Last Friday, Exxon Mobil Corp. (NYSE: XOM) announced first production from its Liza-1 well in the Stabroek block about 120 miles offshore of Guyana. The development includes the company’s Liza Destiny floating, production, storage and offloading (FPSO) vessel and four moored four subsea drill centers supporting 17 wells.

At full-production, Liza-1 is expected to yield 120,000 barrels of oil a day. A second development, Liza-2, includes a second FPSO, the Liza Unity, with a capacity to produce up to 220,000 barrels of oil per day and front-end engineering design is underway for a potential third FPSO, the Prosperity, to develop the Payara field once the company receives government and regulatory approvals. Exxon anticipates that by 2025 at least five FPSOs will be producing more than 750,000 barrels per day from the Stabroek Block.

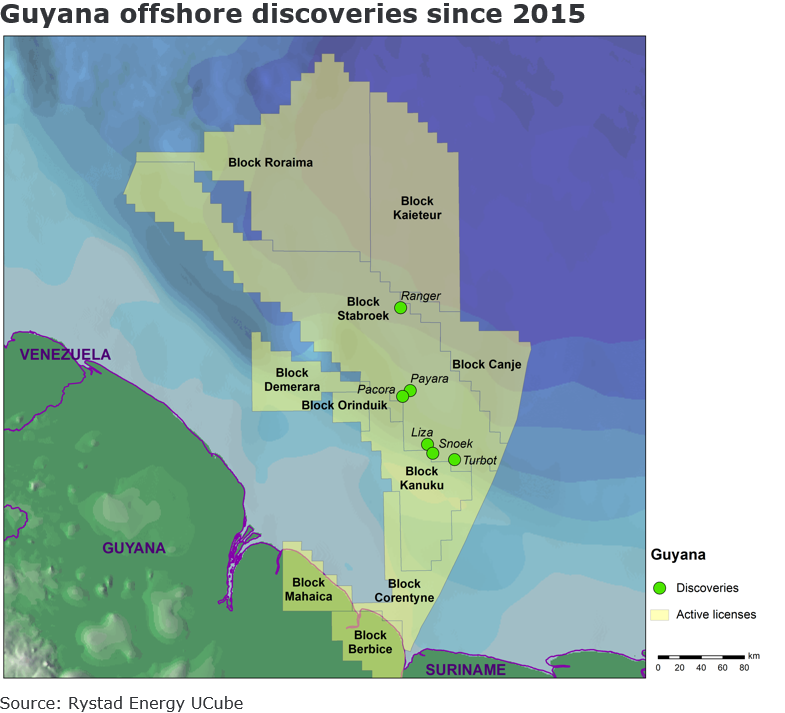

On Monday, the company announced yet another discovery in the Stabroek block. The Mako-1 well southeast of the Liza field marks the 15th discovery on the Stabroek block and adds to the previously announced estimated recoverable resource of more than 6 billion oil-equivalent barrels on the Stabroek block.

The Payara field, north of Liza, awaits government approvals and project sanctioning that could start production as early as 2023, reaching an estimated 220,000 barrels of oil per day.

The following map from Rystad Energy Ucube shows the location of the Liza and Payara fields, along with other fields in the Stabroek block.

Exxon affiliate Esso Exploration and Production Guyana is the operator and holds a 45% interest in the Stabroek block. Hess Corp.’s (NYSE: HES) Hess Guyana Exploration holds a 30% interest and Cnooc Ltd.’s (NYSE: CEO) Cnooc Petroleum Guyana holds a 25% interest.

Rystad Energy, in April 2018, estimated that total production in Guyana’s offshore deposits could surpass 600,000 barrels a day by the end of the 2020s. The discoveries could generate as much as $15 billion annually with a profit of about $10 billion to a calculated split of 60-40 (60% to the government). That is far more generous to the producers than, say, offshore Nigeria production for which the government takes about 85% of the profit.

The following map from Seeking Alpha’s The Natural Resources Hub indicates the leaseholders in each of the eight blocks that have so far been leased.

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.