Economy

The Next Crisis: People Don't Know How to Pay for Retirement Expenses!

Published:

It is of no surprise that the Great Recession had an impact on the retirement plans of many Americans. What is a shock though is just by how much. A component in the Federal Reserve’s Report on the Economic Well-Being of U.S. Households quantifies the number: roughly 40% of people 45 and over who were not yet retired have pushed back their retirement plans.

This is no simple report to ignore, and this can affect the future of many things in America. It can affect Social Security, it can affect the financial markets via contributions and withdrawals of retirement funds, and it can affect the future workforce demographics in that older workers may simply not be removing themselves from the workforce, making it impossible for younger workers to graduate or move up.

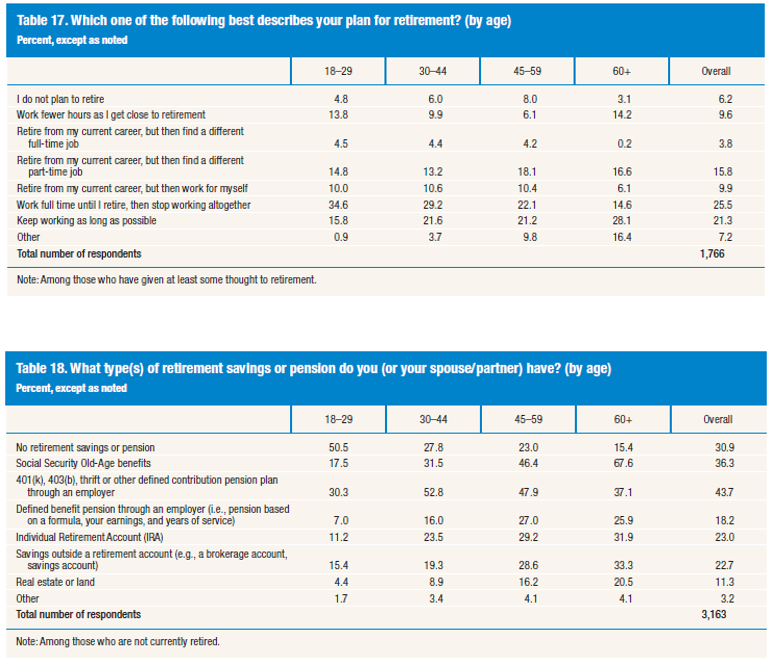

In how much (or any) contribution is being made, some 54% of those with incomes under $25,000 reported having no retirement savings or pension. This compares with only 10% of those earning $100,000 or more.

Roughly one-third reported that they plan to retire at the same age as they had planned prior to 2008, and 36% now plan to retire at a later age than before the recession. The age breakdown is where the data gets skewed: some 41% of adults aged 45 and over now plan to retire at a later date than they had before 2008, and only 5% who gave at least some thought to retirement now plan to retire sooner than they had prior to 2008.

ALSO READ: America’s Best Companies to Work For

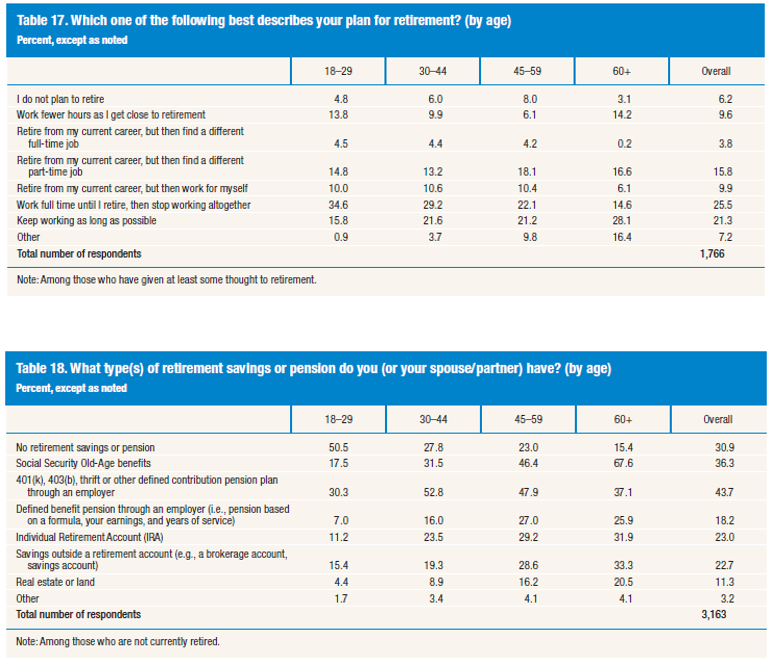

Among those aged 55 to 64 who had not yet retired, only 18% plan to follow the traditional retirement model of working full time until a set date and then stop working altogether. Some 24% expected to keep working as long as possible, and another 18% expected to retire and then work a part-time job. Another 9% said that they expect to retire and then become self-employed.

Another retirement scare is a tale you have heard, but this quantifies it. The Fed showed that although the long-term shift from defined-benefit to defined-contribution (from pension to 401(K) and IRA) plans places significant responsibilities on individuals to plan for their own retirement, only about one-fourth appear to be actively doing so.

Here is the true issue affecting many: they are clueless about their retirement! When asked how they and their spouse will pay for expenses in retirement, a whopping one-fourth of all respondents (and even 14% of those aged 45 or more) chose the answer “I don’t know.”

I don’t know. This is a scarier notion than improper planning — it is not having a plan at all.

We have outlined the full Fed household survey as well.

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.