Banking, finance, and taxes

Fed's FOMC Minutes Bring More Concern, or Confusion, Over Bond Buying and QE

Published:

Last Updated:

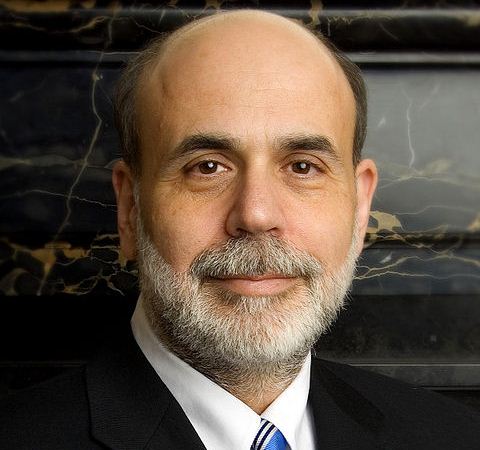

We have already seen Ben Bernanke testify to Congress today and the aim was to push back an immediate end to the bond buying and to even push back on the tapering efforts of continues bond purchases. Now we have the FOMC Minutes of the April 30 and May FOMC meeting and the stock market participants are using it as an excuse to take profits.

It is interesting to see that officials are open to reducing bond purchasing at the June meeting if there is evidence of strong and sustainable growth. A problem is that officials disagree on what evidence would really indicate that there is sufficient underlying growth that would remain if the bond buying was tapered. The minutes also showed that labor markets have improved since last September. That jobs market is what many Fed members want to see improving.

What you have is evidence that Fed officials are starting to think that the bond buying aspect of quantitative easing may not be helping that much. That being said, there is really only one dissenting voice among the voting members of the FOMC.

The markets have continued looking for a reason to sell off and that is what they have done. The S&P 500 is now down 8 ponts at 1,660 after having been over 1,680 this morning. The DJIA is now down about 30 points at 15,356 after having been challenged 15,550 earlier.

The one dissenting vote is Esther George and the minutes said,

“Ms. George dissented because she continued to view monetary policy as overly accommodative and therefore as posing risks to the long-term sustainable growth of the economy. She expressed concern that the stance of policy might be fostering imbalances and excessive risk-taking in some financial markets and institutions, and she cited the potential for the Committee’s ongoing asset purchases to complicate the future conduct of policy, raise uncertainty, and affect future inflation expectations. Accordingly, Ms. George preferred to signal a near-term tapering of asset purchases, which would begin to move policy toward a more appropriate stance.”

Choosing the right (or wrong) time to claim Social Security can dramatically change your retirement. So, before making one of the biggest decisions of your financial life, it’s a smart idea to get an extra set of eyes on your complete financial situation.

A financial advisor can help you decide the right Social Security option for you and your family. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Click here to match with up to 3 financial pros who would be excited to help you optimize your Social Security outcomes.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.