Technicians are an interesting lot. After all, they use charts, inflows and other overbought or oversold indicators to see what the story is telling you. It is no secret that longer-term gains in the stock market generally come with participation from the financial sector. So what happens when a key market technician followed widely by the markets points out trouble in the financial sector?

Sterne Agee’s Chief Market Technician is Carter Worth, and he is well-known throughout the financial industry with many routine media appearances. Worth confirms that the financial sector is generally the most important sector in the market by all accounts, and on Monday’s “Money in Motion” feature for a weekly technical outlook he points out that the financial sector continues to act poorly.

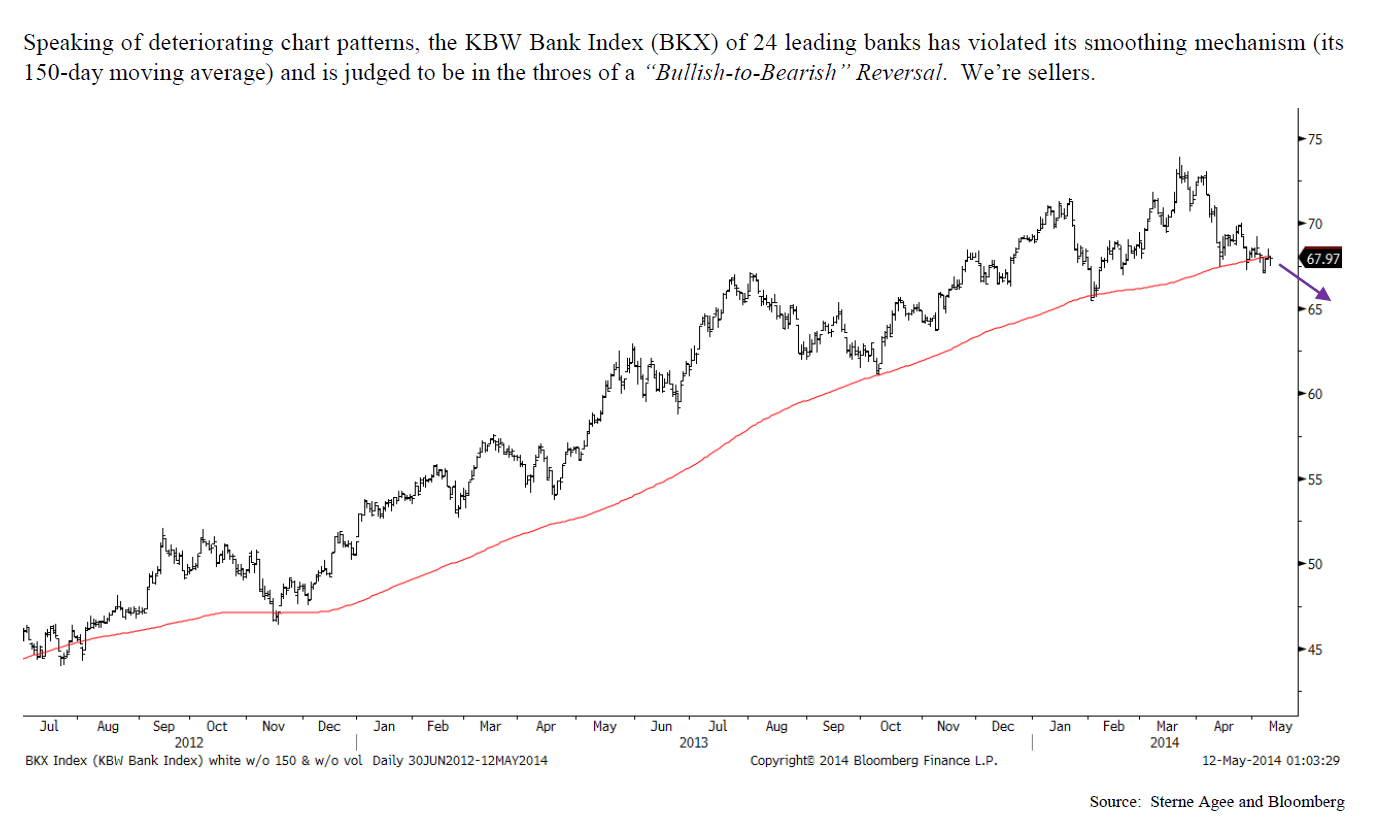

The call is effectively reiterating that it is right to be Underweight the financial sector. Worth pointed out:

At 16.09% of the total value of the S&P 500 (second only to Information Technology at 18.48%), Financials matter a great deal. And it goes without saying, therefore, that the recent deterioration in certain marquee financial stocks is very disconcerting.

Worth says that there are not many actionable buys, and that there are plenty of actionable sells from the 285 stocks in the S&P 1500 designated in the financial sector. Some of the notes on key names were as follows.

Bank of America Corp. (NYSE: BAC) had a poor chart, breaking down under an upward trendline that had been in place for two years. The recent accounting error and settlement news may be the cause, but a technician would simply point to the chart. Another concern was Goldman Sachs Group Inc. (NYSE: GS), with its key trendline now broken since March. Neither are really rated by the fundamental team at Sterne Agee.

READ MORE: Irony in Pairs: Time to Short Treasuries While Buying the Big Banks?

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.