Apps & Software

Full Microsoft Earnings Preview Expectations (MSFT)

Published:

Last Updated:

Microsoft Corporation (NASDAQ: MSFT) is due to report after the close of trading today and Thomson Reuters has estimates for the DJIA component of $0.68 EPS and $17.25 billion in revenues; next quarter estimates are $0.84 EPS and $21.21 billion in revenue.

Microsoft Corporation (NASDAQ: MSFT) is due to report after the close of trading today and Thomson Reuters has estimates for the DJIA component of $0.68 EPS and $17.25 billion in revenues; next quarter estimates are $0.84 EPS and $21.21 billion in revenue.

Shares are trading under $27.00, its 52-week trading range is $23.65 to $29.46 and analysts have a consensus price target of $31.90. The dividend is now close to 3% but investors are still concerned about the PC market causing a slower upgrade cycle for Windows but there is some hope since Intel offered enough of a PC-market buffer.

Options traders are pricing in a move of up to $0.45 to $0.55 in either direction, an indication of less than 2% based upon the news. Frankly, that could easily be understated if the news is off-expectations.

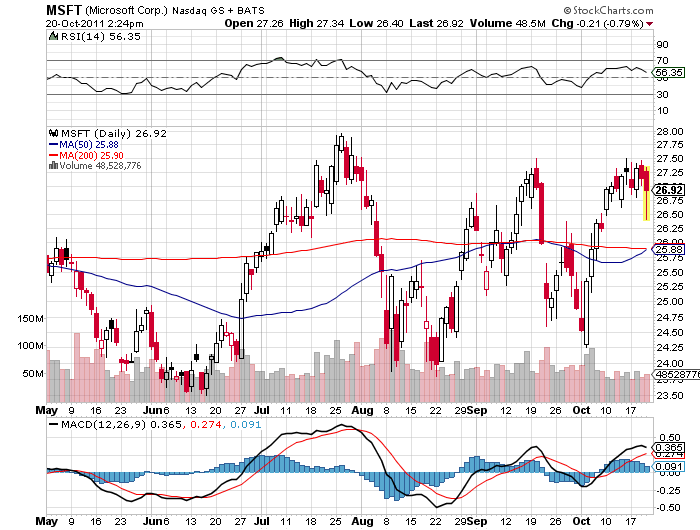

The chart is showing some concern here. While this shows strong support just under $26.00 with the 50-day moving average at $25.88 and the 200-day moving average at $25.90, Microsoft has seen a clear triple-top as you can see on the stockcharts.com stock chart below.

The good news, if the stock goes up the technicians will likely be calling this a breakout move to the upside with a likely challenge of the $28.50 level.

As far as valuation is concerned, Microsoft shares are currently trading at only 9.5-times the $2.85 EPS consensus from Thomson Reuters for the June-2012 fiscal year-end. If you back out the $50+ billion cash from the $225 billion market cap, the stock is even cheaper.

JON C. OGG

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention. Many people have worked their whole lives preparing to retire without ever knowing the answer to the most important question: am I ahead, or behind on my goals?

Don’t make the same mistake. It’s an easy question to answer. A quick conversation with a financial advisor can help you unpack your savings, spending, and goals for your money. With Zoe Financial’s free matching tool, you can connect with trusted financial advisors in minutes.

Why wait? Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.