The acquisition of Vivint Solar Inc. (NYSE: VSLR) just is not having a broad spillover. Sure, some solar players rallied on the news, but the reality is that on a relative basis the solar exchange traded funds (ETFs) just have not participated in the rally.

There is of course a reason why: tracking error risks due to so many foreign company issues in the ETFs. Some investors might think that a $2.2 billion buyout of a solar company that had been poorly received after coming public last year might create more of an impact.

The Guggenheim Solar ETF (NYSEMKT: TAN) was last seen up by only 1.9% at $38.21, and on a meager 84,000 shares or so right before noon. The Guggenheim Solar ETF has a 52-week range of $31.77 to $50.00 and generally trades almost 300,000 shares per day.

The Market Vectors Solar ETF (NYSEMKT: KWT) was up even less than its Guggenheim rival, with a gain of 0.9% to $72.37. This volume is a tiny 551 shares. Yes, really, less than 1,000 shares. With an average daily volume of less than 2,000 shares, the market Vectors Solar ETF has a 52-week range of $62.81 to $90.47.

SunEdison Inc. (NYSE: SUNE), the acquirer of Vivint, is actually the largest holding of each of these ETFs. Even SunEdison’s gain of 4% to $32.83 is not powering the solar ETFs higher. When investors see a gain of over 40% in an acquisition, it is surprising when the fallout or the secondary bounce is so muted. Vivint Solar shares were last seen up 44% at $15.68 on over 7.5 million shares traded.

ALSO READ: Why the Vivint Solar Buyout Is the Strongest Solar Endorsement Yet

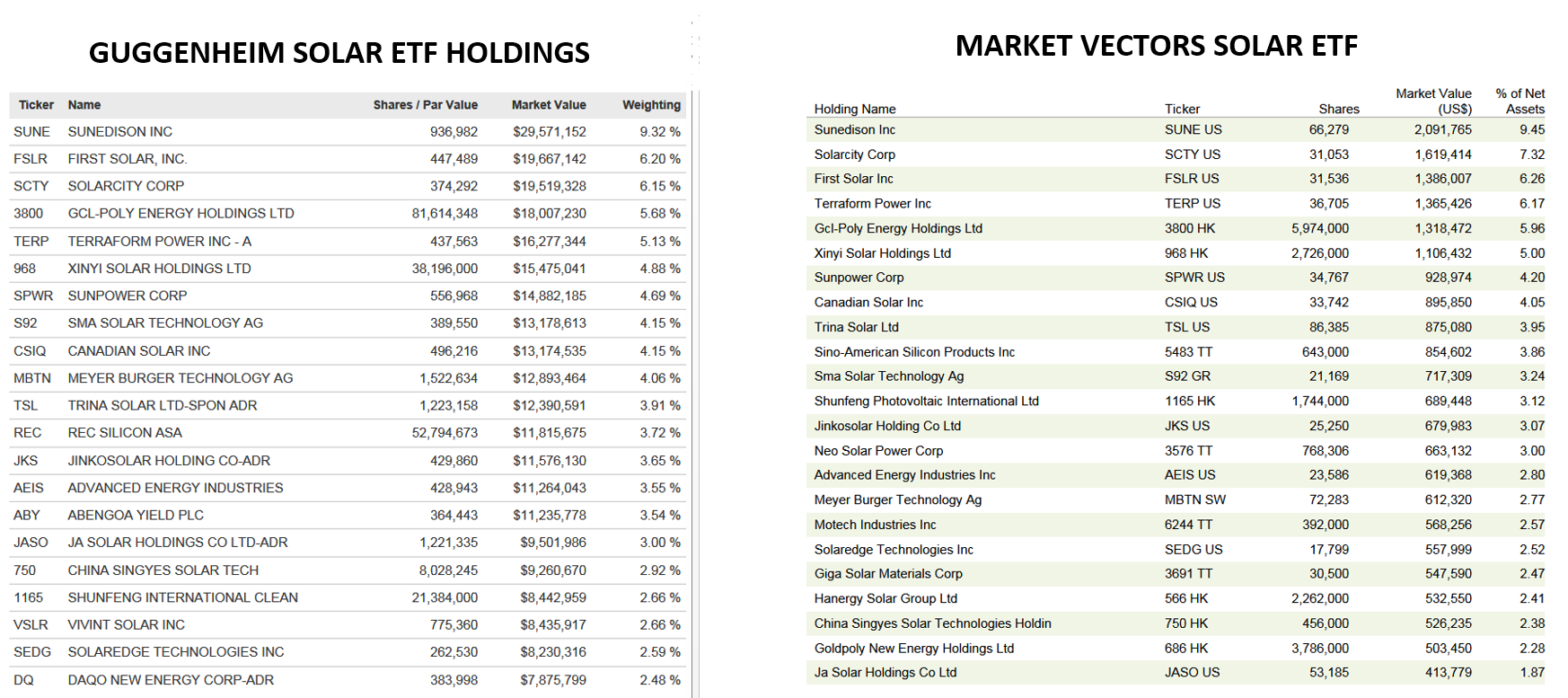

The following is an expandable image showing the top holdings of these two key solar ETFs. Many are foreign companies that are largely unknown to U.S. investors.

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.