Economy

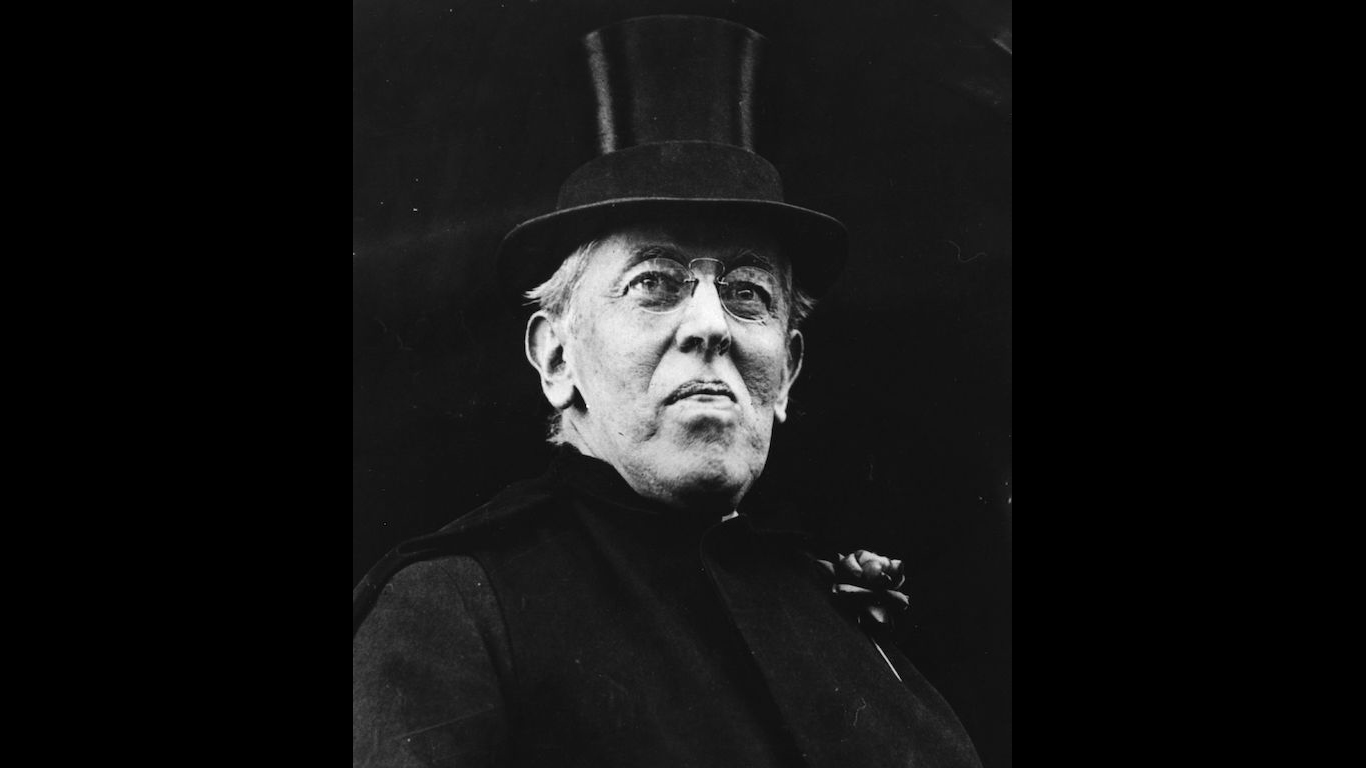

This Democrat President Exploded the U.S. Debt by Over 700%

Published:

Last Updated:

In the United States, the discussion and news coverage of the national debt has taken on a perpetual air of doom and moral ineptitude, but in years past it wasn’t always that way. Competent politicians made use of the debt to benefit the American people instead of wage endless foreign wars. But which president exploded the debt the most?

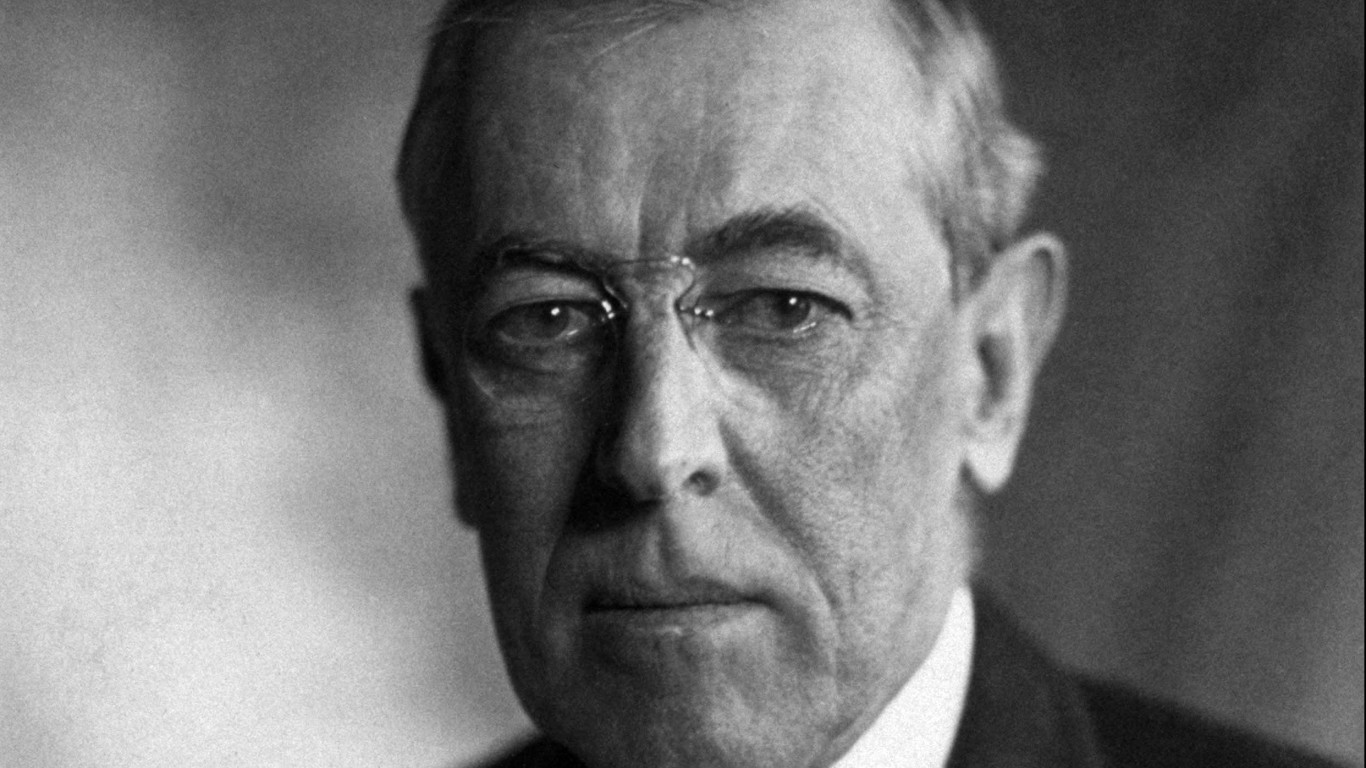

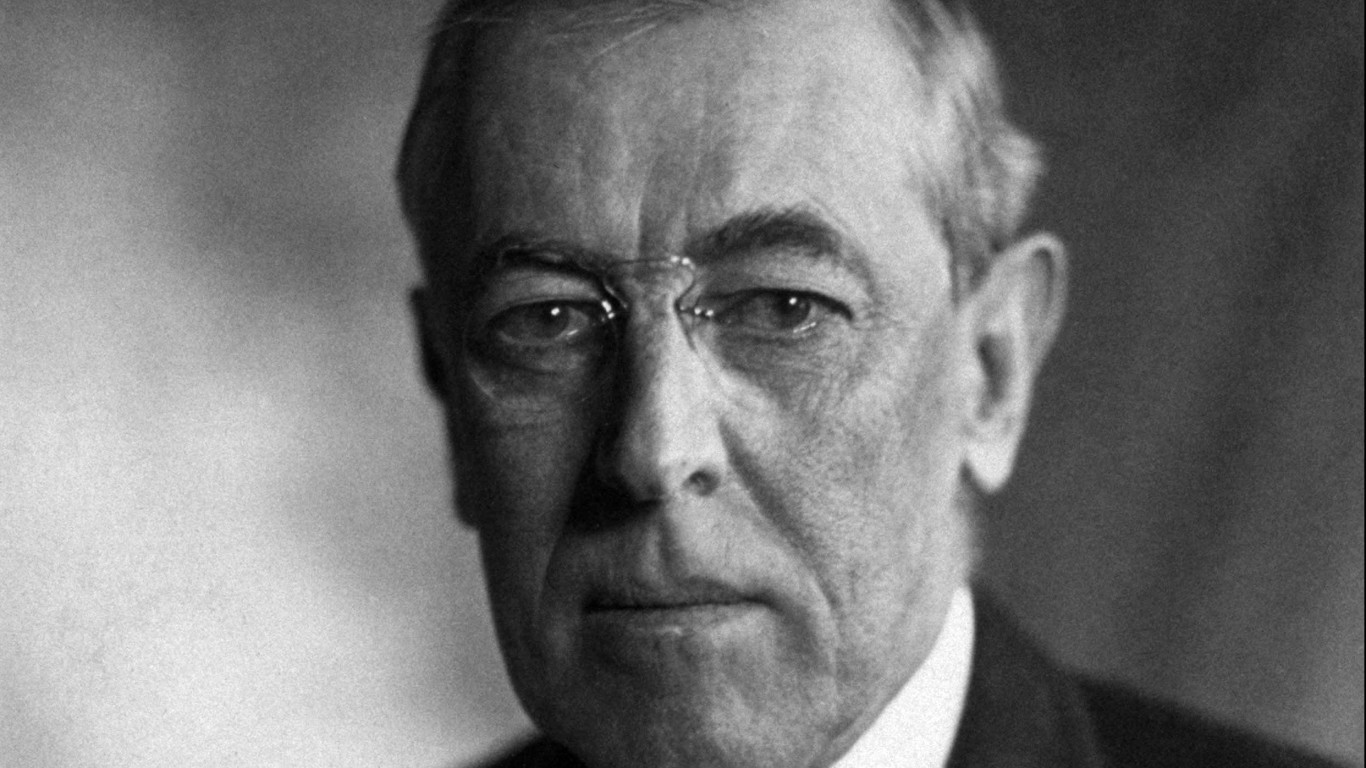

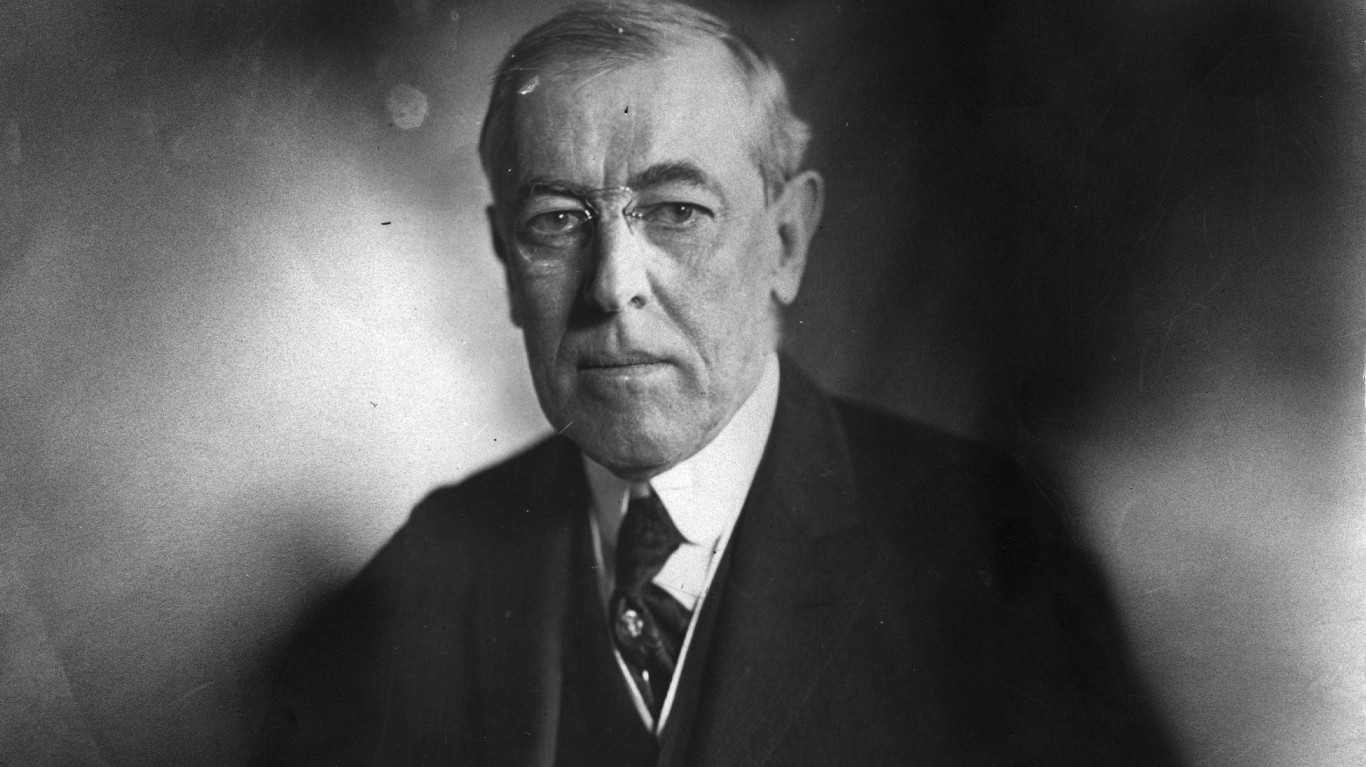

Woodrow Wilson increased the U.S. debt in order to finance fighting World War I.

Through the increase of taxes on the wealthy, businesses, and selling war bonds, Wilson was able to more than pay for the war, and lay the foundation for our strongest economy.

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

We compared the debt created by each president to find who spent the most, what they did with it, and if it was worthwhile in the end. We looked into the conclusions of expert political scientists and economists to determine if this was a good idea in the end. This is the president that exploded the U.S. debt by over 700%

As we watch our national debt skyrocket while politicians and oligarchs gut our government and public institutions, it is probably a good time to think about better times when the use of our government debt was used for the betterment of society, not the enriching of the wealthy.

We’ve covered the impacts of high government debt before, and it largely includes seven major issues.

First, it creates regular political conflict over the debt ceiling, which politicians can use to manipulate their voters. Second, it creates lagging intergenerational equity. Third, it contributes to higher inflation. Fourth, it creates the possibility of a debt crisis. Fifth, it leads to slower economic growth. Sixth, it leads to higher interest rates. Seventh, it causes the government, particularly right-wing politicians, to justify cutting government programs.

While Woodrow Wilson was serving as the Governor of New Jersey, and as a prominent intellectual in the United States, he campaigned on an interventionist federal government and strong progressive issues. He instructed his campaign finance chairman not to accept donations from corporations and instead to try to maximize small donations from across the entire country. According to Wilson, it was the government’s job to “make those adjustments of life which will put every man in a position to claim his normal rights”.

He also campaigned on breaking up large monopolies, fighting powerful trusts, and lowering tariffs.

He won the 1912 presidential election against incumbent president William Howard Taft of the Republican Party, former president Theodore Roosevelt of the new Progressive “Bull Moose” Party, and Eugene V. Debs of the Socialist Party.

He was the first Southerner to hold the presidency since the Civil War (which was still a sore point in living memory) and the first and only president in our history to have a Ph.D.

He was also the first president ever to introduce a broad and comprehensive set of legislation at the very beginning of this presidential term. This included conserving natural resources, reforming the banking industry, reducing tariffs, and providing equal access to raw materials. This was called the “New Freedom” agenda.

Under Woodrow Wilson, the national debt increased by 722.2% from 1913 to 1921, an average annual change of about $2.6 billion, or 30.1% per year.

At the beginning of 1913, the national debt was $2.9 billion, and by the end of 1921, it had reached $24 billion.

This is all in contemporary dollars.

When Wilson entered the Oval Office, he was prepared and determined to reform large parts of American society and industry, and he was largely successful until the outbreak of World War I, which required Wilson to turn his attention almost entirely to maintaining neutrality at first, then helping the Allies win through financing war efforts and finally sending troops.

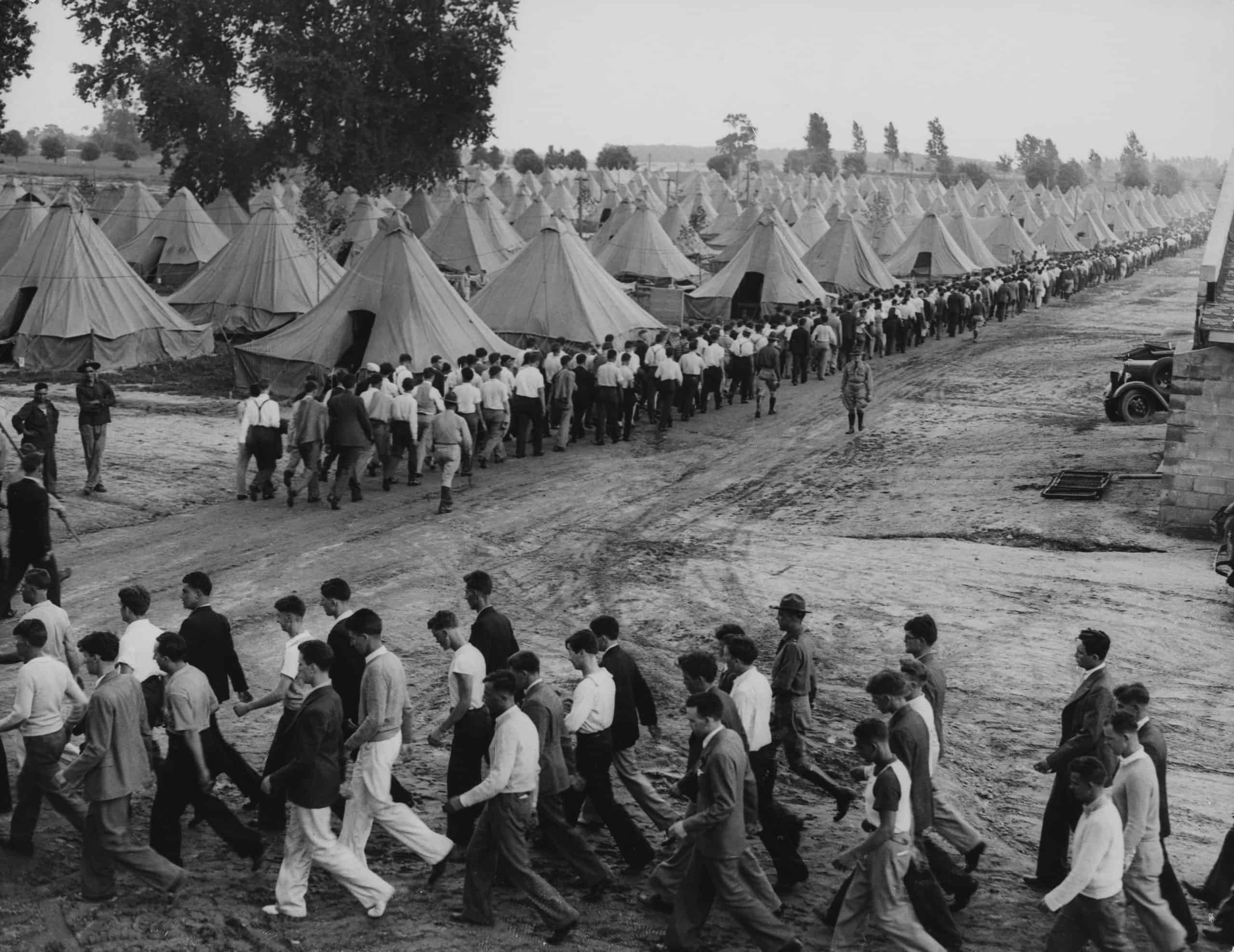

Even though the United States had the largest financial base, most powerful industrial base, and a fresh and young population of manpower to draw from, it was ill-prepared to enter a war, and significant amounts of money were required to recruit, arm, and deploy, and fight the war to its conclusion.

The total cost of the war was around $33 billion. But this does not include loan interest and veterans’ benefits, or the other costs and investments required to sustain the nation while the soldiers went to fight. Of this amount, around $7 was sent as loans to the Allies to help them survive.

Over the course of three years, the federal budget grew from $1 billion in 1916 to over $19 billion in 1919.

The amount of money needed to finance World War I was unprecedented, and while the country was not prepared for the huge costs, it was able to finance its war efforts relatively well. Compared to every other country engaged in the war, the United States had the best financial performance by far.

Wilson and the government launched five separate “Liberty Loan” campaigns to persuade citizens to buy government savings bonds. This raised more than $20 billion in total for the war effort, or around 64% of the total cost of the war. This effectively deferred a majority of the cost of the war into the future.

Around 36% of the cost of the war, effectively the remainder after bond sales, was paid for through increased taxes.

The U.S. government had passed the first income tax just before Wilson became president, and Wilson increased these taxes on the rich, corporate profits, and luxury products along with alcohol and tobacco. This was done through two Revenue Acts.

This Act changed the rates of the brand-new federal income tax and broadly reduced the number of exemptions. Prior to 1917, people earning less than $20,000 per year fell into the 2% tax bracket, while anyone who earned more than $2 million per year paid 15% income tax.

Under the new law, the 2% rate applied to anyone earning less than $2,000 per year, and the top tax rate on the rich was raised to 67%.

This Act also imposed an “excess profits tax” on businesses in the country.

This tax Act not only expanded the previous taxes but also simplified the tax structure.

The bottom tax bracket (for those earning less than $2,000 per year) was raised from 2% to 6%. The top tax rate for the rich was increased from 67% to 77% and included all income above $1,000,000 (lowered from $2,000,000).

Even after these expansions, only 5% of the population in the United States ended up paying any taxes at all, but that was still enough to pay for more than 1/3 of the entire cost of World War I.

Wilson made a concerted effort to raise the wages of farmers and people who worked in war production. This achieved a number of goals: it incentivized thousands of workers to switch jobs from the civilian sector to other areas that better supported the war, it helped workers maintain their purchasing power against rising inflation due to the increased money supply, and it helped workers and unions fight against the monopolies that had significant control over the economy.

In the end, the citizens of the U.S. paid about half the cost of World War I, and the other half was paid by later generations.

Unfortunately, much of the later cost includes the loans that were largely unpaid. In 1932, after several diplomatic issues and economic problems, the U.S. government wrote off about 90% of its loans in the middle of the Great Depression. The remainder was finally repaid in 1951.

Wilson was distracted from his domestic priorities by World War I, but he still managed to implement several of his policies.

These included implementing the Federal Reserve System, creating the FTC, and passing the Adamson Act (which implemented the eight-hour workday for railroad workers after one of the largest railroad strikes in history. It was the first federal law that regulated the work hours for private companies and was subsequently upheld by the Supreme Court after the rich complained), passing the Keating-Owen Act (along with a second law) that made it illegal to ship goods that were made using child labor and imposed a tax on business that used child labor, but both laws were struck down after businesses sued the government.

Wilson was successful in passing several new laws that improved the working conditions of workers, strengthened their labor protections, and increased and protected their wages.

He also passed the Clayton Antitrust Act of 1914.

The Clayton Antitrust Act of 1914 added to the existing antitrust legislation instituted by the Sherman Antitrust Act because trusts (monopolies) had seized control of huge swaths of the American industry and oppressed and abused their workers, requiring a strong government response.

This Act outlawed price discrimination, outlawed “exclusive dealings” (meaning a customer couldn’t do business with a competitor), outlawed “tying” (requiring a customer to purchase a second mandatory product with the first), outlawed certain mergers and acquisitions that lessen competition, and prevented any person from being the director (on the board of directors) of more than one competing corporation.

Due to the work of lobbyists and politicians ever since, the teeth of most of our anti-trust legislation have been weakened, leading to the huge monopolies we have today.

Even though Wilson has an extremely complicated legacy fraught with racism, sexism, and prejudice, he was foundational in creating many of the benefits, labor protections, and wealth we enjoy today.

He exploded the debt, but unlike modern presidents, that money actually went to worthwhile causes, and most of it ended up paying dividends over the years, leading to a stronger economy and wealthier citizens.

He is the father of Modern American liberalism and had a very strong influence on later presidents Roosevelt and Johnson who made their own contributions to the growth of the American middle class and workers’ rights. Alongside Johnson’s Great Society policies and Roosevelt’s New Deal, Wilson’s New Freedom policies created the America we have today.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.