Economy

The New Normal Has Capacity Utilization Rates Still at Recessionary Levels

Published:

Last Updated:

Today’s report from the Fed on industrial production and capacity utilization for October is yet another report that is marred by the impact of the hurricane hitting at the end of the month. Let’s at least hope that the storm affected the report.

Industrial production fell by 0.4%, versus a 0.2% gain in September. Capacity utilization fell to 78.2% from 78.2% in September. On industrial production, Dow Jones and Bloomberg were each calling for a gain of 0.2%. On capacity utilization, Dow Jones was looking for 78.3% and Bloomberg was calling for 78.4%. It is important to realize that this is a national number, but the estimate by the Fed was that production was hit by 1%. It is fairly shocking that the economists themselves missed the marks so bad here.

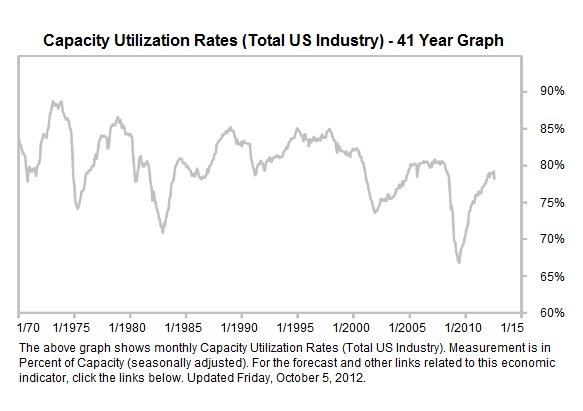

What is a long-term concern here is one that the media just does not cover enough. It lends itself to weaker employment, weaker production, weaker demand and more … only to be followed by more of the same. If you look at our chart on capacity utilization going back 40 years (from forecastchart.com) you will see what this concern is. In the 1990s the range was generally 82% to 85%. The the recession in the early 2000s set the range at 75% to 80%. In the aftermath of the great recession the new range is now 75% to 80%. The last time we operated above the 80% mark was June of 2008. Even though we are in recovery now, the new normal shows that our factories are only operating at what used to be the prior recessionary levels if you look at the long-term table.

The capacity index is an estimate of sustainable potential output and is reported as a percentage of actual output in 2007. The rate of capacity utilization is effectively the seasonally adjusted output index measured as a percentage of the related capacity index.

JON C. OGG

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.