If you are worried about a rapid rise in interest rates, and sooner than expected, from the Federal Reserve, there sure appears to be at least some breathing room here. The New York Federal Reserve has released its Survey of Consumer Expectations for February 2015, and there may be very little to fear on the inflation front — and therefore the interest rate front.

The long and short of the matter is that consumer inflation expectations are going down rather than up. Recent consumer price index and producer price index data have continued to show that energy and commodity price declines have been closer to deflationary than inflationary. Can the Fed really hike rates rapidly in a quasi-deflationary environment?

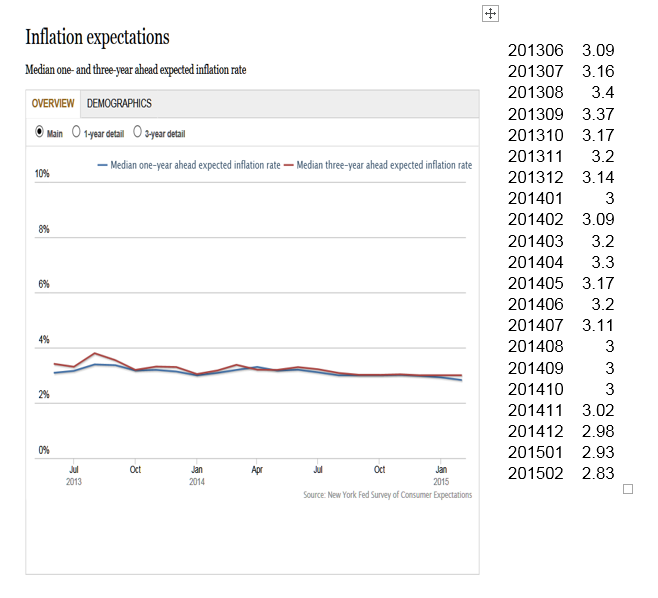

Results from the New York Fed’s February 2015 Survey of Consumer Expectations showed that the median consumer inflation expectations fell to 2.83% for the one-year outlook. This figure was 2.93% in January, and all readings were 3.00% or higher from the inception of the study from June 2013 to November 2014.

Also shown in the New York Fed’s data was that both home price expectations and household spending change expectations fell to their lowest levels since the inception of the survey. The median home price expectation was down to 3.0%. Household income expectations were 2.7% in February, while household spending growth was at a low in expectations at 3.8%.

ALSO READ: 10 Disappearing Middle Class Jobs

The Survey of Consumer Expectations aims to gather information on a wide variety of consumer expectations. These include inflation, future earnings, household income, house prices, access to credit, layoff risk and reemployment prospects, as well as U.S. economic conditions overall. Each month, interviews are conducted with approximately 1,200 people who are part of a rolling panel made of respondents who participate in the survey for up to a year.

One more thing to keep in mind here is that consumers in surveys about the future of inflation have tended to not necessarily be on target. The 3.0% future level seems to be almost ingrained as the standard response, but inflation has been running well short of that level.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.