Underwriters, including J.P. Morgan, Morgan Stanley, BofA Merrill Lynch, Barclays, Credit Suisse, Deutsche Bank Securities, Citigroup, and RBC Capital Markets will have a 30-day overallotment option for an additional 2.25 million shares.

The IPO represents a 20.9% limited partner interest (24% if the overallotment options are fully exercised) in Phillips 66 Partners. Through subsidiaries, Phillips 66 will own the rest plus the 2% general partner interest.

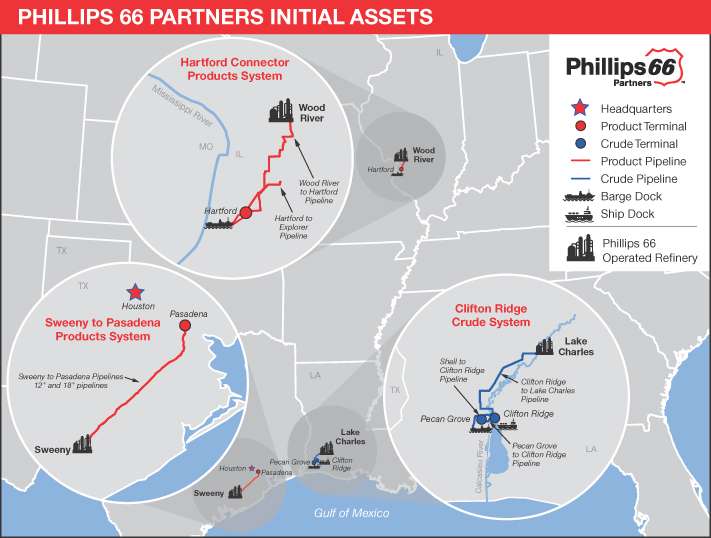

The initial assets of the MLP will be three pipeline systems, one each in Illinois, Texas, and Louisiana.

According to the Form S-1, the company expects to raise up to $315 million in net proceeds from the IPO at a price of $20 a share, the mid-point of the IPO’s expected range of $19 to $21 per common unit. Phillips 66 Partners plans to use the proceeds for general partnership purposes, “including to fund potential future acquisitions from Phillips 66 and third parties and potential future expansion capital expenditures.”

Travel Cards Are Getting Too Good To Ignore (sponsored)

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.