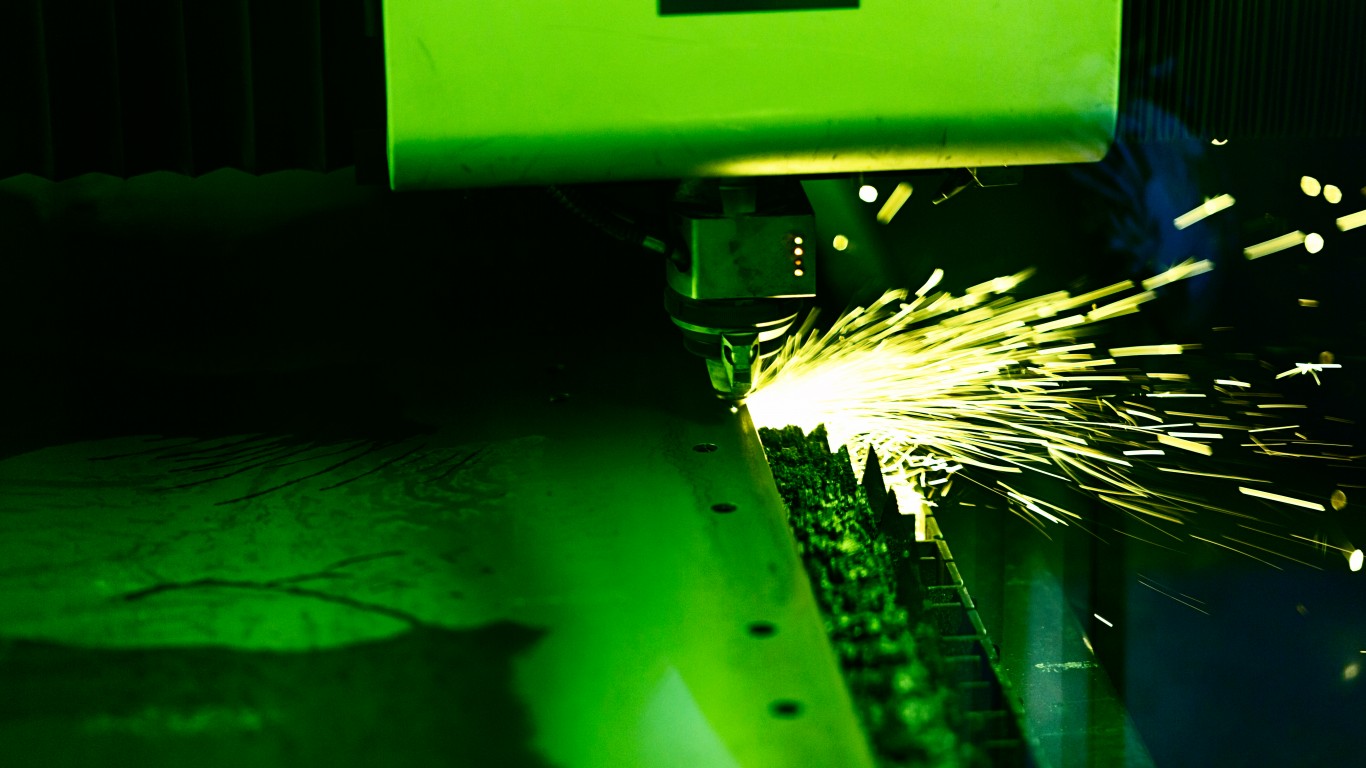

By nearly every measure, the Texas manufacturing industry improved last month. One key indicator, the business activity index, rose from a reading of 8.0 in August to September’s level of 13.6, the highest reading since last November.

The Federal Reserve Bank of Dallas, which issues the monthly report, has highlighted another key indicator of manufacturing conditions in the state. The production index rose by nine points to 22.3, its highest level in two years.

The September survey included special questions related to the respondents’ views on the impact of the COVID-19 pandemic on their businesses. In September, 62% of those surveyed reported lower revenues than in September 2019. That’s more than six percentage points fewer than those that reported lower revenues in August and nearly 20 points lower than reported lower revenues in May.

The average revenue decline in September fell by 31% year over year. Some 21% of firms reported a year-over-year revenue increase in September, compared to just 10% reporting an increase in May. The average increase was nearly 21% year over year. One in six firms reported no change in year-over-year revenues.

On the labor front, the report was less optimistic. Nearly half (49%) of firms reported that headcount was lower this year. In May, 43% reported a lower headcount than in the same month last year. The average decrease was nearly 31% in September, compared to an average decline of more than 26% in May.

At the same time, headcount was higher at nearly 15% of Texas firms in September, compared to higher headcount in just 11% of firms surveyed in May. A third of firms reported no change in headcount, down from 44% that reported no change in May.

In April, just 59% of reporting companies said they were fully operational. In September, that number had risen to just over 82%.

Raw materials costs rose by seven points to 26 and prices for finished goods rose to more than five index points, its highest level in 17 months. Wage and benefits costs also posted a higher number in September, at nearly 16, up about a point from August. All these index readings fell below zero in April.

Expectations for future activity were also more positive in September. The future production index score rose to 47.8 and the future general business activity index added eight points to post a reading of 28.

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.