There are many indicators that the investment community, business owners and consumers might use to judge the future of interest rates. Now that fed funds have been at a targeted range of 0.00% to 0.25%, and are expected to rise soon, many use the 30-day fed funds futures as a tool to decide when interest rates actually will rise and by how much.

Fed funds futures are far from a perfect tool for determining when interest rates will rise. For years now, they have indicated that fed funds would rise at some point in the next year or so — at least until 2015.

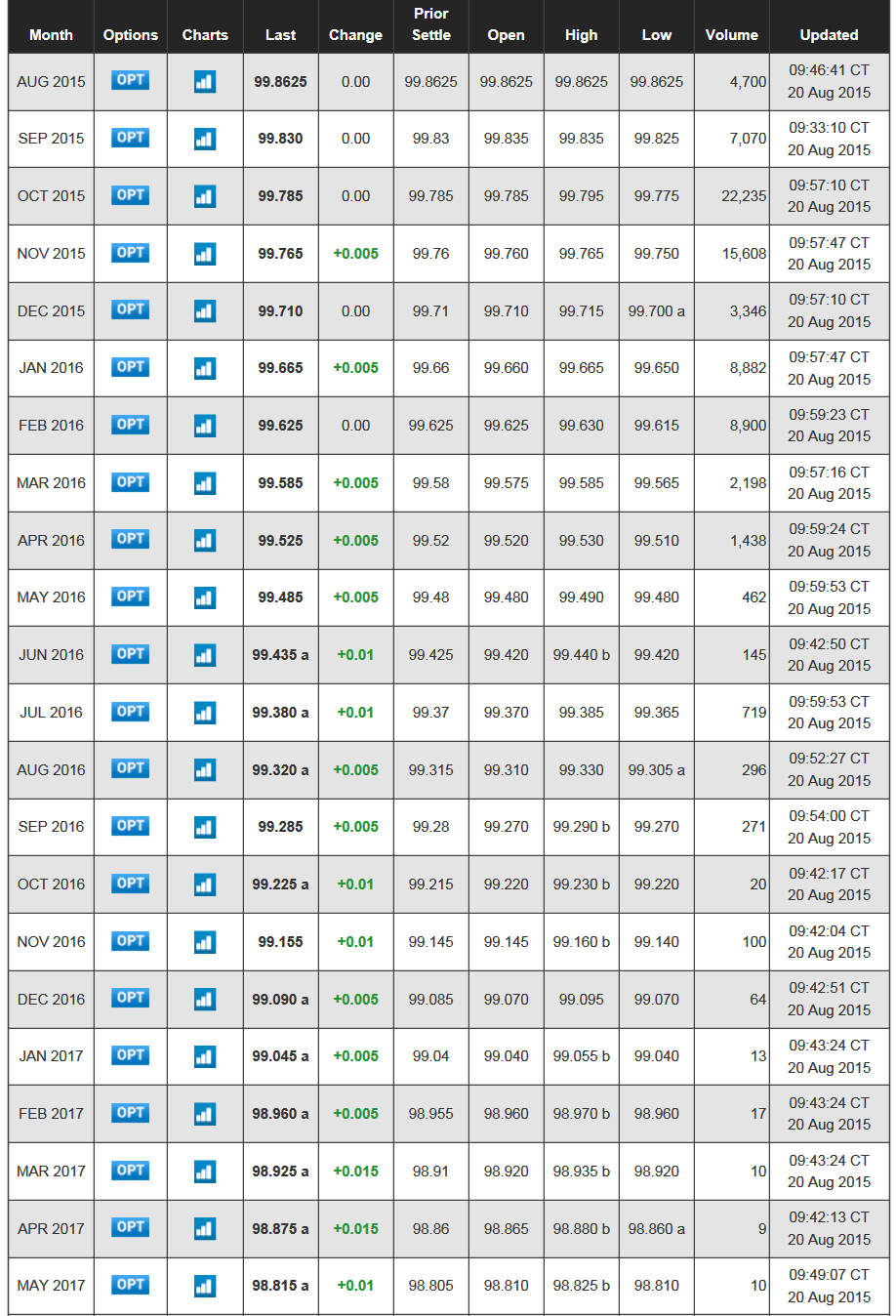

The unofficial hope, or fundamental call, has been for a September 2015 rate hike as the start. The fed funds futures had been looking at October 2015 as the month, but that has now moved farther out again. There is still a chance this could happen of course.

Prior to the release of the FOMC’s minutes on Wednesday (for the end of July meeting), November 2015 was the real month that a 100% chance of fed funds rising to 0.25% was priced in. That is now no longer the case, even though there is still a good chance as the contract price rose to 99.765 from 99.735 before the minutes came out.

With the exception of early in July, December 2015 fed funds futures had been calling for a 100% chance of fed funds being 0.25% by then. That remains the case at a contract of 99.71.

ALSO READ: How Obamacare Increased Insurance Coverage in Every State

What investors need to consider here is that the fed funds futures are now not even calling for a fed funds rate of 0.50% until all the way out in May of 2016. A 100% chance of 0.75% fed funds is now not even priced in until October of 2016, and a 1.00% fed funds is now not seen with a 100% price-in on futures until February 2017 — and 1.50% is not priced in until January of 2018.

Again, many tools are used for predicting what interest rates will rise to. What is impressive about fed funds futures themselves is that real money is being bet each day to generate these figures.

ALSO READ: 7 Countries Near Bankruptcy

Is Your Money Earning the Best Possible Rate? (Sponsor)

Let’s face it: If your money is just sitting in a checking account, you’re losing value every single day. With most checking accounts offering little to no interest, the cash you worked so hard to save is gradually being eroded by inflation.

However, by moving that money into a high-yield savings account, you can put your cash to work, growing steadily with little to no effort on your part. In just a few clicks, you can set up a high-yield savings account and start earning interest immediately.

There are plenty of reputable banks and online platforms that offer competitive rates, and many of them come with zero fees and no minimum balance requirements. Click here to see if you’re earning the best possible rate on your money!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.