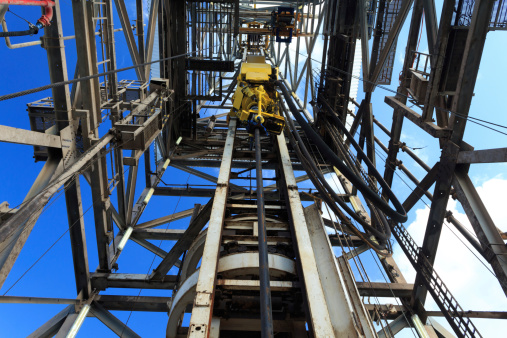

If any sector has been taking a beating it’s energy, and the price of crude continued the downward spiral last week to under $50 again. With West Texas Intermediate 20% below the June high and the rig count still dropping, the analysts at Merrill Lynch are very positive on two land drillers and in a new research report they are very bullish on the upside potential.

The Merrill Lynch team notes in the report that they continue to expect US onshore production to decline meaningfully, supporting rising oil prices and multiple expansion. They also think two land drillers could be poised to have a much better rest of 2015 and a very solid 2016. They also think they both have big long-term upside potential.

Precision Drilling

Precision Drilling Corporation (NYSE: PDS) provides customers with access to an extensive fleet of contract drilling rigs, directional drilling services, well service and snubbing rigs, coil tubing services, camps, rental equipment, and water treatment units backed by a comprehensive mix of technical support services and skilled, experienced personnel. This company is Canada’s leading oilfield services firm which provides contract drilling, well servicing and strategic support services to its customers.

While the company did report a second quarter loss of $0.08 per share that was far less than analyst estimates of a loss of .14 per share. Revenue also topped analysts estimates when they posted $272 million versus $253.6 million.

Precision shareholders are paid an outstanding 4.68% dividend. The Merrill Lynch price target is $7. The Thomson/First Call consensus target is posted much higher at $9.41. The stock closed on Friday at $4.81 A move to the Merrill Lynch target would be an outstanding 45%. Trading to the consensus would be a massive 95% gain.

ALSO READ: 5 Opportunities Brewing in MLPs

Patterson-UTI Energy

Patterson-UTI Energy, Inc. (NASDAQ: PTEN) subsidiaries provide onshore contract drilling and pressure pumping services to exploration and production companies in North America. Patterson-UTI Drilling Company LLC and its subsidiaries operate land-based drilling rigs in oil and natural gas producing regions of the continental United States and western Canada. Universal Pressure Pumping, Inc. and Universal Well Services, Inc. provide pressure pumping services primarily in Texas and the Appalachian region. This company could see meaningful business coming from Canada this year.

Patterson also reported a smaller second quarter loss than analysts were expecting. The company reported a loss per share of 13 cents, significantly narrower the consensus estimates for a loss of 26 cents. While revenues also fell to $472 million they were also higher that the estimated figure of $454 million. The outperformance could be attributed to good execution and reduction in the cost structure, and the Merrill Lynch analysts noted that the company’s pressure pumping margins improved 4% to 16.7%.

Patterson-UTI investors are paid a 2.48% dividend. The Merrill Lynch price target for the stock is $25, and consensus stands at $22.52. The stock closed Friday at $16.11. Trading to the Merrill Lynch target would be a huge 55% gain.

ALSO READ: 6 Oil & Gas Stocks Analysts Want You To Buy Now

Clearly these are contrarian trades, as oil and oil services are very out-of-favor. The fact is that Merrill Lynch isn’t alone in their preference for the land drillers and patient growth investors could be paid off big as the sector recovers next year and into 2017. In this weekend’s research summary, we showed how Credit Suisse was also very positive on exploration and production companies – admitting it may be early in its call.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.