Energy

Federal Panel Wants Controls on Fracking (HAL, SLB, WFT, CPX, KEG, PTEN, RES, SWSIP, BHI, CHK, RRC)

Published:

Last Updated:

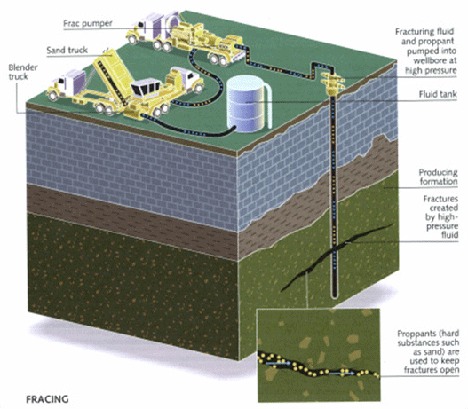

The boom in natural gas production resulting from horizontal drilling and hydraulic fracturing (fracking) has come at a price. There is plenty of anecdotal evidence that the chemical stew of fluids used in fracking causes damage in some cases to both air and water quality. What’s lacking is any rigorous proof that fracking does or can cause these problems. Oil field services companies that make and use the fluids have denied any harmful effects, but they have a dog in the hunt and stand to lose big if the fluids are shown to be dangerous.

The boom in natural gas production resulting from horizontal drilling and hydraulic fracturing (fracking) has come at a price. There is plenty of anecdotal evidence that the chemical stew of fluids used in fracking causes damage in some cases to both air and water quality. What’s lacking is any rigorous proof that fracking does or can cause these problems. Oil field services companies that make and use the fluids have denied any harmful effects, but they have a dog in the hunt and stand to lose big if the fluids are shown to be dangerous.

A US Department of Energy panel has recommended that the Environmental Protection Agency institute tighter controls on air emissions, disclosure of the contents of the fracking fluids, and more study on the possible contamination of drinking water from the use of the fluids. The EPA requested and received information from nine oil field services companies on the make-up of their fracking fluids. The nine were Halliburton Co. (NYSE: HAL), Schlumberger Ltd. (NYSE: SLB), Weatherford International Inc. (NYSE: WFT), Complete Production Services, Inc. (NYSE: CPX), Key Energy Services Inc. (NYSE: KEG), Patterson-UTI Energy Inc. (NASDAQ: PTEN), RPC Inc. (NYSE: RES), Superior Well Services (OTC: SWSIP), and BJ Services, since acquired by Baker Hughes Inc. (NYSE: BHI).

The services companies have invoked an amendment to the 2005 Energy Act, usually called the ‘Halliburton Amendment’, which allows the companies to treat the make-up of their fracking fluids as company-confidential. All of the fluids are primarily water and sand with generally small amounts of chemicals intended to increase the amount of natural gas and oil that can be squeezed out of the shale rocks. One of the chemicals in use is ordinary diesel fuel, which contains benzene, a known carcinogen.

The industry argument is that fracking fluids contain essentially trace amounts of these chemicals and that these amounts are harmless. That may be true, but fracking a well uses millions of gallons of fluids so that even trace amounts eventually add up.

Natural gas producers like Chesapeake Energy Corp. (NYSE: CHK) and Range Resources Corp. (NYSE: RRC) have called on the services companies to reveal the composition of their fracking fluids because these companies also stand to lose big if federal and state governments impose really strict controls on drilling. The CEO of Range Resources has referred to the secrecy surrounding the composition of fracking fluids as “a little silly.”

He’s right of course. It’s a little hard to believe that tiny differences in the composition of these fracking fluids make any significant difference at all to the amount of gas that actually flows from a well. The whole thing looks like a case of secrecy for its own sake in an attempt by the services companies to boost their own profits either by using dangerous chemicals or by selling snake oil.

Pressure from producers like Chesapeake and Range Resources is far more likely to have an impact on the services companies than is the threat of federal regulation. The producers have even more to lose than the services companies because if they can’t pump gas out of the ground, they lose both the revenue and the lease rights.

The question the services guys and the producers should be asking themselves is how much less gas would we extract if we used non-toxic chemicals in our fluids. The answer is probably ‘Not much.’

If that’s the case, the natural gas industry and the services companies could have avoided a lot of the negative news about hydraulic fracturing. But for some reason, they’d always rather fight than adapt.

Paul Ausick

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.