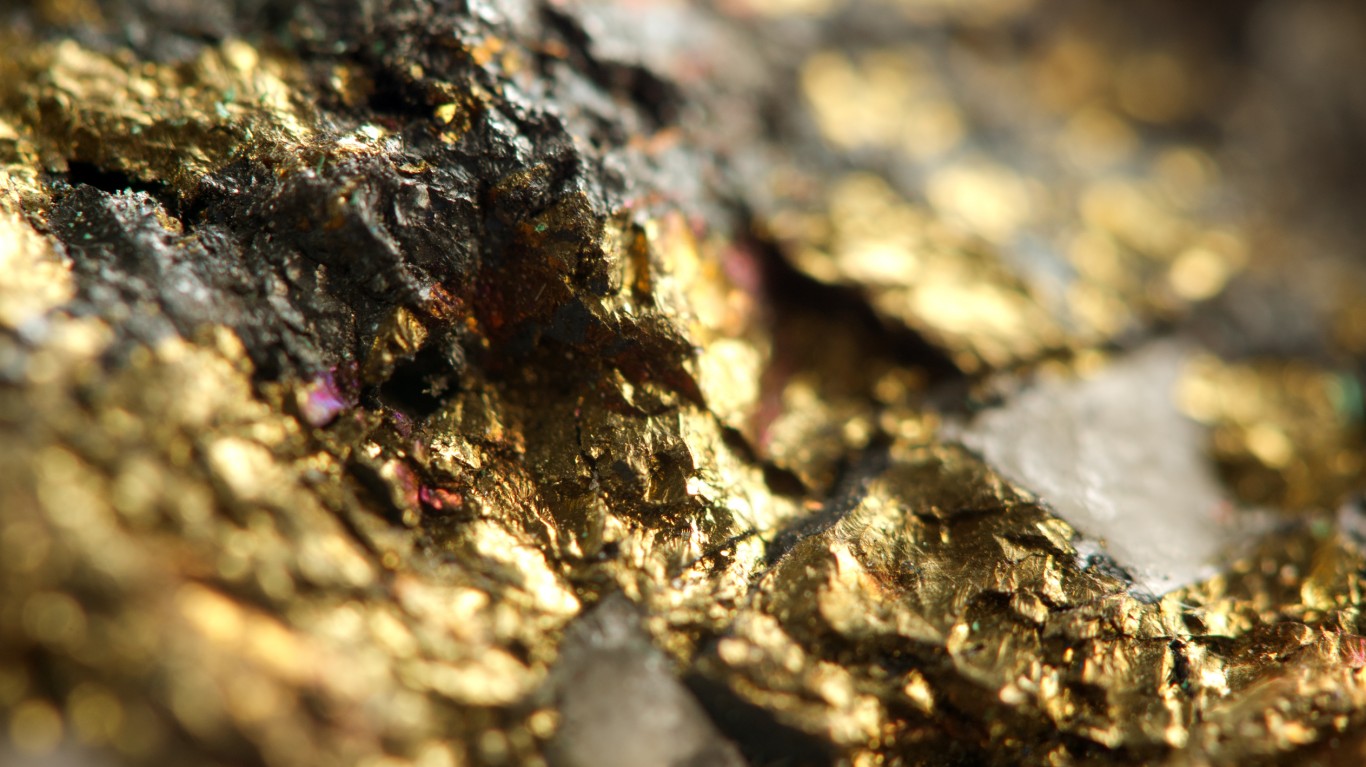

Commodities & Metals

Commodities & Metals Articles

Silver is supposed to be correlated to gold, so it should be rising by close to the same amount. Yet, there has been a disparity in the metals market.

Published:

The current coronavirus outbreak could be a pandemic. If so, one asset class could explode much higher. While gold traded to seven-year highs recently, the top could get blown off if things get...

Published:

Livent stock tumbled Friday after the company released its fourth-quarter financial results late on Thursday.

Published:

Iron-ore miner Cleveland-Cliffs is expected to close its acquisition of AK Steel next month. When both reported quarterly and full-year earnings Thursday morning, share prices dipped in tandem.

Published:

The CEO of Barrick Gold said earlier this week that the world's supply of gold could fall 30% short of demand by 2029. Will a digital currency replace the missing gold? Is that even possible?

Published:

With the markets facing a “witches' brew” of potential problems, one way to hedge a sell-off would be to buy gold. Here are five solid stock picks and an ETF for investors to consider.

Published:

The positives for the market remain, but now is the time for investors to take a deep breath and see if a little portfolio hedge might be in order. These four stock make sense for investors to add as...

Published:

With Alcoa being a leader in aluminum, the problem here is that many investors see problems in aluminum also translating into problems for companies involved in steel, copper, titanium and other...

Published:

U.S. Steel announced late Thursday that it will shut down most of its Great Lakes Works plant, cut its dividend, and terminate its share buyback program as it tries to weather tough economic...

Published:

Here are five of the top gold-mining and gold-producing stocks that appear undervalued despite gold's performance in 2019.

Published:

Last Updated:

The U.S. Army is seeking proposals to build a pilot plant in the United States to refine rare earth elements used in many weapons systems.

Published:

A new RBC report notes that the gold-mining stocks may be turning around. These stocks make sense for nervous investors looking to add some exposure to gold.

Published:

Global food prices spiked in November, another challenge to the efforts to feed the world's hungry. Rising prices come at the same time as other factors that represent high hurdles.

Published:

Iron ore miner Cleveland-Cliffs will acquire steelmaker AK Steel in an all-stock deal valued at $1.1 billion. Investors are less than excited.

Published:

Discover Our Top AI Stocks

Our expert who first called NVIDIA in 2009 is predicting 2025 will see a historic AI breakthrough.

You can follow him investing $500,000 of his own money on our top AI stocks for free.