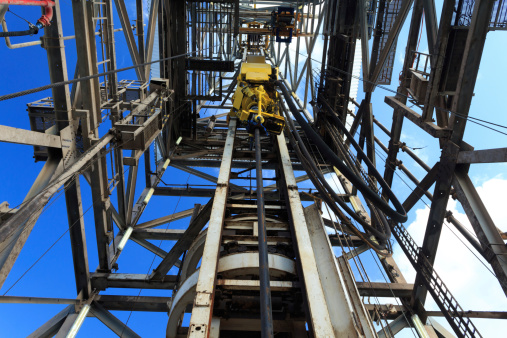

Energy

Why Credit Suisse Says Not to Buy Oil Service Stocks, Yet ...

Published:

Last Updated:

The biggest risk is seen in the land drillers and the ultimate inflection point in the price of oil. However, land drillers also have the most upside off the bottom.

For those that must be invested, Credit Suisse recommends its top pick, Schlumberger Ltd. (NYSE: SLB). In a downturn, large-cap, diversified service companies are able to bundle and cross-sell to take share from their smaller peers and Schlumberger seems best-positioned to take advantage of this dynamic.

OFS stocks bottom when the oil price bottoms, which statistically happens in the first quarter and usually at the end of January. Credit Suisse anticipates some dire fourth-quarter conference calls with troubling 2015 guidance that still needs to work its way into the stock prices.

Apart from Schlumberger, Superior Energy Services Inc. (NYSE: SPN) offers leverage to a recovery and is hoarding cash on its balance sheet in preparation to pounce on anything that comes out of recent large M&A deals.

Weatherford International PLC (NYSE: WFT) has sold businesses and generated $1.7 billion in proceeds in an effort to decrease its debt load. Frank’s International N.V. (NYSE: FI) has a new CEO and CFO, which should bring in some public and industry experience while competing in a global duopoly. Patterson-UTI Energy Inc. (NASDAQ: PTEN) is not being recommended by Credit Suisse — nor are any other land drillers for that matter — but it has led the OFS stocks out of the last two down cycles.

The brokerage firm mentions slashing its earnings per share estimates and target prices across the space. The large-cap oilfield services companies are getting earnings per share cut by an average of 27% to 30% and price targets were cut by an average of 13%. The small- and mid-cap equipment group is getting earnings per share cut by an average of 27% to 29% and price targets by 21%. Land drillers had the largest average cuts to earnings per share of 80% to 93% and price targets of 53%.

Wicklund lowered 2015 earnings estimates as follows:

ALSO READ: Oilfield Services Stocks May Have No Way to Escape Low Crude Prices

The Average American Is Losing Momentum On Their Savings Every Day (Sponsor)

If you’re like many Americans and keep your money ‘safe’ in a checking or savings account, think again. The average yield on a savings account is a paltry .4%1 today. Checking accounts are even worse.

But there is good news. To win qualified customers, some accounts are paying more than 7x the national average. That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn a $200 bonus and up to 7X the national average with qualifying deposits. Terms apply. Member, FDIC.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.