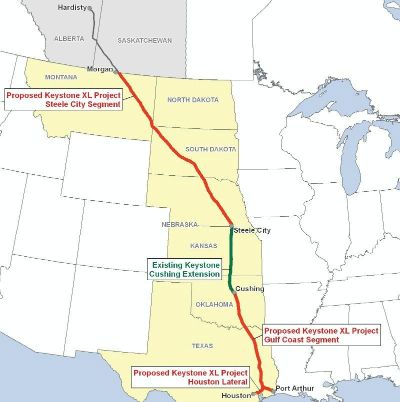

Because the pipeline crosses an international border, the U.S. State Department must approve the plan as well. A determination on the pipeline is due by the end of the first quarter of this year according to TransCanada Corp. (NYSE: TRP), the company that is proposing to build the pipeline.

The state of Nebraska’s Department of Environmental Quality had approved TransCanada’s request earlier this month after the company re-routed the pipeline’s route to avoid the environmentally sensitive Sand Hills region. The Keystone XL would cross the Ogallala Aquifer, a key bone of contention with environmentalists.

The Obama Administration rejected an earlier proposal for the Keystone XL, and there is still plenty of opposition to the new route. However the strongest arguments favoring the new pipeline are that it is likely to be safer and cheaper than transporting the Canadian crude than are the growing networks of rail and truck transportation.

Competing proposals to transport the oil sands product to the West Coast are being sponsored by Kinder Morgan Inc. (NYSE: KMI), which is proposing an expansion to its existing Trans Mountain pipeline, and Enbridge Inc. (NYSE: ENB), which has proposed a new Northern Gateway pipeline.

The impact on railway transportation won’t be felt for several years, until the Keystone XL pipeline is completed. But the Burlington Northern Santa Fe, owned by Warren Buffett’s Berkshire Hathaway Inc. (NYSE: BRK-A), the Canadian Pacific Railway Ltd. (NYSE: CP), and the Canadian National Railway Co. (NYSE: CNI) will very likely see a drop in demand for tank car transportation. Tank car builders The Greenbrier Companies Inc. (NYSE: GBX) and Carl Icahn-controlled American Railcar Industries Inc. (NASDAQ: ARII) are among a handful of companies currently benefiting from the increased demand for rail transportation.

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.