Nomura has issued a very different sort of research report on the U.S. regional and large banks. The firm’s Bill Carcache has a Neutral rating on the sector, but he has identified which banks have done very well and which ones should perhaps be ashamed about how their stock buyback plans have performed.

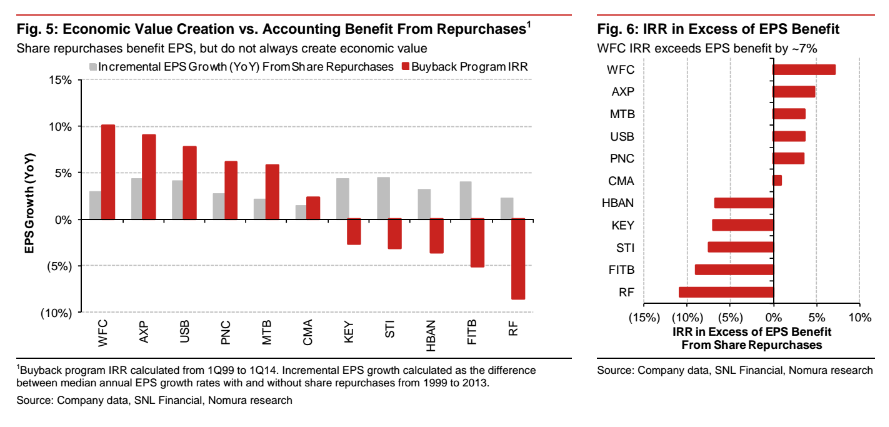

The Federal Reserve has been more allowing of stock buybacks than they have of committing to higher dividends in the sector. It turns out that some of the banks have not recovered enough or their buyback plans have been weak enough that they would have a negative internal rate of return (IRR) if you were to factor in the savings of the dividend-related expenses.

The successful buybacks saved billions of dollars in dividend liabilities and generated positive internal rates of return. Unfortunately, history has shown that some of the banks might have been better off holding their capital for reserves or to acquire growth opportunities after the recession.

Carcache’s research goes all the way back to 1999. As his report says, not all buybacks are created equally. Many of the banks have perhaps lost money or had to pass up growth opportunities due to negative internal rates of return on their buybacks. Too bad the banks did not have a crystal ball.

Note that there are almost certainly other buybacks out there that were much worse. These are just the ones in the Nomura report on Tuesday. Another issue to consider is what the market caps and current dividend yields of these names are.

24/7 Wall St. has broken up this research feature into two pieces: first is the best bank buybacks programs, and the worst buyback plans are featured here.

ALSO READ: Banks With the Most Successful Stock Buyback Plans

KeyCorp (NYSE: KEY) has paid $4.1 billion for shares that are worth $2.7 billion today, and the $0.8 billion in dividend-related savings generated a negative IRR of -2.7% in its buyback program. KeyCorp’s market cap is $12.3 billion, and its dividend yield is currently 1.9%.

SunTrust Banks Inc. (NYSE: STI) paid $5.1 billion for shares worth $2.9 billion now. With $1.0 billion in dividend-related savings, that generates a negative IRR of -3.0% for its buyback plan. SunTrust’s market cap is $20.75 billion currently, and its dividend yield is 2.1%.

Huntington Bancshares Inc. (NASDAQ: HBAN) paid $1.7 billion for shares that now are worth $1.1 billion. The $0.3 billion in dividend-related savings generates a negative IRR of -3.5% for its buyback program. Its market cap is $7.8 billion, and its dividend yield is currently 2.2%.

Fifth Third Bancorp (NASDAQ: FITB) has paid $7.5 billion for shares worth only $4.7 billion today. The $0.8 billion in dividend-related savings generates a negative IRR of -5.0% for its buyback program. Its market cap is $18.15 billion, and its dividend yield is currently 2.3%.

Regions Financial Corp. (NYSE: RF) paid out $4.2 billion for shares that are worth only about $1.7 billion today. The $0.8 billion in dividend-related savings was projected to generate a dismal -8.6% IRR for its stock buyback program. The current market cap is $14.35 billion, with a current dividend yield of 2.0%.

ALSO READ: 11 Ways to Protect Your Portfolio From the Next Stock Market Crash

Credit card companies are handing out rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.