Economy

As NetFlix and Starbucks Hit All-Time Highes, the Consumer Takes Center Stage

Published:

Last Updated:

Expensive coffee and movie rentals are in a different class from daily food intake, home heating fuel and the cost of clothing children for school. It is heartening then that the stock prices of Netflix Inc. (NASDAQ: NFLX) and Starbucks Corp. (NASDAQ: SBUX) have reached all time-highs, with each making a tremendous advance this year.

It takes real money to buy a $4 cup of coffee or pay $9 a month for a nearly unlimited library of films. Even if the real median household income in the United States has fallen over a 10-year period, for some reason people are feeling rich. There could be several causes. Perhaps it is that fewer homes in the United States have an underwater mortgage. The number of these has fallen by the millions as home prices have risen. Along with this, a surge in positive home equity makes owners feel a little easier about their future prospects.

The U.S. Labor Department says layoffs reached an all-time low in July, according to research that goes back to 2001. Unfortunately, hiring levels were very low. At least one part of the equation has improved. For those lucky enough to be in the stock market through direct investments, mutual funds and exchange traded funds, the past two years have been spectacular, except in cases in which people sold short at the wrong time

Netflix hit $314.18, not only the best ever, but up from a 52-week low of $53.05. Starbucks reached $75.39, against a 52-week low of $44.27

It should be encouraging that Starbucks and Netflix are in such different businesses. That means the rising perception of a recovery among people is not restricted to one sector. Netflix not only rents videos, but streams them. Netflix even produces its own shows. Starbucks is essentially the same company it was when it started. Customers can buy coffee. Starbucks would say it has evolved. It does offer WiFi.

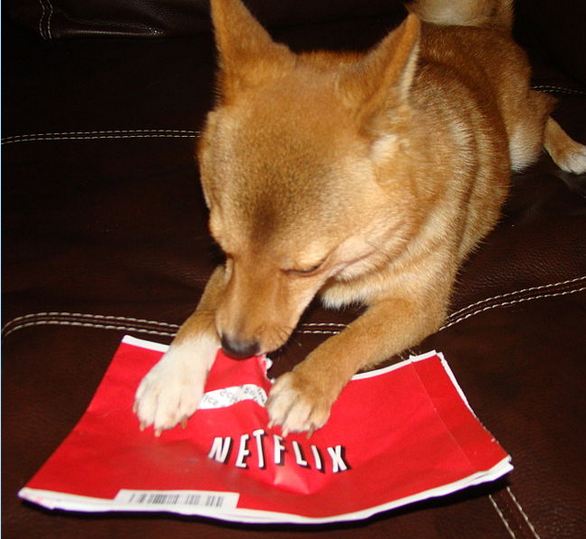

The consumer has returned. He sits on his couch, drinks coffee and watches on-demand TV.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.