Apple Inc

NASDAQ: AAPL

$227.52

Closing Price on September 26, 2024

AAPL Articles

With four trading days left in 2020, the best performing Dow stock has already been determined. Apple Inc.’s (NASDAQ: AAPL) share price has risen almost 80% this year. The DJIA is up 6%. No other...

Published:

Five years ago, no one could have imagined any company eventually would reach the $1 trillion market cap. Now, four public corporations are above that, and Apple's shares continue to rise.

Published:

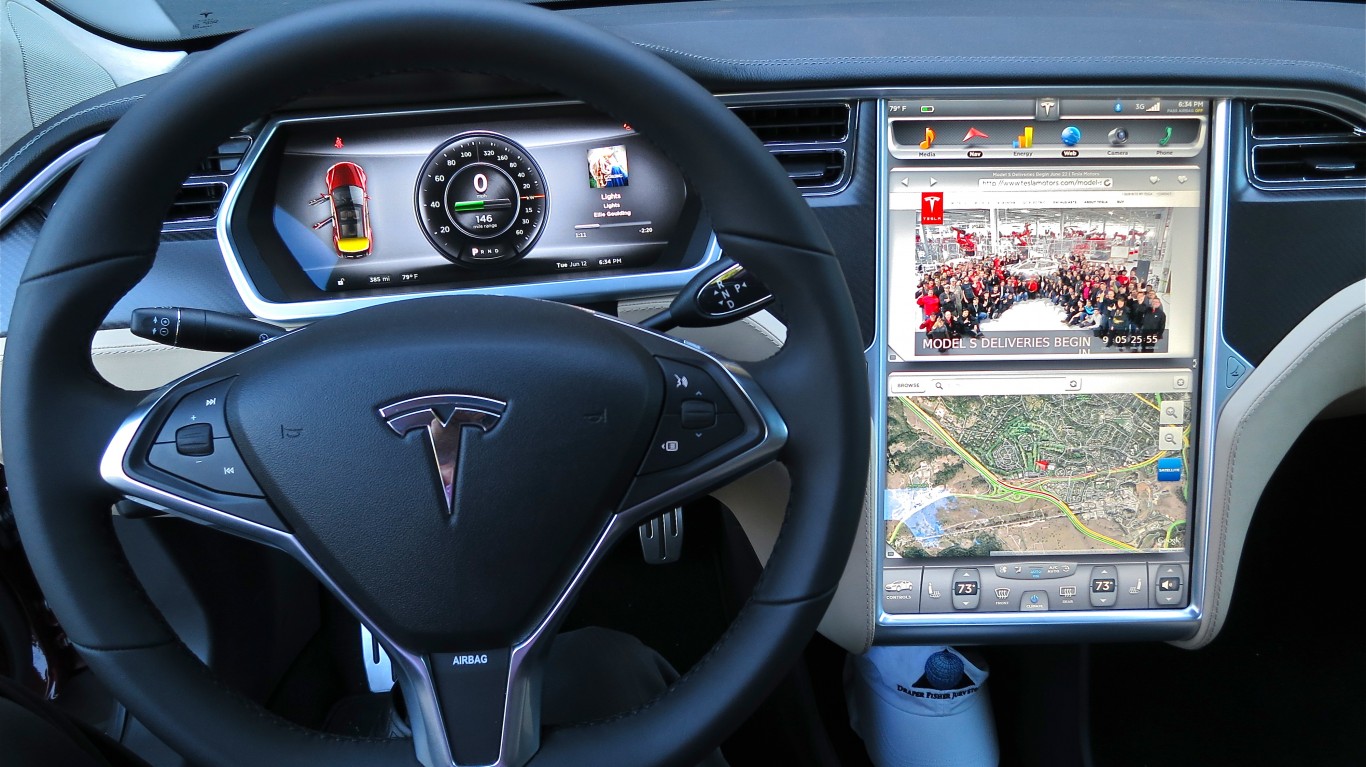

A report that Apple may have an autonomous, electric vehicle on the road in 2024 had investors humming Tuesday. Could it really happen?

Published:

Hundreds of millions of people own Apple products. Many of them hold great loyalty to the Apple brand and can't wait for an Apple car. That hurts Tesla as much as any other industry player.

Published:

There are four U.S. companies that currently have a market value of more than $1 trillion. All four are expected to continue performing well, but, perhaps, not as well as they have this year.

Published:

Apple has closed stores. If the pandemic worsens, and it will, it will close more.

Published:

Apple is reportedly planning to produce 96 million iPhones in the first six months of next year, an increase of 30% over production in the same period this year.

Published:

Walt Disney management made it clear at its investor day that its streaming services growth will crush the competition.

Published:

Wednesday's top analyst calls included American Express, Apple, Baidu, CarMax, Chewy, Lululemon Athletica, Micron Technology, Moderna, Slack, Walt Disney and Zoom Video Communications.

Published:

The iPhone 12 appears to be on the way to matching records for the top-selling smartphone in Apple's history.

Published:

Not included among 75 tech company CEOs who signed a pledge to pay their "fair" share of taxes to support the Tech for Good initiative were Tim Cook of Apple and Jeff Bezos of Amazon.com.

Published:

Monday's top analyst upgrades and downgrades included Apple, BP, CrowdStrike, Delta Air Lines, Moody's, NuStar Energy, PPL, Salesforce.com, Slack Technologies and Wells Fargo.

Published:

Wednesday's top analyst upgrades and downgrades included Analog Devices, Apple, Best Buy, Dell Technologies, Dollar Tree, Ford, General Electric, General Motors, HP, Medtronic and Zscaler.

Published:

Though its Services business is Apple's play to move beyond hardware, the primary reason its stock has surged is hope for iPhone 12 sales.

Published:

Last Updated:

The business of fabricating semiconductors is set to grow by nearly a quarter this year, according to new estimates from research firm TrendForce.

Published: