Banking, finance, and taxes

See The Oldest Fortune 500 CEOs Today

Published:

Last Updated:

Did you know that human cognitive abilities peak during our twenties and level off during middle age? After that point, depending on how well you took care of your brain, your ability to think quickly, rationally, recall information, and make informed decisions will gradually decline. Sometimes this decline is small and almost imperceptible except during extreme situations. However, noticeable cognitive impairment begins to occur around age 70 for men and age 73 for women. Around this age, typically, humans begin to lose the ability to rely on their own cognitive functions without help. During periods of intense stress or emotion, this cognitive impairment can become especially noticeable and embarrassing.

For a variety of reasons, we have decided to trust our nations and the largest companies in the world to a group of aging men with mental impairment and questionable moral values. When you realize that most of the companies you interact with, the products you buy, the entertainment you watch, and even the opinions you hold are all sold to you by a handful of aging, cognitively impaired, out-of-touch, white men who only care about stuffing their pockets with more money, you begin to understand how we got the world we have today.

That being said, who are the oldest Fortune 500 CEOs today? We looked into it and ranked them here from youngest (relatively) to oldest. Here are the 15 oldest Fortune 500 CEOs.

For this list we compared the age of only the active CEOs of all Fortune 500 companies, picking only the top 15. While there might have been older CEOs in the past, and older CEOs of non-Fortune 500 companies, we did not include them on this list. These old gentlemen are among the most powerful people in the world.

Sola is actually one of the original founders of Sanmina when it was created back in 1980. It is one of the biggest printed circuit board manufacturers in the world with around 80 manufacturing sites around the world. Besides some brief moments of leadership changes, Sola has served as Sanmina’s CEO since 1991.

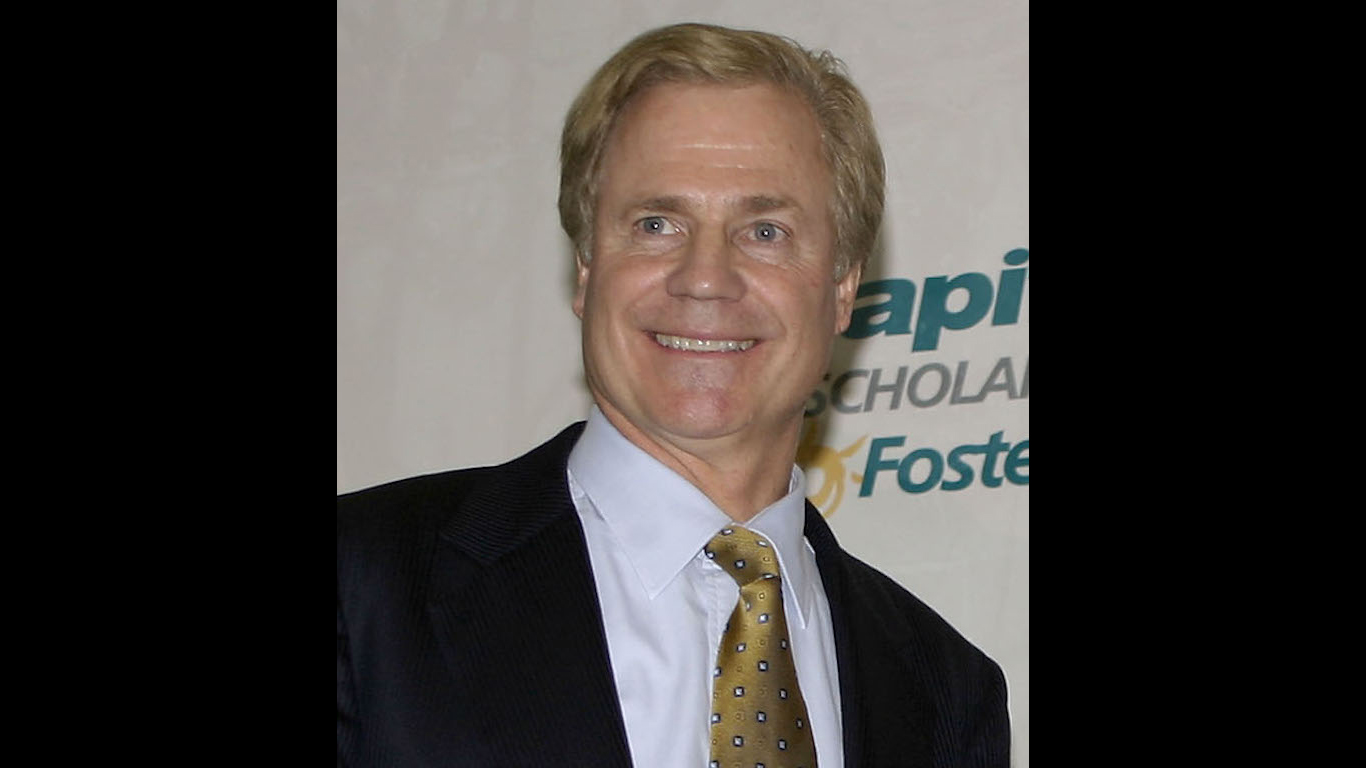

Amos first joined Aflac as a salesman in 1973 and quickly rose the sales charts within the company. After ten years in sales, he became the company president in 1983 and the CEO in 1990.

Aflac is the largest insurance company in Japan and the top provider of renewable insurance in the United States.

Besides its success in insurance, Aflac is almost better known for its famous Aflac Duck which made its debut in 1999. The Aflac Duck has become a common and recognizable brand symbol ever since.

Iger has a long career in entertainment and media, beginning with Ithaca College in 1972, then joining ABC in 1974 before becoming head of ABC Entertainment in 1989 and then CEO in 1994. Walt Disney bought ABC in 1995 and Iger became the president of Walt Disney International in 1999. Iger took over as CEO from the controversial Michael Eisner in 2005.

Under Iger’s leadership, Disney bought Pixar, Marvel Entertainment, and Lucasfilm. He was a board member of Apple and made Steve Jobs one of Disney’s largest shareholders. His contract as CEO was extended several times, and after his retirement, he was asked to return to the company after his replacement was ousted by the board. His current contract was then extended to 2026.

Capital One began as a corporate spin-off from Signet Financial Corp (which is now part of Wells Fargo) with Fairbank as CEO. He has remained CEO ever since.

Fairbanks has not been paid a base salary since 1997, instead, all his pay comes from stock awards, options awards, and other various compensation. In total, he earned over $22 million in 2012 alone. This means that Fairbanks doesn’t have to pay payroll taxes or pay any federal or state deductions on his compensation since he technically doesn’t receive a salary.

After Capital One’s price reached a price high in 2018, Fairbank’s wealth grew to over a billion Dollars.

Henry Schein is a worldwide healthcare products company. Bergman joined Henry Schein in 1980 and was promoted to CEO in 1989.

Henry Schein began as a pharmacy in Queens, New York in 1932 and has grown to a multinational conglomerate with over $12.6 billion in revenue every year, expanding into dental and medical fields. It has purchased over 200 companies since 1989, accumulating significant influence in the medical field. Bergman was the CEO of the year for 2017 according to Chief Executive Magazine.

Westlake Corporation is a petrochemical, polymer, and fabrications manufacturer and supplier. It is the top producer of low-density polyethylene in the United States. Westlake has had several chemical leaks over the years.

Albert Chao is the son of Westlake’s founder, Ting Tsung Chao, who created the company with his two sons in 1986. He was born and raised in Taiwan before moving to the United States to help run the company and finish school.

Western & Southern is a financial company that offers a variety of financial services through the companies it owns like insurance, mutual funds, investments, and more.

The company was working to convince Cincinnati to remove the historic designation of several historic buildings in the city so it could demolish them to make room for more corporate offices. Western & Southern owns several life insurance companies including the Gerber Life Insurance Company.

Barrett has been the CEO since 1994. He is responsible for growing the company from a small life insurance provider to a massive financial conglomerate that has doubled in size every year for the last fifteen years.

Freeport is a mining company in Phoenix, Arizona. It is the largest miner of molybdenum and operates the biggest gold mine in the world (located in Indonesia). It also mines copper.

Freeport has a terrible human rights and environmental record, especially when it comes to its gold mine in Indonesia. It has been accused of negligence and disregard for worker safety, leading to the deaths of at least thirty-six workers. The New York Times found that Freeport also paid local military officers including generals and more, police, politicians, and other people tens of millions of dollars to secure the land on which their mine operates. Company leadership even worked with dictator Suharto and cut them in on some of the deals in order to open and operate their mine. It also monitored the telephone calls and email communication from local environmentalists, sharing information with the Indonesian military.

Freeport also paid military members to oppress the native West Papuan people in the area who protested against the ecological devastation. Many natives were killed and injured.

The operations from the mine have severely polluted the water and land around the area, including normal operations and waste leakage (like dangerous acids).

Adkerson has been the CEO of Freeport since 2003. Despite the terrible record of his company, Adkerson has continued to receive high praise from industry insiders.

Blackstone is the largest alternative investment company in the world with over $1 trillion under its control. It was founded in 1985 by Schwarzman and Peter G. Peterson.

Blackstone continues to invest and work with companies that are destroying the Amazon Rainforest and other companies that employ child labor.

In 2019, the United Nations condemned Blackstone for purchasing huge amounts of single-family homes during the 2008 financial crisis. Blackstone abused and took advantage of its tenants with high rent hikes, aggressive evictions, steep fees, and an unethical treatment of communities of color. Blackstone also opposed legislation that would help give poor people access to affordable housing. It spends millions every year on lobbying against housing reform. Other U.N. representatives have accused Blackstone of contributing to and profiting from the financial crisis. If you want to find the pupeteer of many of the issues facing our world today, you don’t have to look much futher than Blackstone.

Schwarzman has remained CEO through the entire lifetime of the company.

Enterprise is a natural gas and oil pipeline company. Several people have been killed and multiple ecological disasters and oil spills as a result of Enterprise’s operations and lack of concern.

Teague is actually co-CEO of the company with his colleague W. Randall Fowler. He is one of the newer inclusions on this list, being the CEO of Enterprise for only around eight years, being promoted to the role in 2016, and has spent his entire professional career in the oil and chemical industry. Prior to this, he served in the United States navy as an officer and fought in an attack helicopter squadron in Vietnam.

Air Products is a gas and chemical company based in Pennsylvania and primarily serves industrial customers.

Ghasemi became the CEO of the company in 2014 and is passionate about pushing for clean hydrogen-based energy. He is also proud of the fact that he hasn’t taken a “vacation” in over 20 years. Though what a billionaire could possibly need a vacation for in the first place is a question for another day.

Watsco is an air conditioning, heating, and refrigerator equipment, parts, and supplies distributor. It used to manufacture all the parts and tools itself but shifted to only distribution in 1989. It was founded in 1947.

Nahmad became CEO of Watsco in 1972 and guided the company from a $22 million value to a multi-billion-dollar giant.

Robert Greenberg actually founded Skechers himself in 1992 with an initial focus on men’s shoes. The company grew quickly and is now the third-largest footwear company in the United States. It only entered the Fortune 500 list in 2023.

Greenberg runs his company along with his family who have become one of the most famous families in the shoe industry.

Penske was originally known as United Automotive Group when it was founded in 1990. It was bought by Roger Penske through his company, the Penske Corporation, and changed its name in 2007.

Roger Penske is a retired racing driver and a recipient of the Presidential Medal of Freedom. He was Sports Illustrated’s Driver of the Year in 1961 and even raced in two Formula One Grands Prix and won a NASAR race in 1963.

Warren Buffett: the man hanging on the bedroom wall of every young, aspiring hedge fund manager, financial influencer, and lifestyle guru. The go-to “oracle” of all things investments to the inexperienced and greedy alike. A “sage” of making money at the expense of the poor and forwarding toxic corporate culture. What can be said about Buffett that hasn’t been parroted from the stage in a Las Vegas hotel ballroom at a thousand corporate motivational retreats?

Buffett is the seventh-richest man in the world with a net worth of over $134 billion. He is the co-founder, CEO, and chairman of Berkshire Hathaway, which is one of the top holding companies in the industry and the biggest corporate conglomerate in the world. The class A shares of Berkshire Hathaway have the highest per-share price of any company in the world with a price of 623,040.00 as of March 2024.

What world views, values, prejudices, and business practices Buffett has carried from the 1930s to today continue to heavily influence the world we live in.

To his credit, he has pledged to give away 99% of his wealth by the time he parts from this Earth. We wait with bated breath to see if he keeps his promise.

Let’s face it: If your money is just sitting in a checking account, you’re losing value every single day. With most checking accounts offering little to no interest, the cash you worked so hard to save is gradually being eroded by inflation.

However, by moving that money into a high-yield savings account, you can put your cash to work, growing steadily with little to no effort on your part. In just a few clicks, you can set up a high-yield savings account and start earning interest immediately.

There are plenty of reputable banks and online platforms that offer competitive rates, and many of them come with zero fees and no minimum balance requirements. Click here to see if you’re earning the best possible rate on your money!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.