At a meeting this week in Russia, cryptocurrency miners from 15 countries will show the country’s parliament how cryptocurrencies are mined and explain how the miners’ home countries regulate mining. The proposed mining regulations are expected to be sent to parliament by the end of March.

A draft bill to regulate cryptocurrencies (without specific rules attached) and initial coin offerings (ICOs) is expected to be presented by the end of this week.

According to the chairman of the State Duma financial market committee, Anatoly Aksakov, other draft regulations define cryptocurrencies as “other property” for tax purposes and ICOs as crowdfunding with a limit on the amount one person is allowed to invest.

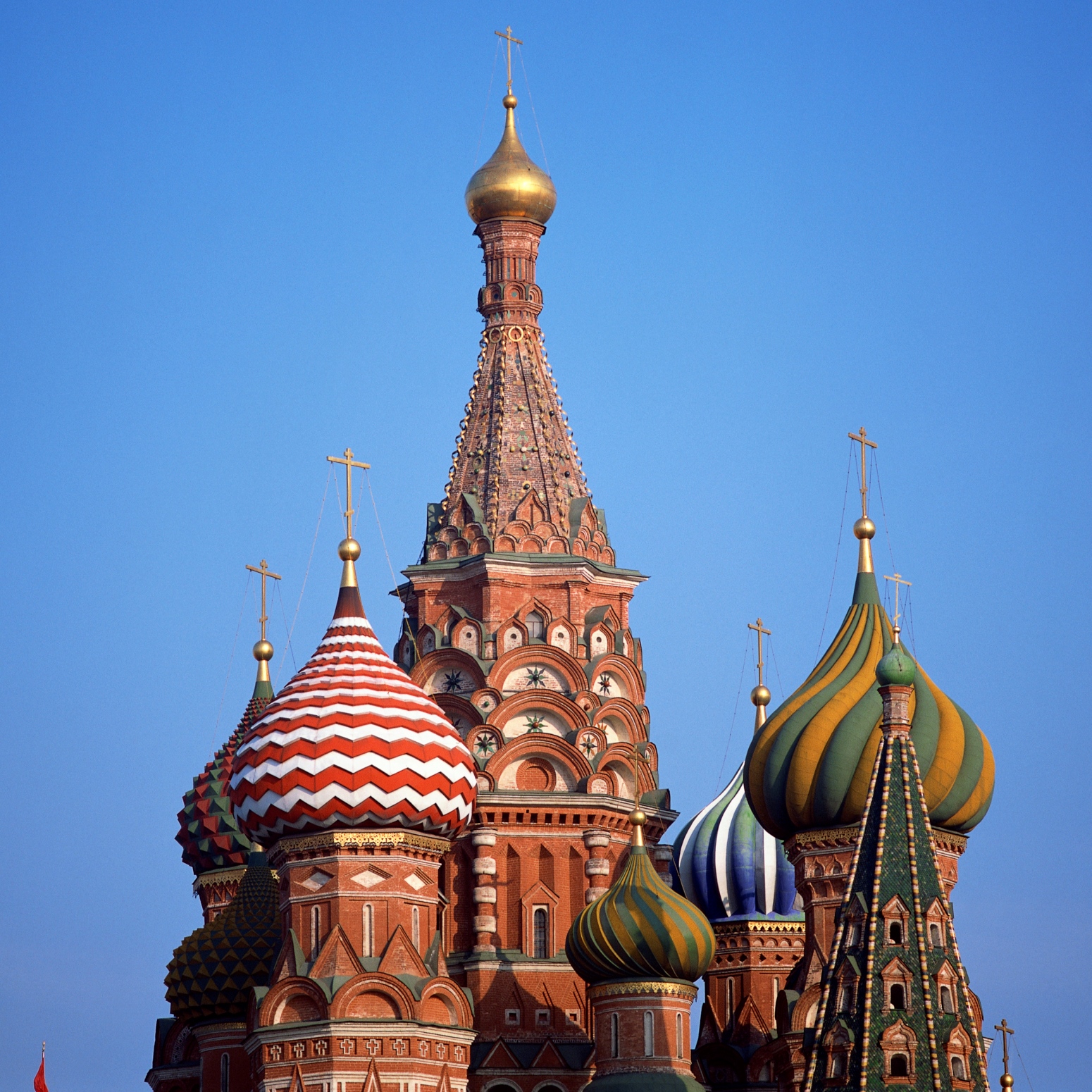

The activity follows orders from Russian President Vladimir Putin, who in October told officials that he wants regulation of digital currencies, ICOs and cryptocurrency mining. Mining operations are to be registered with the government and taxed. Officials have a July 2018 deadline for completing their work.

The United States and China currently account for about 75% of all the world’s cryptocurrency mining, but Russian cities from St. Petersburg to Kaliningrad also host large mining farms. Until about a year ago, mining was primarily a hobbyist endeavor with technically sophisticated enthusiasts building homemade systems to do the millions of calculations needed to win a payment in digital currency.

As the price of (especially) bitcoin and most other cryptocurrencies rose, massive mining farms with thousands of computing devices have sprung up to speed along the process of earning digital currency by tracing a transaction through the blockchain.

Because Russia is pursuing a strategy to regulate cryptocurrencies in its own country, wondering how that structure would play in the world is worth some thought. For example, if a Russian mining operation must be registered so it can be taxed, that implies a central authority that knows who’s doing the mining and the actual value and location of the asset. Those requirements run afoul of the decentralized structure of a cryptocurrency’s blockchain.

Russia is also considering offering its own cryptocurrency, tentatively called the cryptoruble and backed by the country’s energy reserves. There are reports that Russia is also talking with Venezuela about the South American country’s plan to issue its own cryptocurrency (the petro), also based on the country’s energy assets. If the two were to combine their efforts to back a single new digital currency, it might gain some traction.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.