Nearly 25,000 U.S. firefighters will be working Thursday on 70 wildfires, 42 of which have been characterized as large and uncontained. Since these fires started, they have burned nearly 4 million acres. So far this year, more than 44,000 wildfires have burned nearly 7.5 million acres.

Over the past two years, more than 96% of all acres burned were located in 15 states, according to a new report on wildfire risk from CoreLogic. The fires don’t just burn in remote towns and empty landscapes, however.

As Americans move closer to the frontiers (called the wildland-urban interface, or WUI), they are moving closer to the forests, brush and grasses that provide fuel for destructive fires. Major U.S. metropolitan areas that have been sprawling across what was once open space are raising the risk of substantial property damage due both to a greater number of residences being built at the WUI and the relatively higher values of those residences.

Of the 10 U.S. metro areas with the most single-family residences (SFR) at risk from wildfire, seven are located in California, two in Texas and one in Colorado. In the following table from CoreLogic’s September 2020 Wildfire Report, the cities are ranked based on total reconstruction cost value (RCV) of the homes at higher risk of being destroyed by a wildfire. The total RCV for these 10 cities is around $300 billion.

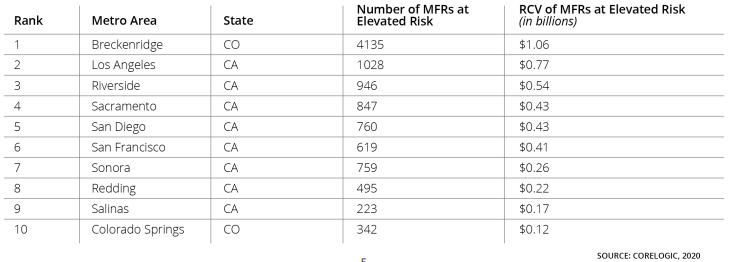

The number of multifamily residences (MFR) at elevated wildfire risk, though much smaller, is still substantial. Eight of the metro areas where RCVs for multifamily homes are highest are located in California and the other two are in Colorado. The top-ranked metro’s population is only around 30,000, but it’s a popular (and apparently expensive) resort destination near Denver.

CoreLogic noted that if a wildfire takes out a multifamily building, the number of people affected and potentially displaced could much higher than the number of structures destroyed. The total RCV of multifamily homes in these 10 cities is around $4.4 billion.

It’s also worth pointing out that RCV is not the same as replacement cost. Homeowners may be underinsured if their policy is based on a replacement value rather than a reconstruction value, according to CoreLogic.

Another factor for homeowners to keep in mind is the time required to rebuild. Northern California’s 2017 Tubbs fire destroyed 3,043 housing units. As of June, less than half (1,282) had been completely rebuilt.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.