Economy

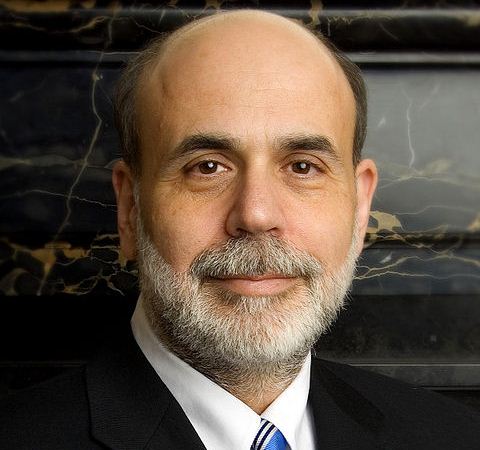

Live Coverage: FOMC, Bernanke, Fed Lowered Forecasts, No Bond Purchase Tapering

Published:

Last Updated:

24/7 Wall St. has been surprised by the FOMC with the decision not to begin tapering its $85 billion per month in bond buying. The markets were surprised too, because the DJIA and S&P 500 Index just hit new highs. We have decided to do a quick hit live coverage of the FOMC and Ben Bernanke events today so that market investors, traders, and the public could have a one-stop spot for what may be the likely change in policies going forward.

(Updated Live)

Full updates continued below, with the most recent first. The long and short is that stocks hit new highs, housing stocks and mortgage REITs loved it, and emerging markets cheered.

3:15 PM Here is the REAL REASON we think no tapering came.

2:53 CNBC asked Ben Bernanke in Q&A about Obama not wanting to appoint him for a third term and whether he would serve a third term if asked. Bernanke refused to address it saying he would discuss his plans in the future.

2:51 PM Janney Montgometry Scott’s Guy LeBas said: “Today’s moment of truth, at which the FOMC was widely expected to announce its first reduction in the pace of quantitative easing—and therefore the turning point in a five year old monetary policy regime—has fallen flat. Instead, what we have from the central bank is just one more brick in the carefully-laid wall of shifting monetary policy… The game of diminishing marginal returns has forced the Fed’s hand, but Bernanke simply isn’t willing to give up. Not yet, at least. That will have to wait for November.”

2:47 PM Bernanke already moved into Q&A session, took only about 15 minutes. Questions from New York Times and WSJ.

2:42 PM Bernanke: LOW FED FUNDS FOREVER! Bernanke said that the median projected Fed Funds Rate for the end of 2015 is only 1% and is only 2% for the end of 2016.

2:36 PM FOMC participants in outlooks to 2016 lowered GDP forecasts marginally.

2:30 PM Ben Bernanke started his live press conference… mostly re-reading and restating what was in the statement.

2:25 PM DJIA HITS NEW ALL-TIME HIGH of 15,664.82… S&P 500 Index also hits new high of 1,723.36

2:16 PM Housing and Mortgage REITS love the hell out of this news… The iShares U.S. Home Construction ETF (NYSEMKT: ITB) is up almost 35 at $22.97 as Lennar, Pulte, Toll, and others rise. In mortgage REITs, the leader is Capital Management, Inc. (NYSE: NLY) and it is up 2.5% at $12.25 versus 52-week low of $10.63. As a reminder, Annaly yields double-digit still (for now), and we would note that it is often considered as the best-in-class of mortgage REITs.

2:12 PM Major gains for emerging markets, broad and for India: iShares MSCI Emerging Markets (NYSEMKT: EEM) has surged 2.7% to $42.63 as the easy money will keep the US dollar weaker and keep a lid on overseas rates too. The WisdomTree India Earnings (NYSEMKT: EPI) is up 2.2% at $16.04, good news for India as they need it.

2:06 PM S&P 500 up 10 points, DJIA up almost 70.. from statement: When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

2:04 PM Stock surged… DJIA now up 75 and S&P 500 up 9… FOMC concerned that the rise in rates may already be crimping housing market gains. FULL FOMC STATEMENT … Some indicators of labor market conditions have shown further improvement in recent months, but the unemployment rate remains elevated. Household spending and business fixed investment advanced, and the housing sector has been strengthening, but mortgage rates have risen further and fiscal policy is restraining economic growth.

2:02 PM The FOMC surprised us. NO BOND TAPERING YET!!! The FOMC will hold bond purchases steady until more evidence of progress is sustained. The outcome means that the $85 billion in monthly bond buying will continue!!!

1:50 PM Good take from Bloomberg: “Hedge-fund managers from Stanley Druckenmiller to Fortress Investment Group LLC (FIG)’s Michael Novogratz and Passport Capital LLC’s John Burbank said U.S. stocks will continue to do well this year even as the Federal Reserve gradually reduces its asset purchases.”

1:30 PM Market pre-FOMC news updates… DJIA -36 at 15,493; S&P 500 is -1.48 at 1703.28… 30YR TREASURY at 3.82% and 10YR TREASURY at 2.86%… Where is Larry Summers now?

1:05 PM 5 Must See charts pre-FOMC on tapering and history from StockTwits.

12:45 PM As a reminder, no formal Fed Funds Rate change is expected. CME Fed Fund Futures only see a 100% chance of Fed Funds rising to 0.25% out to October 2014 and puts Fed Funds at 0.50% with a 100% chance by April of 2015.

12:55 PM ZeroHedge previewed the FOMC expectations and 24/7 Wall St. believes the FOMC is being forced into tapering whether it wants to not (hint, Larry Summers rally).

12:50 PM The Bloomberg Economic Calendar stated,

For expectations of Fed taper, the Econoday survey panel has a median forecast for a $10 billion reduction to $75 billion from the current level of QE purchases of $85 billion monthly. The low forecast for QE purchases is $70 billion ($15 billion reduction) and the high is $85 billion (no taper at the September meeting). For timing, the median forecast is for taper to start with the September FOMC meeting; the low (earliest), of course, also is September. The furthest out for taper start is the October 29-30 FOMC meeting.

Credit card companies are handing out rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.