Energy

UPDATE: Harvey Upgraded to Hurricane, on Track for Gulf Coast Refineries

Published:

Last Updated:

UPDATE: At 1 p.m. CT, the National Hurricane Center upgraded tropical storm Harvey to Hurricane Harvey. The storm now clocks sustained winds of 85 mph and continues on its slow course toward the Gulf Coast of Texas.

The Houston Chronicle reported Shell has shut-in production on its Perdido platform and that Anadarko is removing nonessential personnel from its four Gulf fields. Valero is reported to be making preparations and watching the storm closely.

********

The National Hurricane Center released a new advisory on tropical storm Harvey Thursday morning at 10 a.m. CT. The storm is “quickly strengthening and forecast to be a major hurricane when it approaches the middle Texas coast … life-threatening storm surge and freshwater flooding expected.”

The storm is currently located about 365 miles southeast of Corpus Christi, with maximum sustained winds of 65 miles per hour, and is moving north-northwest at 10 mph.

A hurricane warning has been issued for Port Mansfield to Matagorda, Texas, and a hurricane watch is in effect south of Port Mansfield to the mouth of the Rio Grande. A tropical storm warning has been issued for the area north of Matagorda to High Island, north of Galveston.

Tropical storm Harvey is now expected to approach the middle Texas coast on Friday and make landfall Friday night or early Saturday before stalling near the coast through the weekend. The storm is expected to become a major hurricane before it makes landfall.

Any major storm in the Gulf of Mexico threatens U.S. offshore oil and gas production and onshore facilities such as refineries. As of May, refineries along the Texas coast had an operating capacity of 4.94 million barrels a day, nearly half the total capacity of Petroleum Administration for Defense District (PADD) 3, which comprises the states of Texas, Louisiana, Arkansas, Alabama, Mississippi and New Mexico.

High winds and possible flooding could force the suspension of operations at much of the Gulf Coast’s refining capacity, although the worst part of the storm is currently on a track to miss most of the offshore production rigs and platforms.

Citgo, which is owned by Venezuela’s PdVSA, has a 52,800 barrel per day refinery in Corpus Christi, and Flint Hills, owned by Koch Industries, operates a 296,470 barrel a day refinery there as well.

Valero Energy Corp. (NYSE: VLO) operates a 293,000 barrel a day refinery in Corpus Christi, along with a 225,000 barrel a day refinery in Texas City and a 197,000 barrel a day plant in Houston.

Exxon Mobil Corp. (NYSE: XOM) operates a 155,500 barrel a day refinery in Baytown and a 362,300 barrel a day refinery in Beaumont.

Phillips 66 (NYSE: PSX) operates a 247,000 barrel a day refinery in Sweeney, about 25 miles northeast of Matagorda.

The U.S. arm of Total S.A. (NYSE: TOT) operates a 225,500 barrel a day refinery in Port Arthur, and the massive Motiva refinery with a capacity of 625,000 barrels a day and owned by Saudi Aramco is also located in Port Arthur.

Marathon Petroleum Co. (NYSE: MPC) operates a 459,000 barrel a day refinery in Galveston Bay and another 86,000 barrel a day facility in Texas City.

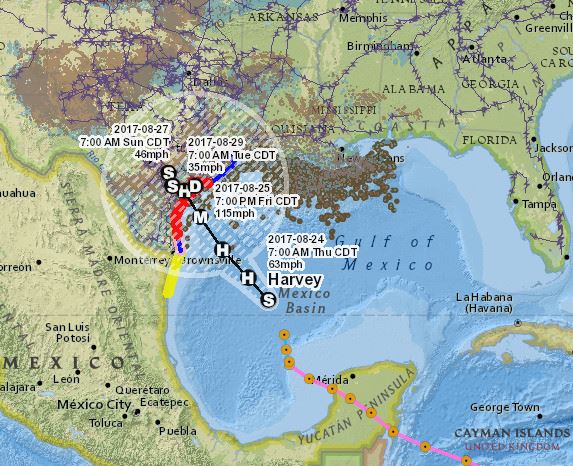

Here is the most recent storm map posted by the U.S. Energy Information Administration showing where the storm is expected to make landfall and where offshore production may be affected.

The front-month contract for West Texas Intermediate (WTI) crude oil settled at $48.41 a barrel on Wednesday, up more than 1% on the day, but it was trading down nearly 2.3% in the noon hour Thursday at $47.38 a barrel. The falling price is likely due to a reduced threat to the offshore production fields, but a hit on a refinery could boost short-term gasoline prices.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.