Commodities & Metals

Commodities & Metals Articles

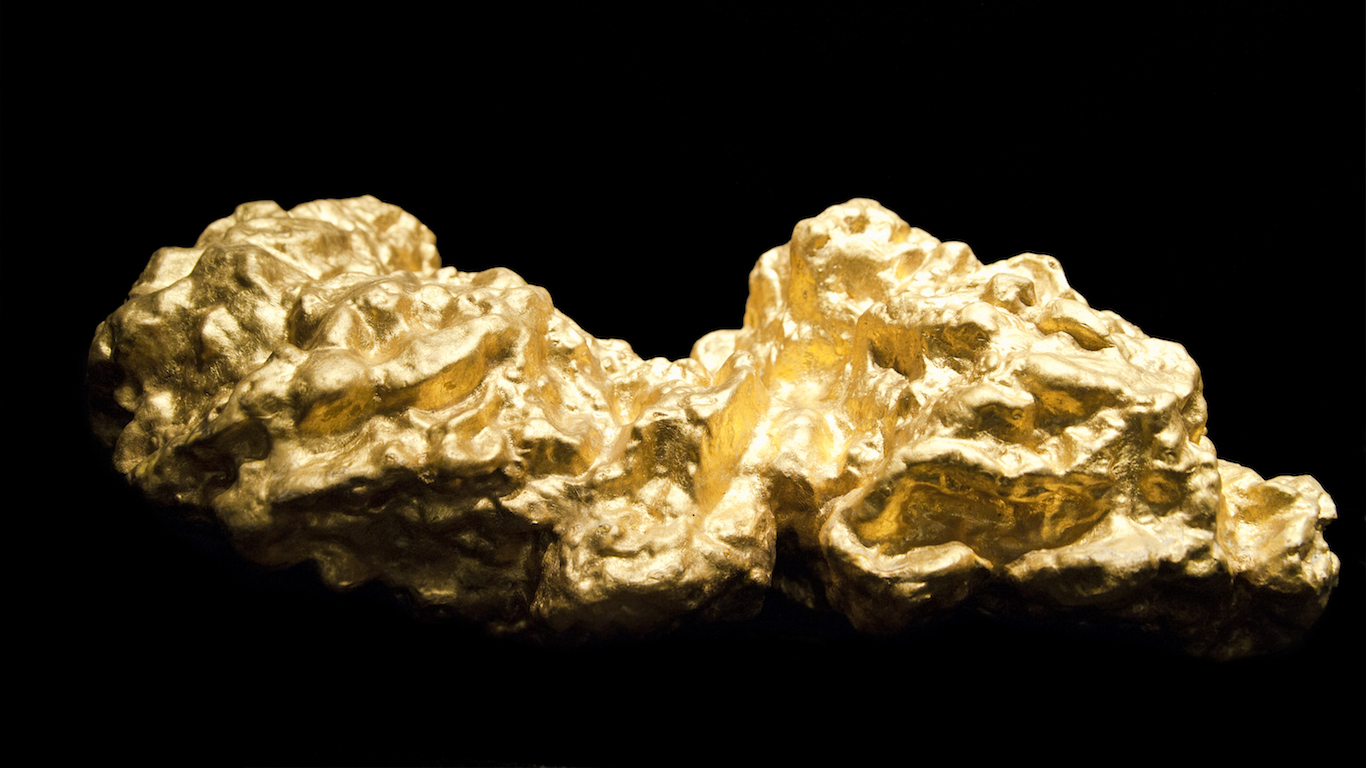

Global gold ETFs saw a decline of some $4 billion in assets under management in July. North American outflows totaled about $984 million.

Published:

Last Updated:

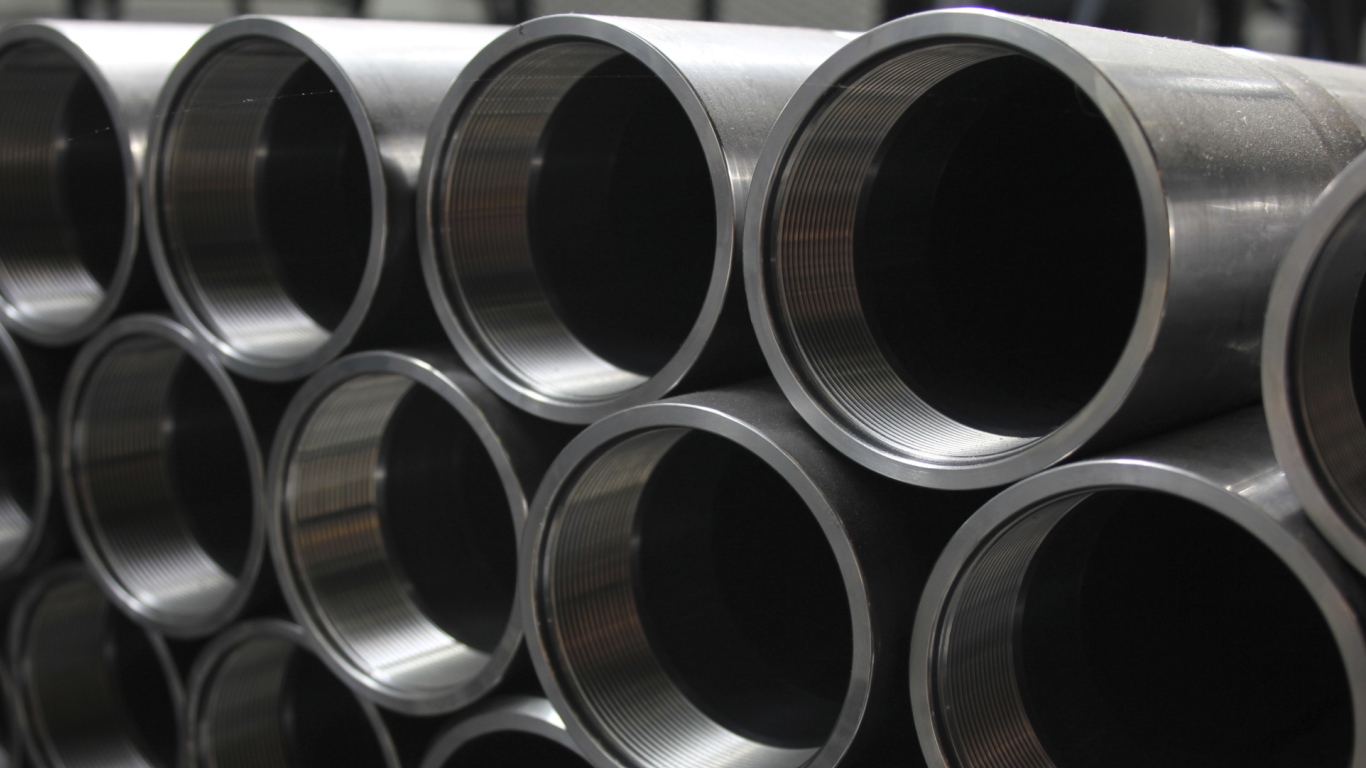

With pricing firm and export potential and demand at home still strong, these five steel stocks make sense for growth investors.

Published:

Last Updated:

Gold has had a rough 2018. Despite some of the international trade worries and international suspense, the reality is that most investors are just not looking for the "ultimate safety trade."

Published:

Last Updated:

U.S. mining giant Freeport-McMoran has struck an agreement with the government of Indonesia that will lead eventually to the transfer of control for its Grasberg copper mine to the country's...

Published:

Last Updated:

With pricing firm, and export potential and demand at home still strong, these steel stocks make sense for growth investors, especially after significant price pullbacks.

Published:

Last Updated:

After a serious rut, now the Goldman Sachs Commodities Research is telling customers that it's time to buy commodities.

Published:

Last Updated:

These four top mining and commodities companies all make good sense for growth portfolios looking to add mining exposure at a time when trade concerns may be weighing on the stock prices.

Published:

Last Updated:

Four steel companies stand out, according to a new Deutsche Bank report. Its analysts note that despite the shrill volume of complaints over steel and aluminum tariffs, the backdrop for the sector is...

Published:

Last Updated:

After years of steady growth, Chinese demand for gold jewelry began to plunge in 2014 before posting a small gain again last year. Is the country's market for gold turning around?

Published:

Last Updated:

There has been a big resurgence in coal use and demand, with prices being driven substantially higher by overseas demand, especially from India.

Published:

Last Updated:

In the past month, global gold-backed exchange traded fund holdings added 15 tonnes. Ultimately, Europe and Asia drove inflows.

Published:

Last Updated:

Due to higher demand and fewer imports, the price for steel is going higher, and the analysts at Merrill Lynch feel that numerous companies in the industry look poised to benefit.

Published:

Last Updated:

The World Gold Council has just published a 30-year look-ahead at the market for gold.

Published:

Last Updated:

Luxembourg-based steelmaker ArcelorMittal beat consensus estimates for both profits and revenues when it reported results Friday morning. Rising prices for steel were a primary factor.

Published:

Last Updated:

RBC remains generally positive on the gold-mining stocks as prices have held despite the rise in U.S. interest rates and gold is seen as a solid way to hedge against market volatility.

Published:

Last Updated:

Discover Our Top AI Stocks

Our expert who first called NVIDIA in 2009 is predicting 2025 will see a historic AI breakthrough.

You can follow him investing $500,000 of his own money on our top AI stocks for free.