shuttered,...

Published:

Because of the disruption caused by COVID-19, the IRS has extended the deadline for filing individual tax returns from April 15 to July 15. U.S. states have followed suit, with the majority moving...

Published:

For most people, achieving a comfortable retirement is a tricky business. The past few weeks have added to the challenges as the world has changed as much as in any period since WWII. The world is...

Published:

The coronavirus pandemic has thrust the shortcomings of America’s health care system into the spotlight once again. The United States has one of the costliest health care systems in the world, and...

Published:

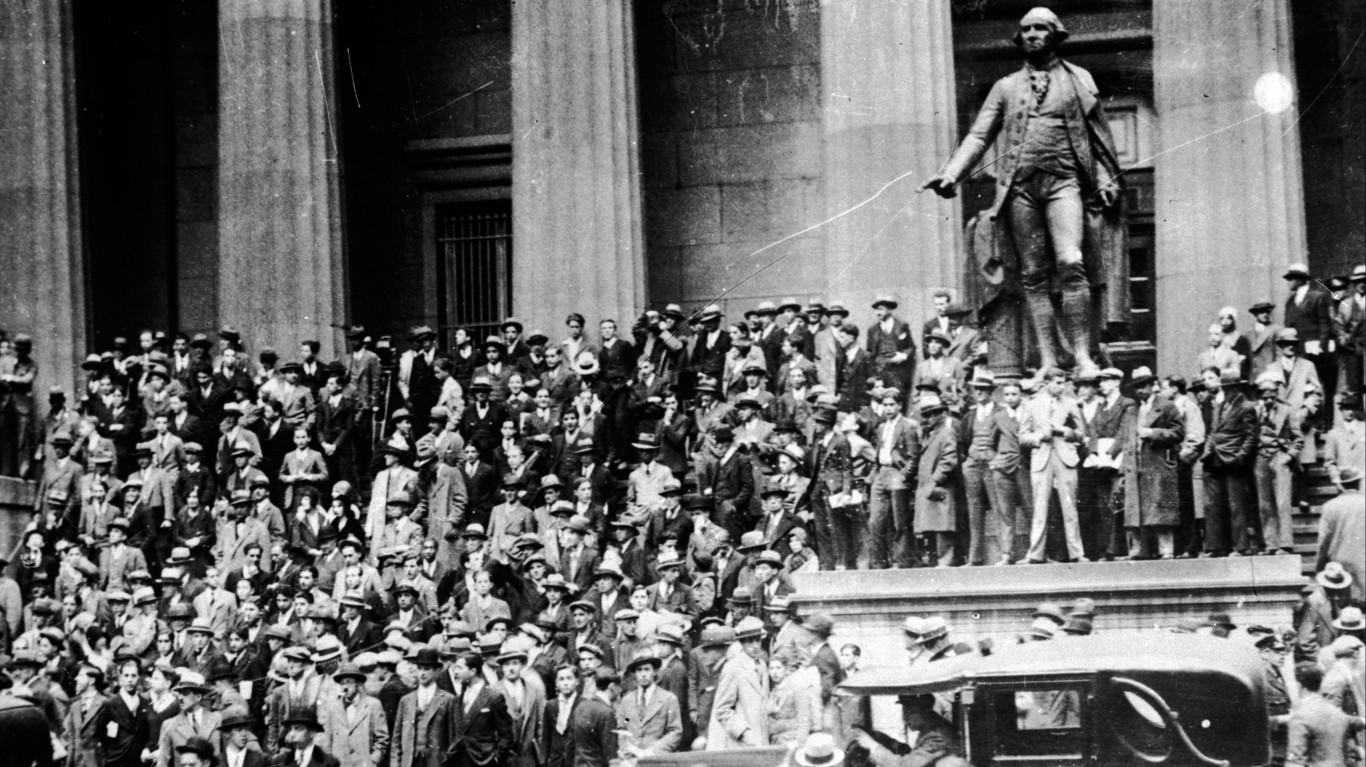

In mid-February 2020, the Dow Jones Industrial Average reached nearly 30,000 points, the highest level in its more than 100 year history. And then, the severity and scale of the COVID-19 pandemic...

Published:

Individual income taxes are the largest source of income for the federal government, accounting for 48% of federal tax revenue. Income taxes are similarly important to the vast majority of state...

Published:

Individual income taxes are the largest source of income for the federal government, accounting for 48% of federal tax revenue. Income taxes are similarly important to the vast majority of state...

Published:

Property tax regularly ranks among the least popular forms of taxation in the United States. Though property taxes can be set by local authorities such as cities, counties, and school boards, states...

Published:

Discover Our Top AI Stocks

Our expert who first called NVIDIA in 2009 is predicting 2025 will see a historic AI breakthrough.

You can follow him investing $500,000 of his own money on our top AI stocks for free.