Banking, finance, and taxes

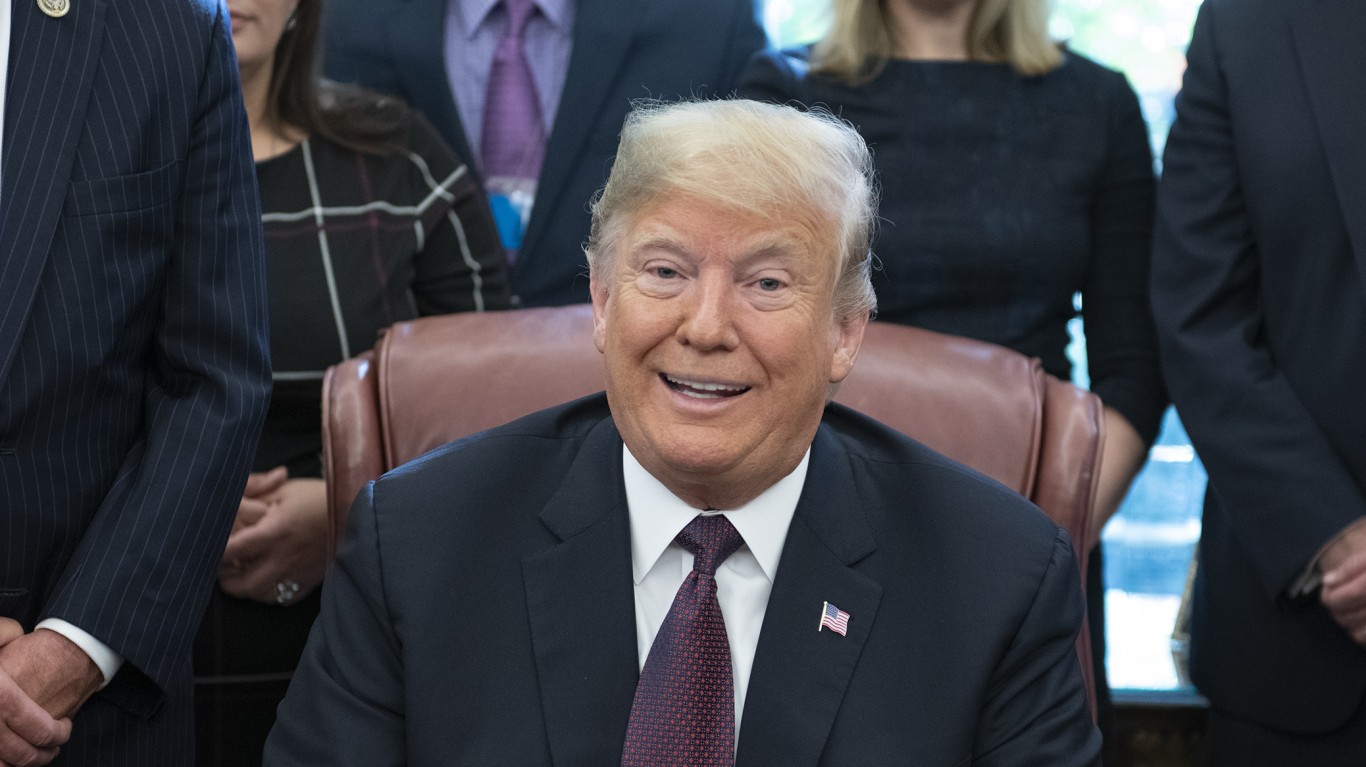

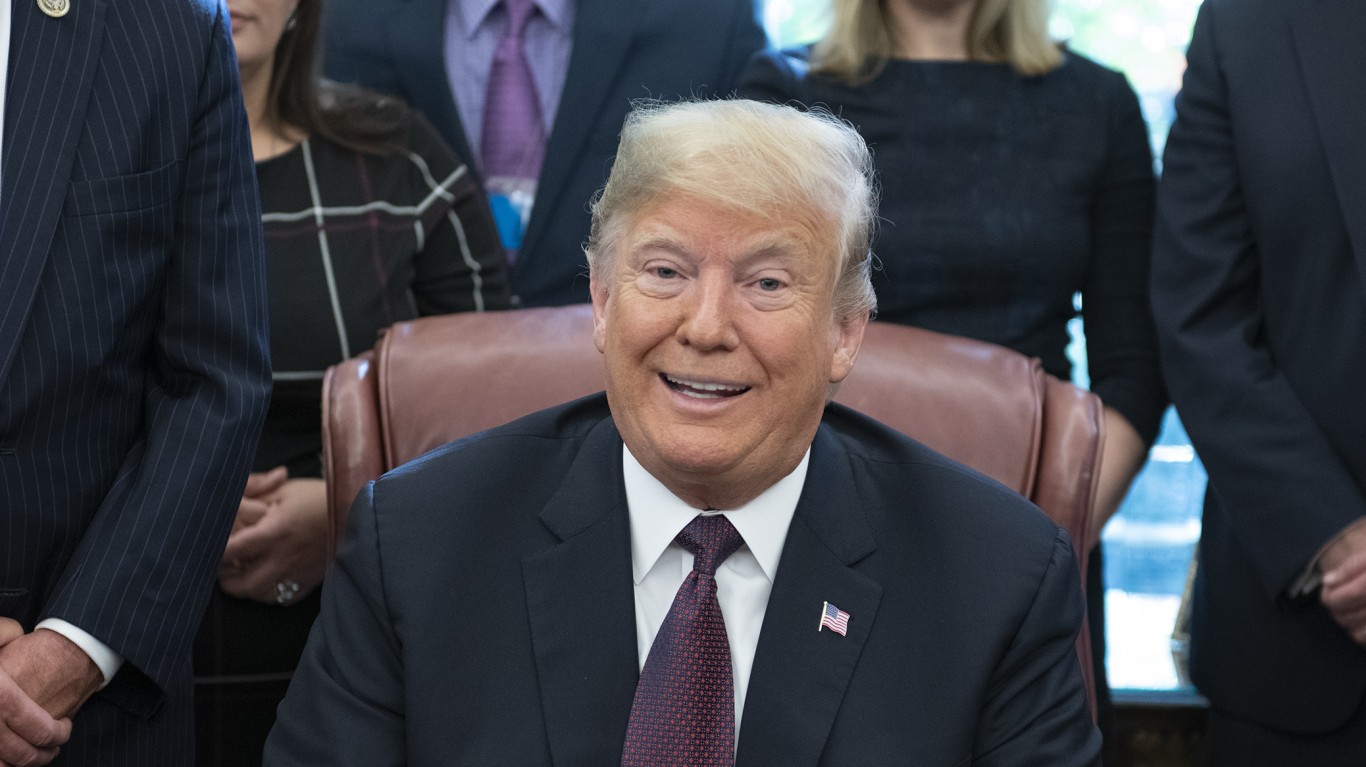

This Is What Caused the National Debt to Increase $8.2 Trillion Under Trump

Published:

Of all the lies, scandals, crimes, and other issues with the Trump presidency, one thing that many people forget is his extreme contribution to the national debt. But how bad is it?

Former President Trump has come under much criticism for racking up around $8.2 Trillion in national debt. According to the Check Your Fact Institute, “When President Trump left the White House, the deficit had reached the largest peacetime level as a share of the economy, in U.S. history, as the federal debt exceeded 100 percent of the economy for the first time since World War II.”

$8.2 Trillion is almost twice as much as all car loans, credit card debt, and student loans in the United States combined. It equals $23,500 in new debt per person. The only two other presidents who racked up more national debt were George W. Bush and Abraham Lincoln. Both of those presidents were funding wars and served two terms.

The Pandemic Relief Legislation enacted in 2020 added $3.9 Trillion. Most of that was spent on the Paycheck Protection Program and stimulus payments. This was a loan program for businesses and was part of the CARES Act. The goal was to help businesses including self-employed workers, nonprofit organizations, tribal businesses, and sole proprietors to continue paying their employees through periods of lockdown.

The PPP allowed business owners to apply for low-interest loans for payroll and other costs. The PPP loans amounted to 2.5 times the average monthly payroll costs of the applicant and were able to be fully or partially forgiven if the applicants met certain requirements.

Economists concluded that the PPPs didn’t save as many jobs as were reported by applicants and forgave the loans of businesses that weren’t in danger of redlining. An increase of the safety nets already federally in place (financial aid, food assistance, unemployment insurance, and government aid) has been much more efficient at helping employees and strengthening the economy.

The PPP ended up costing around $258,000 per employee, and most of the money actually went towards creditors, business costs, suppliers, and business owners. It’s estimated that only 25% of the funding actually saved jobs that would have been lost.

The 2017 Tax Cuts and Jobs Act has been criticized for being skewed toward the rich. The TCP (Tax Policy Center) reports that households in the bottom 60% received less than $500 in tax cuts, compared to the top 1%, which received an average of $60,000 in tax cuts. This means that the top 1 and 5 percent received tax cuts that equaled more than triple the total value of the bottom 60 percent. The tax cut eroded the revenue base in addition to the tax cuts passed by President Bush in 2001 and 2003.

Trump promised that the tax cuts would “lead to a $4,000 boost in household income.” In actuality, households with incomes under $114,000 saw no change in take-home pay and top executive salaries rose significantly. Unsurprisingly, the saved money didn’t trickle down to the working class. Luckily, the Act expires in 2025, and lawmakers will have the chance to correct it and create something more equitable.

The other event that contributed to the national debt increase was, of course, the 2020 COVID-19 Pandemic. More than $3 trillion was spent as pandemic-related stimulus, which, isn’t necessarily irresponsible or unnecessary. The largest portion of that money ($1.8 trillion) went toward individuals and families. $1.7 trillion went towards businesses. $482 billion went toward healthcare.

All this was enough to push the national debt to the point where America can’t recover from it. The problem is that former President Trump signed these legislations on the assumption of faster future economic growth. It states, “President Trump leaves a federal budget with surging debt, unprecedented peacetime deficits, and a daunting $112 trillion baseline shortfall over the next three decades.”

Credit card companies are handing out rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.