Economy

Why the IMF's 2019 Global GDP Growth Decline Expectation Actually Looks Better Ahead

Published:

Last Updated:

The International Monetary Fund (IMF) has made another economic projection for 2019, and it’s got some bad news with it — slower global growth. After this time a year ago when growth was booming, the IMF points toward an escalation of US–China trade tensions first, followed by a needed credit tightening in China, economic stress seen in Argentina and Turkey, and disruptions to the German auto sector in Germany. Also worth pointing out was the financial tightening and monetary policy normalization in the larger advanced economies.

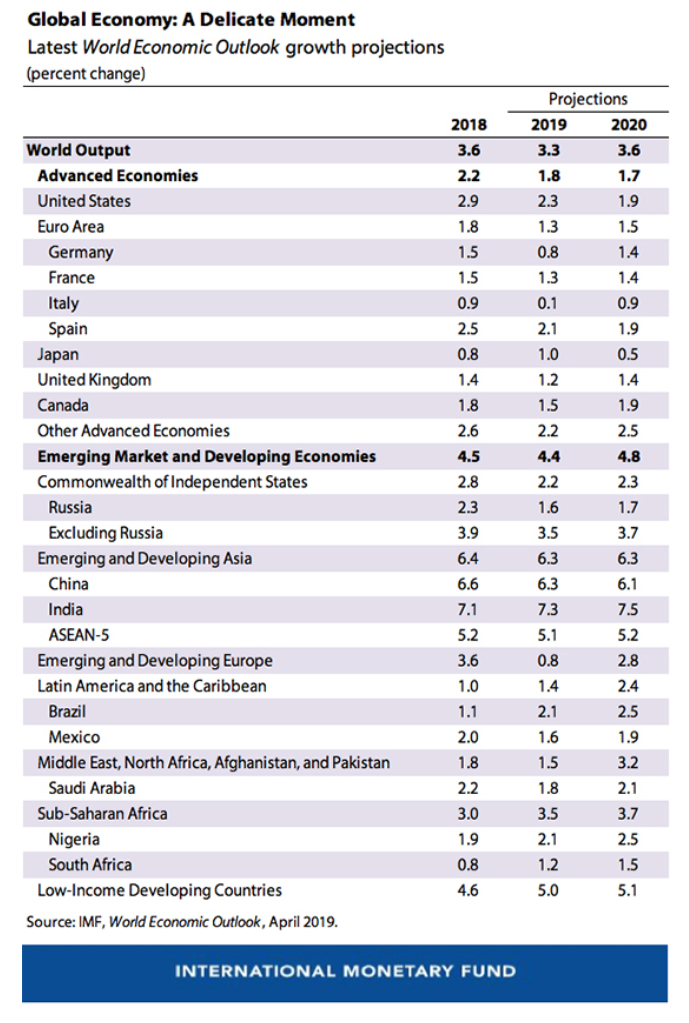

The weakness in global growth was more obvious in the second half of 2018, but the IMF sees that weakness likely persisting into the first half of 2019. The new World Economic Outlook projection is for a slowdown in growth in 2019 for some 70% of the world economy. According to the IMF, global growth fell to 3.6% in 2018 and it is now projecting a drop to just 3.3% growth in 2019.

This drop in growth translates to a 0.2-point downward revision from the IMF’s projection just in January. That downward revision is said to reflect negative revisions for several major economies. Included on the list with slowing growth are the euro area, Latin America, the United States, the United Kingdom, Canada, and Australia.

Still, it’s not all bad news. The current IMF outlook expects that growth will begin to regain some steam in the second half of 2019. Growth expectations for the second half of 2019 are supported by significant monetary policy accommodation by major economies and an absence of inflationary pressures.

Among the central banks shifting toward more accommodative policies are the U.S. Federal Reserve, the European Central Bank, the Bank of Japan, and the Bank of England. China has also been shown to have increased fiscal and monetary stimulus in an effort to counteract the weakness from trade tariffs. The IMF also noted that the outlook for US–China trade tensions has improved now that prospects of a deal are taking shape.

And for the longer-term, the IMF is projecting that global growth will climb back up to 3.6% in 2020. Much of that growth will come from emerging and developing markets if the IMF is correct, with growth projected to rise from 4.4% in 2019 to 4.8% in 2020. The IMF sees global growth after 2020 stabilizing around 3.5% as the growth in China and India are seen — with emerging market and developing economies stabilizing with growth of 5%.

The United States, after a 2.9% growth in 2018, is expected to grow 2.3% in 2019 and just 1.9% in 2020. The 1.8% growth of the euro area in 2018 was expected to drop down to 1.3% in 2019 and then recover to a still-slow 1.5% in 2020. Japan’s mere 0.8% growth of 2018 is expected to rise to 1.0% in 2019 but is also expected to fall to 0.5% in 2020.

Of the two fastest growing nations with mega-populations, the IMF sees a mixed bag for China and India. China’s 6.6% growth in 2018 output is projected to drop to 6.3% in 2019 and 6.1% in 2020. India’s growth of 7.1% in 2018 was projected to rise to 7.3% in 2019 and 7.5% in 2020.

A table from the IMF has been shown below showing the growth of major nations and regions for 2018, 2019 and 2020.

Credit card companies are handing out rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.