Banking, finance, and taxes

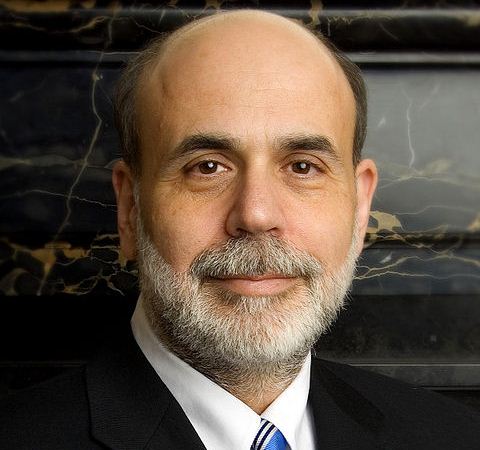

No Change to Interest Rate, QE; Forecast Mixed -- FOMC

Published:

Last Updated:

The vote was 11 to 1, with only Fed Governor Elizabeth George voting against. George’s “no” vote was based on here that “continued high level of monetary accommodation increased the risks of future economic and financial imbalances and, over time, could cause an increase in long-term inflation expectations.”

The Fed’s economic projections got a pretty good workover, though, since the publication of the December projections. The projected GDP growth for 2013 has been lowered from a range of 2.3% to 3% to a new range of 2.3% to 2.8%. Estimated GDP growth for 2014 has dropped from 3% to 3.5% to a new range of 2.9% to 3.4%.

The projected unemployment rate for the year has fallen from a December range of 7.4% to 7.7% to a new range of 7.3% to 7.5%. U.S. unemployment came in at 7.7% in February. The projection for U.S. unemployment to fall to 6.5% remains projected for 2015.

Inflation projections fell slightly from a December projection for 2013 inflation in the range of 1.3% to 2% to a new range of 1.3% to 1.7%. Projections for 2014 and 2015 were unchanged.

There is nothing in the Fed’s statement that indicates a quicker end to asset purchases or near-zero interest rates other than a mild statement that “labor market conditions have shown signs of improvement.” Now, let the close analysis begin.

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.