Cars and Drivers

Why Now's the Time for GM's $2.2 Billion Investment in Electric Vehicle Plant

Published:

Last Updated:

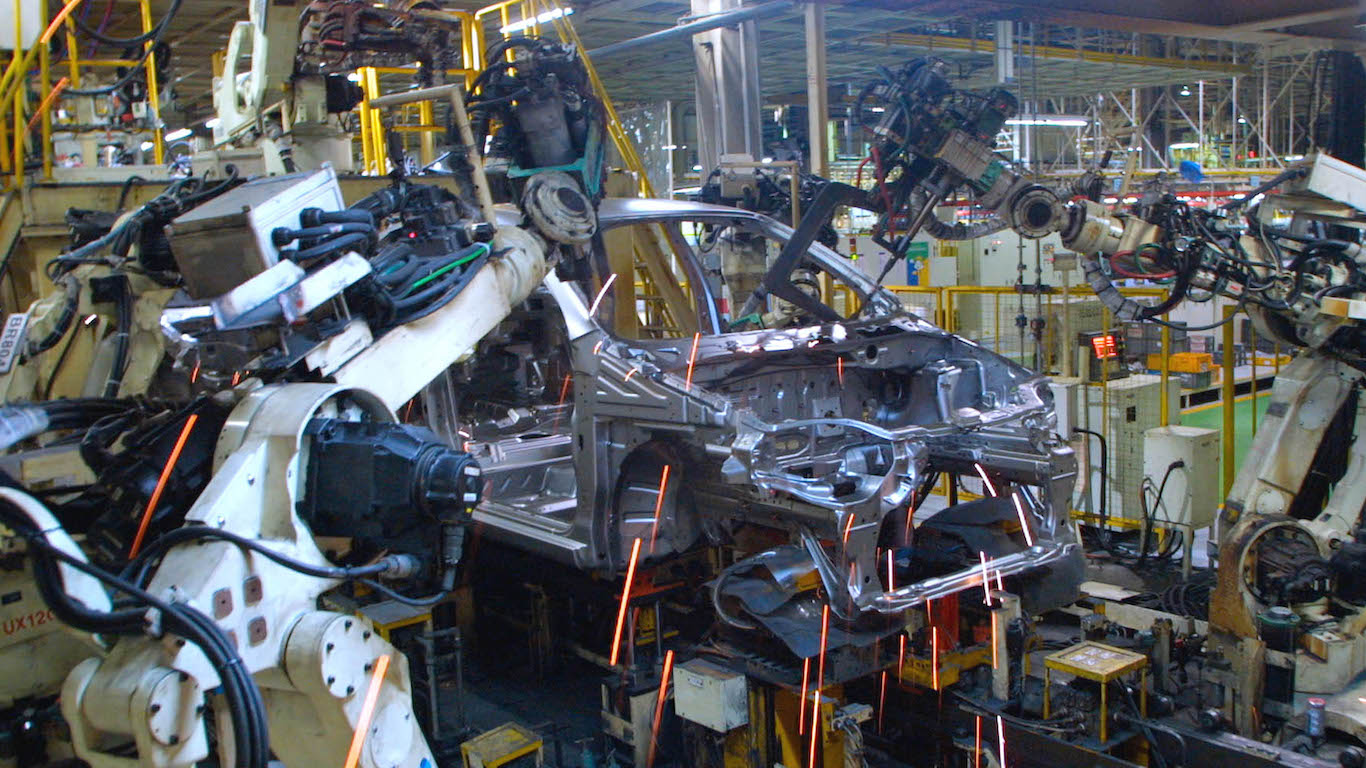

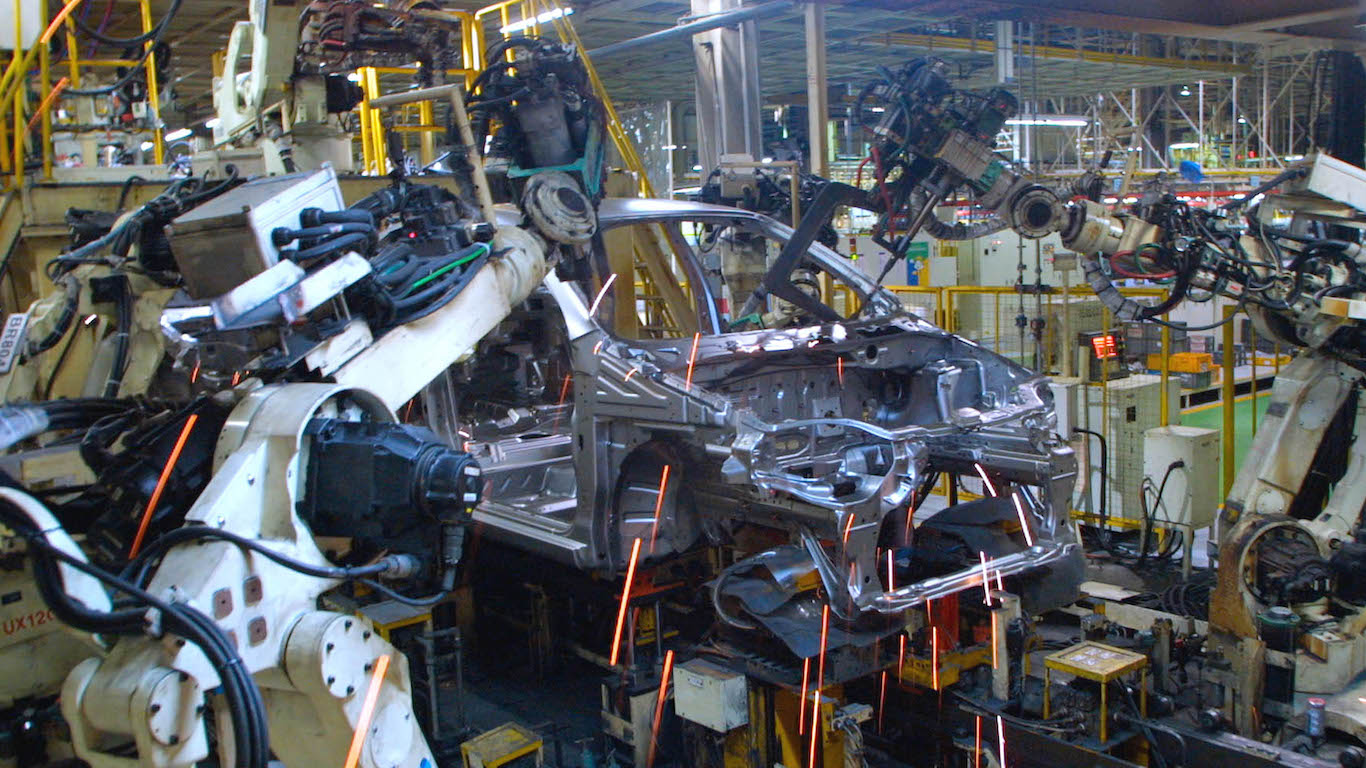

General Motors Co. (NYSE: GM) announced Monday that it will invest $2.2 billion to convert the company’s Detroit-Hamtramck assembly plant from manufacturing sedans to manufacturing a “variety” of all-electric (EV) trucks and sport utility vehicles. The plant, which in November 2018 was set to be closed, will be GM’s first assembly plant that is fully dedicated to building EVs.

The company said that when the plant is fully operational, it will employ more than 2,200 workers. The plant currently runs just one shift, building Cadillac CT6 and Chevrolet Impala sedans. Production of the CT6 is set to end later this week and Impala production will cease at the end of next month.

As part of GM’s settlement last year with the United Autoworkers, the Hamtramck plant was given new life. In addition to the all-electric pickups and SUVs that will be built at the plant, GM expects to produce the Cruise Origin autonomous vehicle unveiled last week in San Francisco.

GM President Mark Reuss said:

Through this investment, GM is taking a big step forward in making our vision of an all-electric future a reality. Our electric pickup will be the first of multiple electric truck variants we will build at Detroit-Hamtramck over the next few years.

EV production is expected to begin late next year after a 12- to 18-month period to refurbish the plant. In addition to assembling EVs, the Hamtramck facility is also expected to include a battery-pack assembly line.

While the revamped plant is good news for GM employees, there is less clarity about the future of EVs and how quickly they will comprise more than a low-single-digit percentage of all new vehicles sold in the United States.

Carmakers around the world are investing billions in EVs. Ford Motor Co. (NYSE: F) expects to have a stable of 40 EVs by 2022, Volkswagen has set a target of 70 such vehicles by 2028 and GM CEO Mary Barra has said her company will have 23 by 2022. The big question is whether consumers will buy them.

Subaru’s CEO has commented that only Tesla EVs are selling well and that it may take another decade before the U.S. market rewards EV makers.

The U.S. market, however, is not the global poster child for EVs. Stricter emissions rules in Europe are already pushing EV sales up and governments are building out the recharging infrastructure. China, too, is pushing EVs although not as hard as it once did. If the trade disputes don’t escalate in the next several years, U.S.-built EVs could gain a toehold in other global markets. But it is definitely a gamble.

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.