Ford Motor Co. (NYSE: F) has been lagging the S&P 500 and stock market in general. With a phased restart to production in the cards though, Ford stock could see some strong tailwinds.

Among American auto manufacturers, Ford stock ranks last in terms of year-to-date performance. Its shares are down about 44% year to date, while competitors like General Motors Co. (NYSE: GM) and Tesla Inc. (NASDAQ: TSLA) are down 35% and up 96%, respectively.

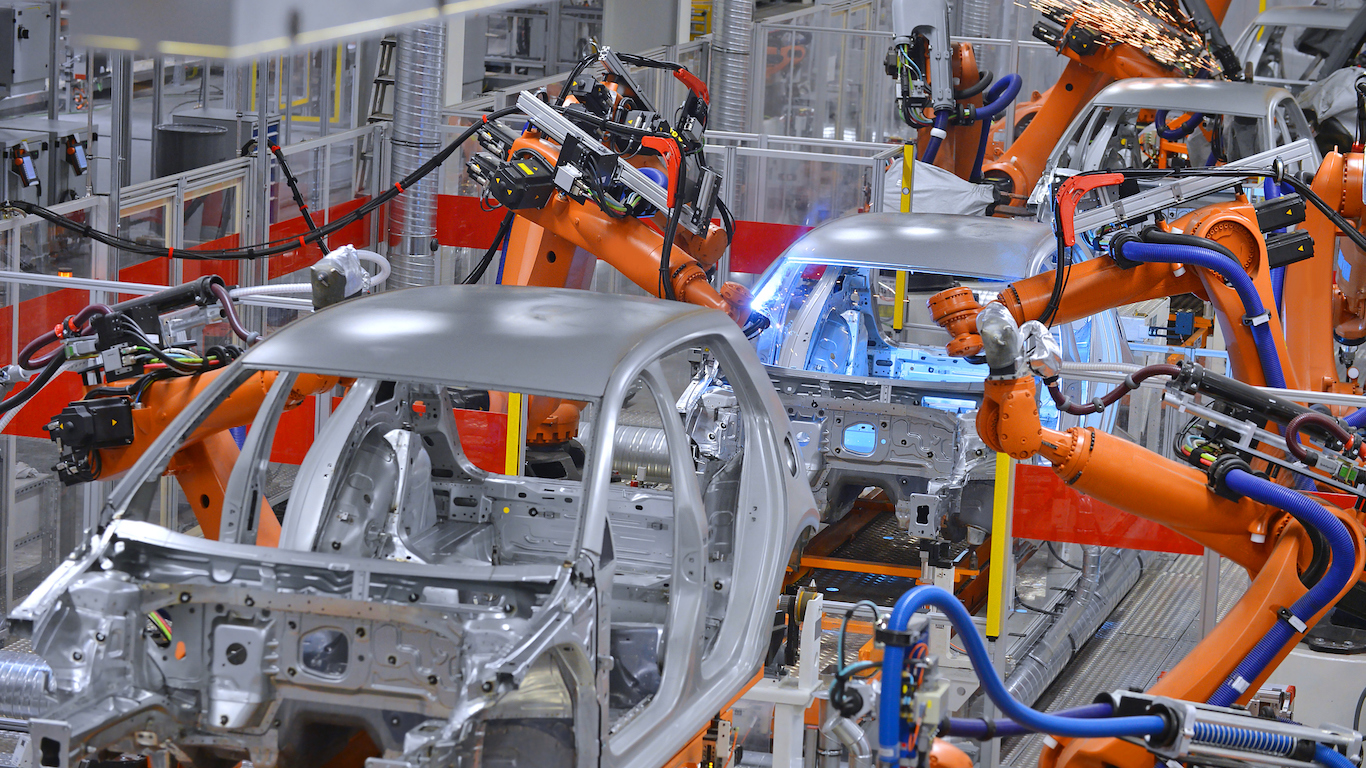

However, a phased restart to production could jumpstart Ford’s stock, or at least this is what management is hoping for. There are obviously other trends to deal with, like consumers moving toward electric vehicles. Yet, restarting production is the first step for Ford to get back in the game and avoid falling to penny stock status.

Jump Start

Ford is planning to resume its production in North America beginning on May 18, but it will be in a phased approach. Accordingly, the automaker will be returning some of its employees whose jobs cannot be done remotely, including vehicle testing and design. Overall, Ford is looking at returning about 12,000 personnel to work in North America.

Parts and distribution centers will resume full operations on May 11, in an effort to support Ford dealers in providing service to keep vehicles on the road.

Perhaps the most important part of this restart will be the safety and care measures that will be implemented on a global basis. These include health assessment measures, personal protective equipment (PPE) and facility modifications to increase social distancing.

In terms of the specifics, North American assembly plants previously operating on three-shift patterns will return with two-shifts. Most two-shift plants will return on one shift, and most one-shift plants will continue to operate on one shift. The Flat Rock Assembly Plant in Flat Rock, Michigan, and Oakville Assembly Complex in Oakville, Ontario, are expected to resume production the week of May 25 on one shift. Separately, components plants will restart production as needed to support this plan.

Overall, the ramp-up process will be gradual, as workers adjust to the new health and safety protocols and as Ford’s entire supply chain comes up to speed. The staggered approach allows Ford to effectively implement new safety protocols and provide proper PPE for all employees as they return to work.

Executive Commentary

To put it simply, one job of the executive team of any company is to allocate resources in line with the company’s overall goal. The best chief executive officers do this by driving growth and innovation for a company within its industry.

In this case, Ford is not making any money with its plants standing idle. The best way to get the wheels turning again is to start pushing more cars out the door and to get its employees back to work. With this restart, Ford has to take ample safety precautions to avoid some nasty consequences for its employees and stockholders. Here’s what a couple of the executives had to say about this strategy.

Jim Farley, Ford’s chief operating officer, commented:

We’ve been working intently with state and federal governments, our union partners and a cross-section of our workforce to reopen our North American facilities. We have reopened our facilities in China, successfully begun our phased restart in Europe and have been producing medical equipment in Michigan for more than six weeks and are using the lessons from all of that to ensure we are taking the right precautions to help keep our workforce here safe.

Gary Johnson, Ford’s chief manufacturing and labor officer, added:

We’ve developed these safety protocols in coordination with our union partners, especially the UAW, and we all know it will take time to adjust to them. We are in this together and plan to return to our normal operating patterns as soon as we are confident the system is ready to support.

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.