Many of the firms we cover on Wall Street are not overly excited about energy or oil services stocks this year, and the good news may be the bad news. Oil exploration and production has skyrocketed in the United States over the past five years and is only expected to increase. Lawmakers in Washington, D.C., may soon begin to wrestle with the issue of allowing U.S. companies to export oil products globally. The bottom line is that most of the people that cover the sector ultimately think that the price of oil will decline.

Declining oil prices will not be good for oil service stocks, and the analysts at UBS say to stay with the big-boys in the sector and avoid the smaller cap names that will be hard pressed to maintain earnings if business starts to slowdown. In their new report, they actually make the case that the bigger companies are already taking business away from the smaller ones, and this will only accelerate if the price of oil starts to slide dramatically.

Here are the only five stocks UBS recommends investors buy. They are divided into diversifiers and equipment companies. UBS has no Buy ratings on land or offshore drillers.

Baker Hughes Inc. (NYSE: BHI) is a top diversified name in oil field services. The company has consistently reported solid earnings. Cash increased by $245 million to $1.37 billion as debt decreased by $334 million to $4.58 billion, sequentially. While Baker Hughes is a $25 billion oilfield services company, it never hurts to improve your balance sheet. The company is well positioned for the shale revolution and for the possible return of natural gas drilling activity. That is expected to increase, driven by record cold in some parts of the country this winter. Investors are paid a 1% dividend. The UBS price target is $62. The Thomson/First Call price target is $64.02. Baker Hughes closed Friday at $59.51.

Halliburton Co. (NYSE: HAL) is another one of the few names UBS is positive about. The company stands to benefit from continued robust levels of domestic drilling activity and a pick-up in international markets. Management believes the company can deliver earnings per share of $6 by 2016, double the level from 2012. Investors receive a 1.2% dividend. The UBS price target is $70, and the consensus estimate is much lower at $63.84. Halliburton closed Friday at $51.97.

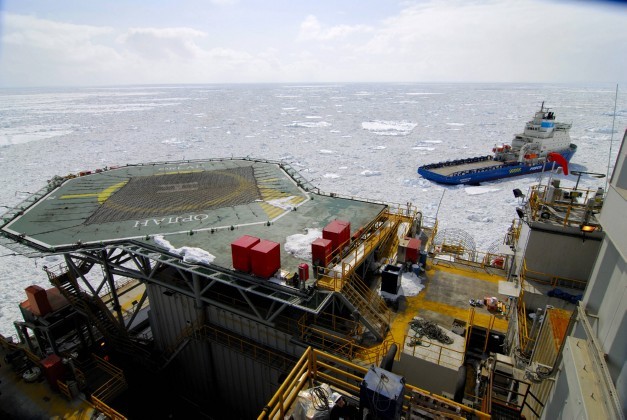

Schlumberger Ltd. (NYSE: SLB) is another mega-cap oil field services stock to buy for 2014. Strong offshore drilling activity combined with a seasonal rebound in Western Canadian activity has driven Schlumberger’s recent growth. The company said it expects double-digit earnings growth for the rest of the year when it reported earnings recently. For 2014 and beyond, Schlumberger sees five markets providing strong growth: Russia, Sub-Saharan Africa, the Middle East, China and Australia. Shareholders are paid a 1.4% dividend. The UBS price target is $110. The consensus is right in line at $110.13. Schlumberger closed Friday at $89.50.

FMC Technologies Inc. (NYSE: FTI) remains on the list of top stocks to buy at UBS. The UBS analysts believe that Subsea equipment is one of the few services areas that will see secular growth in 2014 and beyond. The company’s Subsea Technologies segment designs and manufactures subsea systems used in the offshore production of crude oil and natural gas and multiphase meters used in production and surface well testing, reservoir monitoring, remote operation, fiscal allocation, process monitoring and control and artificial lift optimization. It also provides installation and workover tools, installation assistance and field support for commissioning, intervention and maintenance of subsea systems. The UBS price objective is $58. The consensus target is $61.15. Shares closed Friday at $48.37.

Frank International N.V. (NYSE: FI) has made the cut, stays on the list and is also one of Jim Cramer’s top stock picks. This specialty company provides various engineered tubular services for the oil and gas exploration and production companies in the United States and internationally. Its tubular services include the handling and installation of multiple joints of pipe to establish a cased wellbore, and the installation of smaller diameter pipe inside a cased wellbore to provide a conduit for produced oil and gas to reach the surface. Shareholders are paid a 1.3% dividend. The UBS price target is $28, while the consensus is at $29.64. Franks closed Friday at $23.40.

The growth of oil exploration and production can be a boon for consumers and those looking for a job. States with big production have some of the lowest unemployment rates in the country. When more oil hits the market, unless there is a significant increase in demand, prices will decline. The companies with the best and biggest balance sheets will continue to grab the largest share of the business, both domestically and internationally.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.