First Solar said it would use the proceeds from the sale:

[F]or general corporate purposes, which may include acquisitions of under development photovoltaic solar power system projects, investments in photovoltaic solar power system projects that will be jointly developed with strategic partners and capital expenditures or strategic investments to develop certain business units and expand in new geographies.

At the time of the announcement, First Solar’s shares were trading near the 52-week high of $59, so the timing could not have been much better from the company’s point of view. From a shareholder’s perspective, perhaps not so much.

Solar power installations in the first quarter of this year reached an all-time high in the United States. Prices for solar panels have stopped sinking like a stone, and First Solar’s technology always has been competitive on price and is gaining in terms of efficiency. The company’s acquisition of a solar installation company in 2010 has helped bring First Solar’s revenues and profits back from the deal.

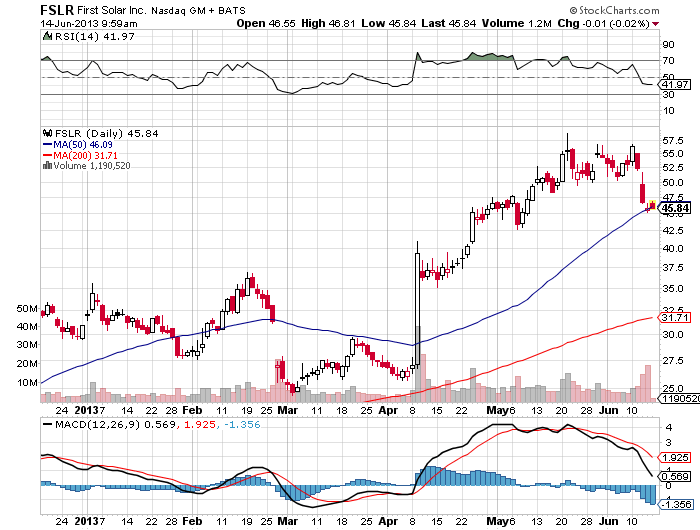

Shares traded flat at $45.85 about 45 minutes after today’s open, in a 52-week range of $13.25 to $59.00. Here is a 12-month chart of First Solar’s share price, showing that it continues to trade very near its 50-day moving average and well above the 200-day average.

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.