According to the final July survey from the University of Michigan, consumer sentiment rose 13% month over month in August to 58.2. That is still 17.2% below the level posted in August of last year. The major change came in consumers’ expectations, which rose 22.6% from 47.3 in July to 58.0 in August.

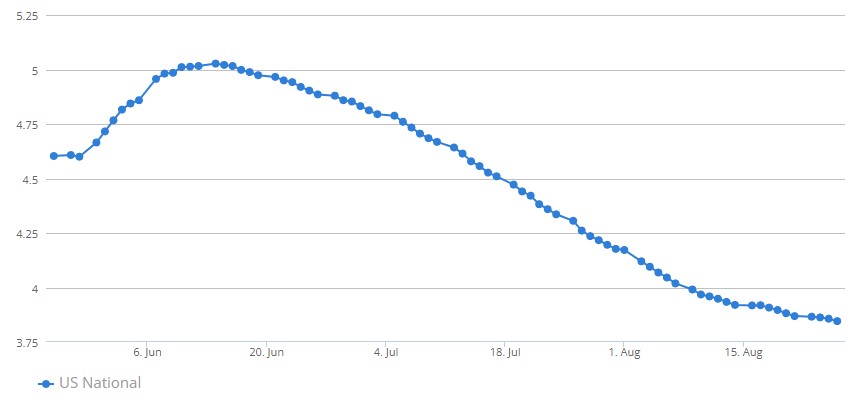

National average gasoline pump prices have been declining daily for two months, and nothing makes Americans feel better about the U.S. economy than lower fuel prices, just as nothing makes them unhappier than high fuel prices.

[in-text-ad]

Survey director Joanne Hsu said that although lower gas prices and slowing inflation gave consumers some relief in August, people continue to feel the weight of persistently high prices on their spending.

“Hopefully this recent improvement continues, as sentiment remains close to the all-time historic low reached in June. There is a long way to go before consumers feel truly confident about the state of their personal finances and their outlook for the economy,” Hsu said.

According to a research note from BofA Global Research economist Jeseo Park, the drop in gasoline prices and consumer resiliency have led to the bank’s own consumer confidence indicator to rise from an historic low in early July to 31%. That is still a long way from a pre-pandemic reading of around 60%. The BofA index closely tracks the Michigan consumer sentiment index.

In their survey this month, BofA’s economists asked consumers for their views on the economic outlook. Nearly two-thirds (66%) expect inflation to remain high for the next 12 months. More than a third (38%) expect a recession and 28% expect slower growth.

More than a third (35%) of those who expect a recession believe that the U.S. economy is already in recession, and 42% of survey respondents who earn between $125,000 and $250,000 annually believe the economy is already in recession. For this group, more than half (53%) said that savings and investments were their biggest concern. At the other end of the wage scale, 28.7% of respondents who earn less than $50,000 or less annually are most concerned with job security. BofA comments: “Overall, our latest survey results still portray a very pessimistic consumer.”

For specialty retailers and department stores, consumer spending, particularly on back-to-school clothing, has led to a jump in sales so far in August. Spending on clothing by higher-income groups picked up in August, after several months of year-over-year declines.

Among lower-income consumers, year-over-year spending is down 8% as of mid-August but up 18% compared with the same date in August 2019. BofA’s retail analysts, led by Lorraine Hutchinson, comment:

We attribute this to strong wage growth among the lower-income cohort compared to negative real wage growth among higher-income cohorts. The lower-income consumer also improved its financial profile the most through stimulus. Lower-income households also have a higher marginal propensity to consume, meaning a greater proportion of their income (which is now higher) is spent rather than saved.

The analysts, however, do not expect the trend to last beyond mid-September: “After that, we expect consumers will likely pull back on spending until the holiday season picks up in November.”

The University of Michigan survey report noted that more than half of consumers expect to see their incomes grow over the next year, with gains averaging 2.3%. Only 18% expect their income growth to exceed inflation.

The #1 Thing to Do Before You Claim Social Security (Sponsor)

Choosing the right (or wrong) time to claim Social Security can dramatically change your retirement. So, before making one of the biggest decisions of your financial life, it’s a smart idea to get an extra set of eyes on your complete financial situation.

A financial advisor can help you decide the right Social Security option for you and your family. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Click here to match with up to 3 financial pros who would be excited to help you optimize your Social Security outcomes.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.