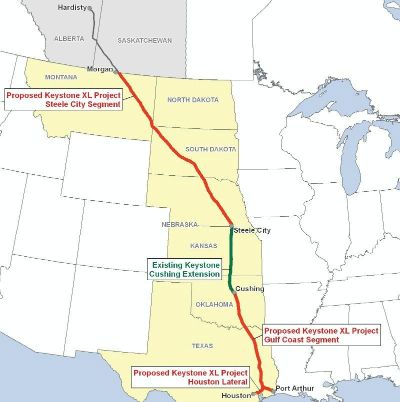

Because the pipeline crosses an international border, the U.S. State Department must approve the plan as well. A determination on the pipeline is due by the end of the first quarter of this year according to TransCanada Corp. (NYSE: TRP), the company that is proposing to build the pipeline.

The state of Nebraska’s Department of Environmental Quality had approved TransCanada’s request earlier this month after the company re-routed the pipeline’s route to avoid the environmentally sensitive Sand Hills region. The Keystone XL would cross the Ogallala Aquifer, a key bone of contention with environmentalists.

The Obama Administration rejected an earlier proposal for the Keystone XL, and there is still plenty of opposition to the new route. However the strongest arguments favoring the new pipeline are that it is likely to be safer and cheaper than transporting the Canadian crude than are the growing networks of rail and truck transportation.

Competing proposals to transport the oil sands product to the West Coast are being sponsored by Kinder Morgan Inc. (NYSE: KMI), which is proposing an expansion to its existing Trans Mountain pipeline, and Enbridge Inc. (NYSE: ENB), which has proposed a new Northern Gateway pipeline.

The impact on railway transportation won’t be felt for several years, until the Keystone XL pipeline is completed. But the Burlington Northern Santa Fe, owned by Warren Buffett’s Berkshire Hathaway Inc. (NYSE: BRK-A), the Canadian Pacific Railway Ltd. (NYSE: CP), and the Canadian National Railway Co. (NYSE: CNI) will very likely see a drop in demand for tank car transportation. Tank car builders The Greenbrier Companies Inc. (NYSE: GBX) and Carl Icahn-controlled American Railcar Industries Inc. (NASDAQ: ARII) are among a handful of companies currently benefiting from the increased demand for rail transportation.

Take Charge of Your Retirement: Find the Right Financial Advisor For You in Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding professional guidance—and we’ve made it easier than ever for you to connect with the right financial advisor for your unique needs.

Here’s how it works:

1️ Answer a Few Simple Questions

Tell us a bit about your goals and preferences—it only takes a few minutes!

2️ Get Your Top Advisor Matches

This tool matches you with qualified advisors who specialize in helping people like you achieve financial success.

3️ Choose Your Best Fit

Review their profiles, schedule an introductory meeting, and select the advisor who feels right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.