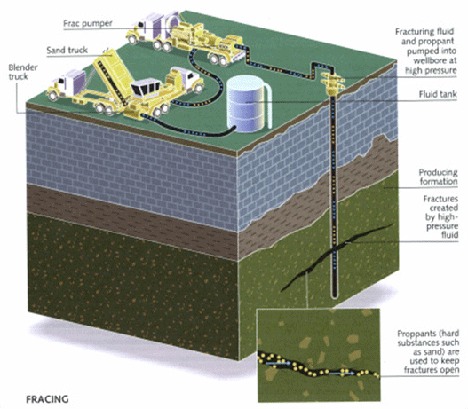

Virtually all the increase in U.S. crude oil production is due to hydraulic fracturing, aka fracking. And fracking requires enormous volumes of water. In many parts of the U.S., producers buy that water from rights holders who no longer want to sell it. In the Midwest, water rights are often held by farmers who have been willing to sell millions of barrels of water at prices as low as $0.35 a barrel. According to a CNNMoney, the same farmers are now refusing to accept as much as $0.75 a barrel.

At some point, production will decline either due to the high cost of water or the inability of the producers to obtain water at any cost. The lower flow of natural gas will continue to push up the price. The same thing could happen with the natural gas liquids and crude oil that is now produced by fracking, but the impact on consumers likely will be smaller and later than the impact from natural gas prices.

All those air conditioners need electricity, and the continuing hot weather presages a continuing high demand for natural gas, which now generates more than 30% of U.S. electricity. But natural gas in storage remains well-above the historical five-year average, which means that unless more production goes off-line, recent price hikes may be wishful thinking.

The United States Natural Gas Fund (NYSEMKT: UNG) closed yesterday at $21.91 in a 52-week range of $14.25 to $42.24.

Paul Ausick

Travel Cards Are Getting Too Good To Ignore (sponsored)

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.