Economy

Economic Confidence Collapses Most Since Lehman Bros. Debacle -- Gallup

Published:

Last Updated:

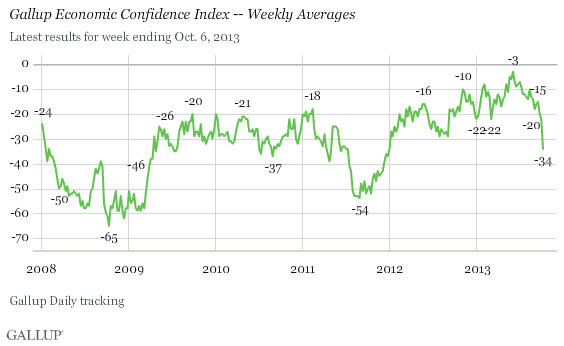

Americans’ confidence in the economy last week fell the most since the week of September 15, 2008, when Lehman Brothers collapsed and set off the global economic crisis. The Gallup economic confidence index plunged to -34 in the week ending October 6, down 12 points from the previous week. The index is at its lowest point since late 2011.

Americans’ confidence in the economy last week fell the most since the week of September 15, 2008, when Lehman Brothers collapsed and set off the global economic crisis. The Gallup economic confidence index plunged to -34 in the week ending October 6, down 12 points from the previous week. The index is at its lowest point since late 2011.

That cannot be a surprise. The shutdown of most federal government offices and the threat that the United States may default on its federal debt combine to send shivers down all but the most implacable spines. In July 2011, during the last impending threat of a U.S. default, the Gallup economic confidence index fell eight points.

While the collapse is serious, Gallup notes that index readings have recovered relatively quickly once the threat passes:

[E]conomic confidence bounced back within several months of the 2011 debt crisis and the downgrading of the U.S. credit rating. Likewise, confidence rebounded within weeks of the sequestration spending cuts that took effect in early March 2013. This suggests that these fiscal debates may not affect consumer confidence in the same long-term negative way that hits to the economy — like the 2008-2009 economic recession — do.

The economic confidence index is comprised of two components: a current conditions index and an index on the outlook for the U.S. economy. Last week, 43% of those surveyed said current conditions are poor, and 67% said the outlook is getting worse. The outlook index now stands at -39, down 17 points from the previous week.

Gallup concludes:

[T]he current budget debate and government shutdown clearly show that partisan brinksmanship and the uncertainty it causes on Wall Street can negatively affect consumer confidence. Thus, Congress’ inability to reach a compromise to end the government shutdown and raise the debt ceiling could negatively affect U.S. stock prices, America’s credit rating, and, ultimately, the nation’s economic recovery.

Credit card companies are at war. The biggest issuers are handing out free rewards and benefits to win the best customers.

It’s possible to find cards paying unlimited 1.5%, 2%, and even more today. That’s free money for qualified borrowers, and the type of thing that would be crazy to pass up. Those rewards can add up to thousands of dollars every year in free money, and include other benefits as well.

We’ve assembled some of the best credit cards for users today. Don’t miss these offers because they won’t be this good forever.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.